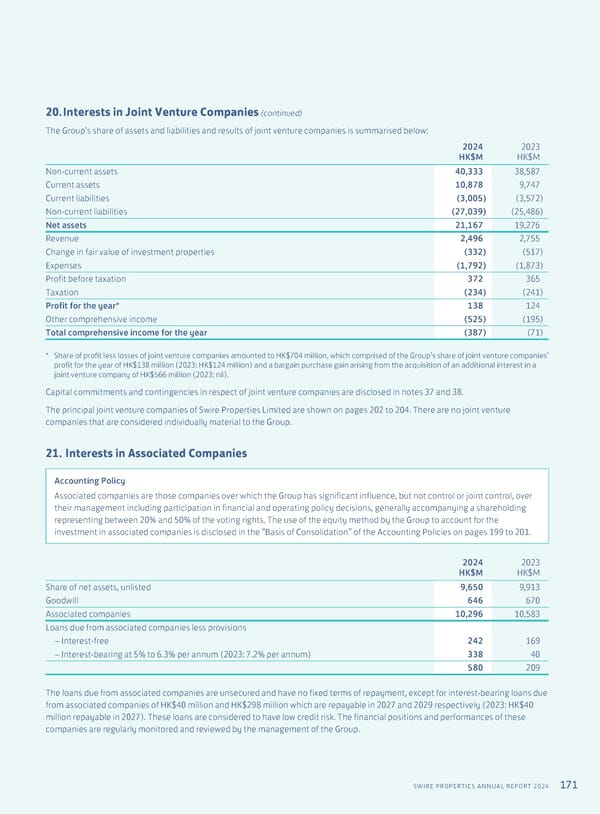

171 SWIRE PROPERTIES ANNUAL REPORT 2024 20. Interests in Joint Venture Companies (continued) The Group’s share of assets and liabilities and results of joint venture companies is summarised below: 2024 HK$M 2023 HK$M Non-current assets 40,333 38,587 Current assets 10,878 9,747 Current liabilities (3,005) (3,572) Non-current liabilities (27,039) (25,486) Net assets 21,167 19,276 Revenue 2,496 2,755 Change in fair value of investment properties (332) (517) Expenses (1,792) (1,873) Profit before taxation 372 365 Taxation (234) (241) Profit for the year* 138 124 Other comprehensive income (525) (195) Total comprehensive income for the year (387) (71) * Share of profit less losses of joint venture companies amounted to HK$704 million, which comprised of the Group’s share of joint venture companies’ profit for the year of HK$138 million (2023: HK$124 million) and a bargain purchase gain arising from the acquisition of an additional interest in a joint venture company of HK$566 million (2023: nil). Capital commitments and contingencies in respect of joint venture companies are disclosed in notes 37 and 38. The principal joint venture companies of Swire Properties Limited are shown on pages 202 to 204. There are no joint venture companies that are considered individually material to the Group. 21. Interests in Associated Companies Accounting Policy Associated companies are those companies over which the Group has significant influence, but not control or joint control, over their management including participation in financial and operating policy decisions, generally accompanying a shareholding representing between 20% and 50% of the voting rights. The use of the equity method by the Group to account for the investment in associated companies is disclosed in the “Basis of Consolidation” of the Accounting Policies on pages 199 to 201. 2024 HK$M 2023 HK$M Share of net assets, unlisted 9,650 9,913 Goodwill 646 670 Associated companies 10,296 10,583 Loans due from associated companies less provisions – Interest-free 242 169 – Interest-bearing at 5% to 6.3% per annum (2023: 7.2% per annum) 338 40 580 209 The loans due from associated companies are unsecured and have no fixed terms of repayment, except for interest-bearing loans due from associated companies of HK$40 million and HK$298 million which are repayable in 2027 and 2029 respectively (2023: HK$40 million repayable in 2027). These loans are considered to have low credit risk. The financial positions and performances of these companies are regularly monitored and reviewed by the management of the Group.

Annual Report 2024 | EN Page 172 Page 174

Annual Report 2024 | EN Page 172 Page 174