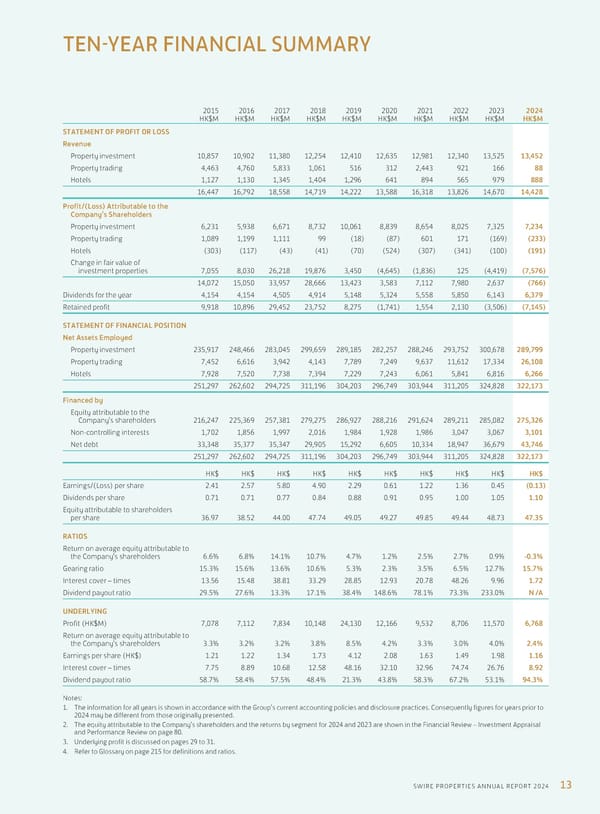

13 SWIRE PROPERTIES ANNUAL REPORT 2024 TEN-YEAR FINANCIAL SUMMARY 2015 HK$M 2016 HK$M 2017 HK$M 2018 HK$M 2019 HK$M 2020 HK$M 2021 HK$M 2022 HK$M 2023 HK$M 2024 HK$M STATEMENT OF PROFIT OR LOSS Revenue Property investment 10,857 10,902 11,380 12,254 12,410 12,635 12,981 12,340 13,525 13,452 Property trading 4,463 4,760 5,833 1,061 516 312 2,443 921 166 88 Hotels 1,127 1,130 1,345 1,404 1,296 641 894 565 979 888 16,447 16,792 18,558 14,719 14,222 13,588 16,318 13,826 14,670 14,428 Profit/(Loss) Attributable to the Company’s Shareholders Property investment 6,231 5,938 6,671 8,732 10,061 8,839 8,654 8,025 7,325 7,234 Property trading 1,089 1,199 1,111 99 (18) (87) 601 171 (169) (233) Hotels (303) (117) (43) (41) (70) (524) (307) (341) (100) (191) Change in fair value of investment properties 7,055 8,030 26,218 19,876 3,450 (4,645) (1,836) 125 (4,419) (7,576) 14,072 15,050 33,957 28,666 13,423 3,583 7,112 7,980 2,637 (766) Dividends for the year 4,154 4,154 4,505 4,914 5,148 5,324 5,558 5,850 6,143 6,379 Retained profit 9,918 10,896 29,452 23,752 8,275 (1,741) 1,554 2,130 (3,506) (7,145) STATEMENT OF FINANCIAL POSITION Net Assets Employed Property investment 235,917 248,466 283,045 299,659 289,185 282,257 288,246 293,752 300,678 289,799 Property trading 7,452 6,616 3,942 4,143 7,789 7,249 9,637 11,612 17,334 26,108 Hotels 7,928 7,520 7,738 7,394 7,229 7,243 6,061 5,841 6,816 6,266 251,297 262,602 294,725 311,196 304,203 296,749 303,944 311,205 324,828 322,173 Financed by Equity attributable to the Company’s shareholders 216,247 225,369 257,381 279,275 286,927 288,216 291,624 289,211 285,082 275,326 Non-controlling interests 1,702 1,856 1,997 2,016 1,984 1,928 1,986 3,047 3,067 3,101 Net debt 33,348 35,377 35,347 29,905 15,292 6,605 10,334 18,947 36,679 43,746 251,297 262,602 294,725 311,196 304,203 296,749 303,944 311,205 324,828 322,173 HK$ HK$ HK$ HK$ HK$ HK$ HK$ HK$ HK$ HK$ Earnings/(Loss) per share 2.41 2.57 5.80 4.90 2.29 0.61 1.22 1.36 0.45 (0.13) Dividends per share 0.71 0.71 0.77 0.84 0.88 0.91 0.95 1.00 1.05 1.10 Equity attributable to shareholders per share 36.97 38.52 44.00 47.74 49.05 49.27 49.85 49.44 48.73 47.35 RATIOS Return on average equity attributable to the Company’s shareholders 6.6% 6.8% 14.1% 10.7% 4.7% 1.2% 2.5% 2.7% 0.9% -0.3% Gearing ratio 15.3% 15.6% 13.6% 10.6% 5.3% 2.3% 3.5% 6.5% 12.7% 15.7% Interest cover – times 13.56 15.48 38.81 33.29 28.85 12.93 20.78 48.26 9.96 1.72 Dividend payout ratio 29.5% 27.6% 13.3% 17.1% 38.4% 148.6% 78.1% 73.3% 233.0% N /A UNDERLYING Profit (HK$M) 7,078 7,112 7,834 10,148 24,130 12,166 9,532 8,706 11,570 6,768 Return on average equity attributable to the Company’s shareholders 3.3% 3.2% 3.2% 3.8% 8.5% 4.2% 3.3% 3.0% 4.0% 2.4% Earnings per share (HK$) 1.21 1.22 1.34 1.73 4.12 2.08 1.63 1.49 1.98 1.16 Interest cover – times 7.75 8.89 10.68 12.58 48.16 32.10 32.96 74.74 26.76 8.92 Dividend payout ratio 58.7% 58.4% 57.5% 48.4% 21.3% 43.8% 58.3% 67.2% 53.1% 94.3% Notes: 1. The information for all years is shown in accordance with the Group’s current accounting policies and disclosure practices. Consequently figures for years prior to 2024 may be different from those originally presented. 2. The equity attributable to the Company’s shareholders and the returns by segment for 2024 and 2023 are shown in the Financial Review – Investment Appraisal and Performance Review on page 80. 3. Underlying profit is discussed on pages 29 to 31. 4. Refer to Glossary on page 215 for definitions and ratios.

Annual Report 2024 | EN Page 14 Page 16

Annual Report 2024 | EN Page 14 Page 16