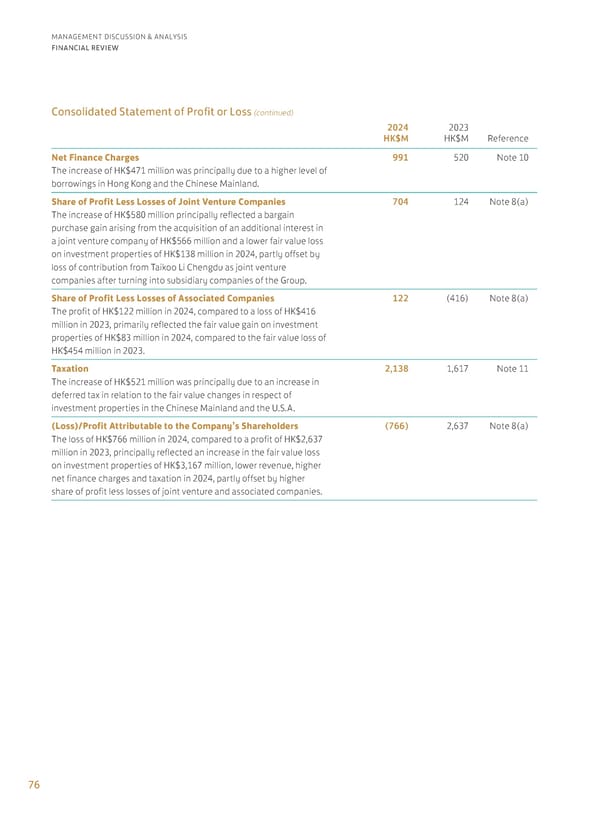

76 MANAGEMENT DISCUSSION & ANALYSIS FINANCIAL REVIEW Consolidated Statement of Profit or Loss (continued) 2024 HK$M 2023 HK$M Reference Net Finance Charges The increase of HK$471 million was principally due to a higher level of borrowings in Hong Kong and the Chinese Mainland. 991 520 Note 10 Share of Profit Less Losses of Joint Venture Companies The increase of HK$580 million principally reflected a bargain purchase gain arising from the acquisition of an additional interest in a joint venture company of HK$566 million and a lower fair value loss on investment properties of HK$138 million in 2024, partly offset by loss of contribution from Taikoo Li Chengdu as joint venture companies after turning into subsidiary companies of the Group. 704 124 Note 8(a) Share of Profit Less Losses of Associated Companies The profit of HK$122 million in 2024, compared to a loss of HK$416 million in 2023, primarily reflected the fair value gain on investment properties of HK$83 million in 2024, compared to the fair value loss of HK$454 million in 2023. 122 (416) Note 8(a) Taxation The increase of HK$521 million was principally due to an increase in deferred tax in relation to the fair value changes in respect of investment properties in the Chinese Mainland and the U.S.A. 2,138 1,617 Note 11 (Loss)/Profit Attributable to the Company’s Shareholders The loss of HK$766 million in 2024, compared to a profit of HK$2,637 million in 2023, principally reflected an increase in the fair value loss on investment properties of HK$3,167 million, lower revenue, higher net finance charges and taxation in 2024, partly offset by higher share of profit less losses of joint venture and associated companies. (766) 2,637 Note 8(a)

Annual Report 2024 | EN Page 77 Page 79

Annual Report 2024 | EN Page 77 Page 79