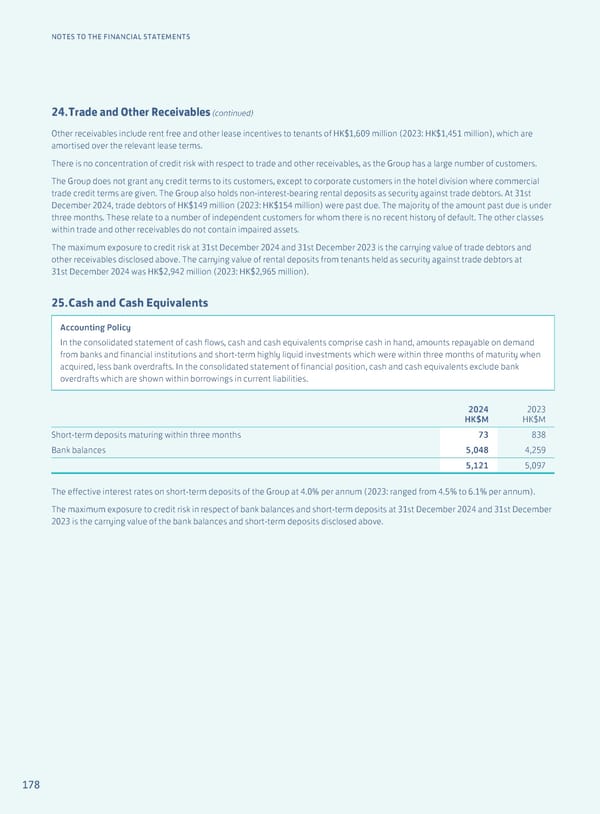

178 NOTES TO THE FINANCIAL STATEMENTS 24. Trade and Other Receivables (continued) Other receivables include rent free and other lease incentives to tenants of HK$1,609 million (2023: HK$1,451 million), which are amortised over the relevant lease terms. There is no concentration of credit risk with respect to trade and other receivables, as the Group has a large number of customers. The Group does not grant any credit terms to its customers, except to corporate customers in the hotel division where commercial trade credit terms are given. The Group also holds non-interest-bearing rental deposits as security against trade debtors. At 31st December 2024, trade debtors of HK$149 million (2023: HK$154 million) were past due. The majority of the amount past due is under three months. These relate to a number of independent customers for whom there is no recent history of default. The other classes within trade and other receivables do not contain impaired assets. The maximum exposure to credit risk at 31st December 2024 and 31st December 2023 is the carrying value of trade debtors and other receivables disclosed above. The carrying value of rental deposits from tenants held as security against trade debtors at 31st December 2024 was HK$2,942 million (2023: HK$2,965 million). 25. Cash and Cash Equivalents Accounting Policy In the consolidated statement of cash flows, cash and cash equivalents comprise cash in hand, amounts repayable on demand from banks and financial institutions and short-term highly liquid investments which were within three months of maturity when acquired, less bank overdrafts. In the consolidated statement of financial position, cash and cash equivalents exclude bank overdrafts which are shown within borrowings in current liabilities. 2024 HK$M 2023 HK$M Short-term deposits maturing within three months 73 838 Bank balances 5,048 4,259 5,121 5,097 The effective interest rates on short-term deposits of the Group at 4.0% per annum (2023: ranged from 4.5% to 6.1% per annum). The maximum exposure to credit risk in respect of bank balances and short-term deposits at 31st December 2024 and 31st December 2023 is the carrying value of the bank balances and short-term deposits disclosed above.

Annual Report 2024 | EN Page 179 Page 181

Annual Report 2024 | EN Page 179 Page 181