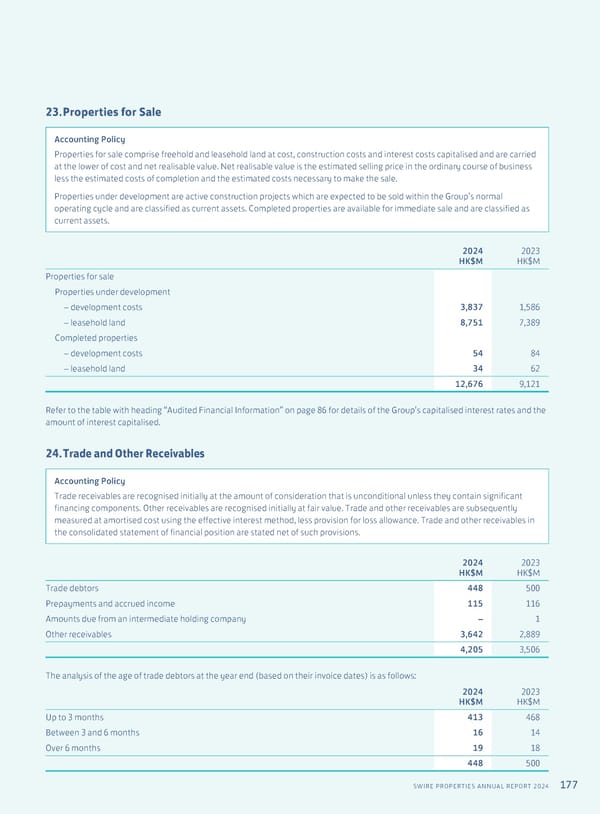

177 SWIRE PROPERTIES ANNUAL REPORT 2024 23. Properties for Sale Accounting Policy Properties for sale comprise freehold and leasehold land at cost, construction costs and interest costs capitalised and are carried at the lower of cost and net realisable value. Net realisable value is the estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs necessary to make the sale. Properties under development are active construction projects which are expected to be sold within the Group’s normal operating cycle and are classified as current assets. Completed properties are available for immediate sale and are classified as current assets. 2024 HK$M 2023 HK$M Properties for sale Properties under development – development costs 3,837 1,586 – leasehold land 8,751 7,389 Completed properties – development costs 54 84 – leasehold land 34 62 12,676 9,121 Refer to the table with heading “Audited Financial Information” on page 86 for details of the Group’s capitalised interest rates and the amount of interest capitalised. 24. Trade and Other Receivables Accounting Policy Trade receivables are recognised initially at the amount of consideration that is unconditional unless they contain significant financing components. Other receivables are recognised initially at fair value. Trade and other receivables are subsequently measured at amortised cost using the effective interest method, less provision for loss allowance. Trade and other receivables in the consolidated statement of financial position are stated net of such provisions. 2024 HK$M 2023 HK$M Trade debtors 448 500 Prepayments and accrued income 115 116 Amounts due from an intermediate holding company – 1 Other receivables 3,642 2,889 4,205 3,506 The analysis of the age of trade debtors at the year end (based on their invoice dates) is as follows: 2024 HK$M 2023 HK$M Up to 3 months 413 468 Between 3 and 6 months 16 14 Over 6 months 19 18 448 500

Annual Report 2024 | EN Page 178 Page 180

Annual Report 2024 | EN Page 178 Page 180