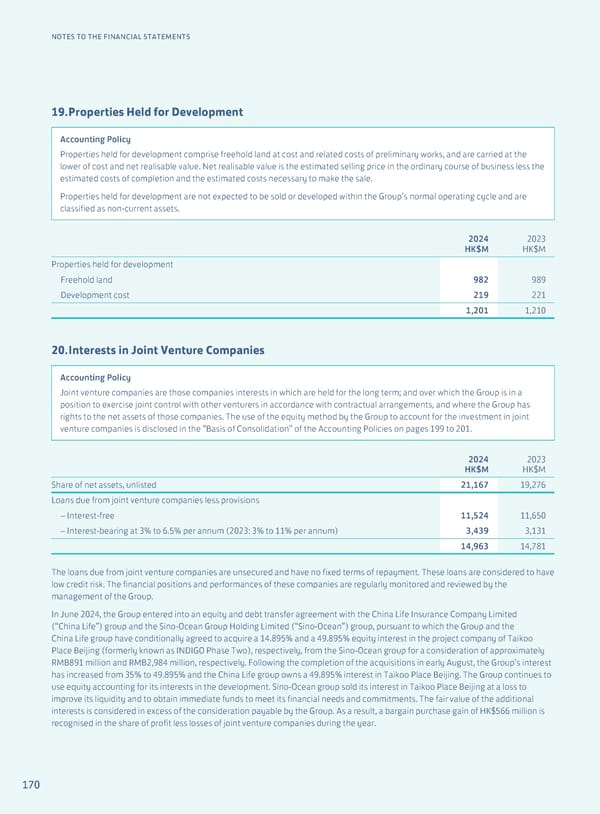

170 NOTES TO THE FINANCIAL STATEMENTS 19. Properties Held for Development Accounting Policy Properties held for development comprise freehold land at cost and related costs of preliminary works, and are carried at the lower of cost and net realisable value. Net realisable value is the estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs necessary to make the sale. Properties held for development are not expected to be sold or developed within the Group’s normal operating cycle and are classified as non-current assets. 2024 HK$M 2023 HK$M Properties held for development Freehold land 982 989 Development cost 219 221 1,201 1,210 20. Interests in Joint Venture Companies Accounting Policy Joint venture companies are those companies interests in which are held for the long term; and over which the Group is in a position to exercise joint control with other venturers in accordance with contractual arrangements, and where the Group has rights to the net assets of those companies. The use of the equity method by the Group to account for the investment in joint venture companies is disclosed in the “Basis of Consolidation” of the Accounting Policies on pages 199 to 201. 2024 HK$M 2023 HK$M Share of net assets, unlisted 21,167 19,276 Loans due from joint venture companies less provisions – Interest-free 11,524 11,650 – Interest-bearing at 3% to 6.5% per annum (2023: 3% to 11% per annum) 3,439 3,131 14,963 14,781 The loans due from joint venture companies are unsecured and have no fixed terms of repayment. These loans are considered to have low credit risk. The financial positions and performances of these companies are regularly monitored and reviewed by the management of the Group. In June 2024, the Group entered into an equity and debt transfer agreement with the China Life Insurance Company Limited (“China Life”) group and the Sino-Ocean Group Holding Limited (“Sino-Ocean”) group, pursuant to which the Group and the China Life group have conditionally agreed to acquire a 14.895% and a 49.895% equity interest in the project company of Taikoo Place Beijing (formerly known as INDIGO Phase Two), respectively, from the Sino-Ocean group for a consideration of approximately RMB891 million and RMB2,984 million, respectively. Following the completion of the acquisitions in early August, the Group’s interest has increased from 35% to 49.895% and the China Life group owns a 49.895% interest in Taikoo Place Beijing. The Group continues to use equity accounting for its interests in the development. Sino-Ocean group sold its interest in Taikoo Place Beijing at a loss to improve its liquidity and to obtain immediate funds to meet its financial needs and commitments. The fair value of the additional interests is considered in excess of the consideration payable by the Group. As a result, a bargain purchase gain of HK$566 million is recognised in the share of profit less losses of joint venture companies during the year.

Annual Report 2024 | EN Page 171 Page 173

Annual Report 2024 | EN Page 171 Page 173