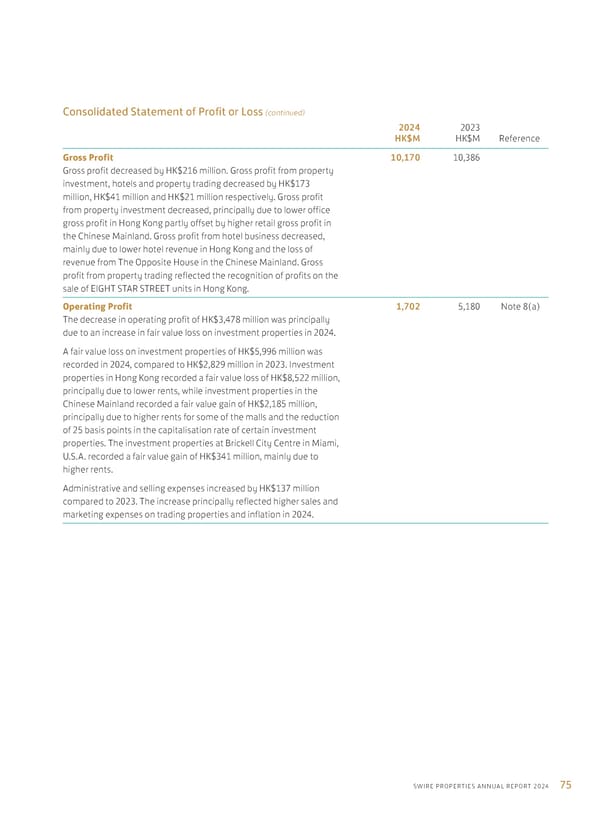

75 SWIRE PROPERTIES ANNUAL REPORT 2024 Consolidated Statement of Profit or Loss (continued) 2024 HK$M 2023 HK$M Reference Gross Profit Gross profit decreased by HK$216 million. Gross profit from property investment, hotels and property trading decreased by HK$173 million, HK$41 million and HK$21 million respectively. Gross profit from property investment decreased, principally due to lower office gross profit in Hong Kong partly offset by higher retail gross profit in the Chinese Mainland. Gross profit from hotel business decreased, mainly due to lower hotel revenue in Hong Kong and the loss of revenue from The Opposite House in the Chinese Mainland. Gross profit from property trading reflected the recognition of profits on the sale of EIGHT STAR STREET units in Hong Kong. 10,170 10,386 Operating Profit The decrease in operating profit of HK$3,478 million was principally due to an increase in fair value loss on investment properties in 2024. A fair value loss on investment properties of HK$5,996 million was recorded in 2024, compared to HK$2,829 million in 2023. Investment properties in Hong Kong recorded a fair value loss of HK$8,522 million, principally due to lower rents, while investment properties in the Chinese Mainland recorded a fair value gain of HK$2,185 million, principally due to higher rents for some of the malls and the reduction of 25 basis points in the capitalisation rate of certain investment properties. The investment properties at Brickell City Centre in Miami, U.S.A. recorded a fair value gain of HK$341 million, mainly due to higher rents. Administrative and selling expenses increased by HK$137 million compared to 2023. The increase principally reflected higher sales and marketing expenses on trading properties and inflation in 2024. 1,702 5,180 Note 8(a)

Annual Report 2024 | EN Page 76 Page 78

Annual Report 2024 | EN Page 76 Page 78