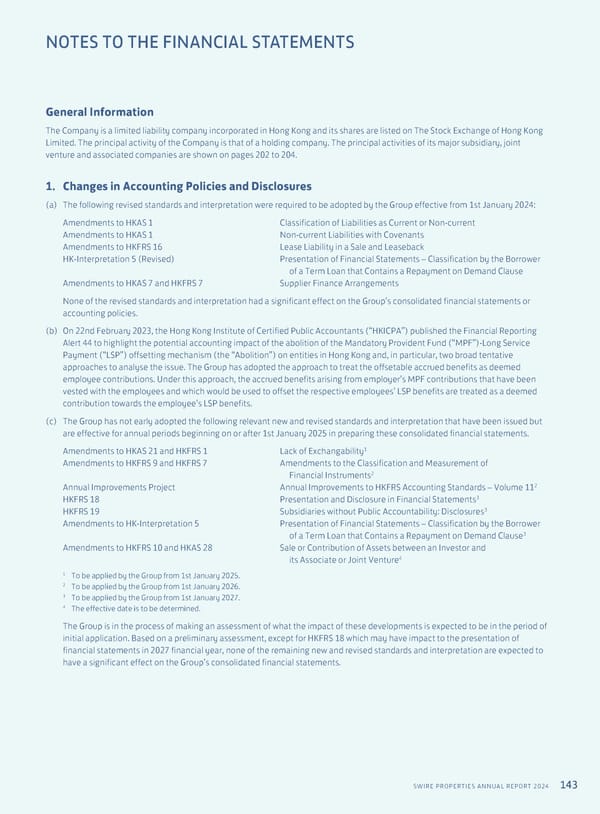

143 SWIRE PROPERTIES ANNUAL REPORT 2024 General Information The Company is a limited liability company incorporated in Hong Kong and its shares are listed on The Stock Exchange of Hong Kong Limited. The principal activity of the Company is that of a holding company. The principal activities of its major subsidiary, joint venture and associated companies are shown on pages 202 to 204. 1. Changes in Accounting Policies and Disclosures (a) The following revised standards and interpretation were required to be adopted by the Group effective from 1st January 2024: Amendments to HKAS 1 Classification of Liabilities as Current or Non-current Amendments to HKAS 1 Non-current Liabilities with Covenants Amendments to HKFRS 16 Lease Liability in a Sale and Leaseback HK-Interpretation 5 (Revised) Presentation of Financial Statements – Classification by the Borrower of a Term Loan that Contains a Repayment on Demand Clause Amendments to HKAS 7 and HKFRS 7 Supplier Finance Arrangements None of the revised standards and interpretation had a significant effect on the Group’s consolidated financial statements or accounting policies. (b) On 22nd February 2023, the Hong Kong Institute of Certified Public Accountants (“HKICPA”) published the Financial Reporting Alert 44 to highlight the potential accounting impact of the abolition of the Mandatory Provident Fund (“MPF”)-Long Service Payment (“LSP”) offsetting mechanism (the “Abolition”) on entities in Hong Kong and, in particular, two broad tentative approaches to analyse the issue. The Group has adopted the approach to treat the offsetable accrued benefits as deemed employee contributions. Under this approach, the accrued benefits arising from employer’s MPF contributions that have been vested with the employees and which would be used to offset the respective employees’ LSP benefits are treated as a deemed contribution towards the employee’s LSP benefits. (c) The Group has not early adopted the following relevant new and revised standards and interpretation that have been issued but are effective for annual periods beginning on or after 1st January 2025 in preparing these consolidated financial statements. Amendments to HKAS 21 and HKFRS 1 Lack of Exchangability1 Amendments to HKFRS 9 and HKFRS 7 Amendments to the Classification and Measurement of Financial Instruments2 Annual Improvements Project Annual Improvements to HKFRS Accounting Standards – Volume 112 HKFRS 18 Presentation and Disclosure in Financial Statements3 HKFRS 19 Subsidiaries without Public Accountability: Disclosures3 Amendments to HK-Interpretation 5 Presentation of Financial Statements – Classification by the Borrower of a Term Loan that Contains a Repayment on Demand Clause3 Amendments to HKFRS 10 and HKAS 28 Sale or Contribution of Assets between an Investor and its Associate or Joint Venture4 1 To be applied by the Group from 1st January 2025. 2 To be applied by the Group from 1st January 2026. 3 To be applied by the Group from 1st January 2027. 4 The effective date is to be determined. The Group is in the process of making an assessment of what the impact of these developments is expected to be in the period of initial application. Based on a preliminary assessment, except for HKFRS 18 which may have impact to the presentation of financial statements in 2027 financial year, none of the remaining new and revised standards and interpretation are expected to have a significant effect on the Group’s consolidated financial statements. NOTES TO THE FINANCIAL STATEMENTS

Annual Report 2024 | EN Page 144 Page 146

Annual Report 2024 | EN Page 144 Page 146