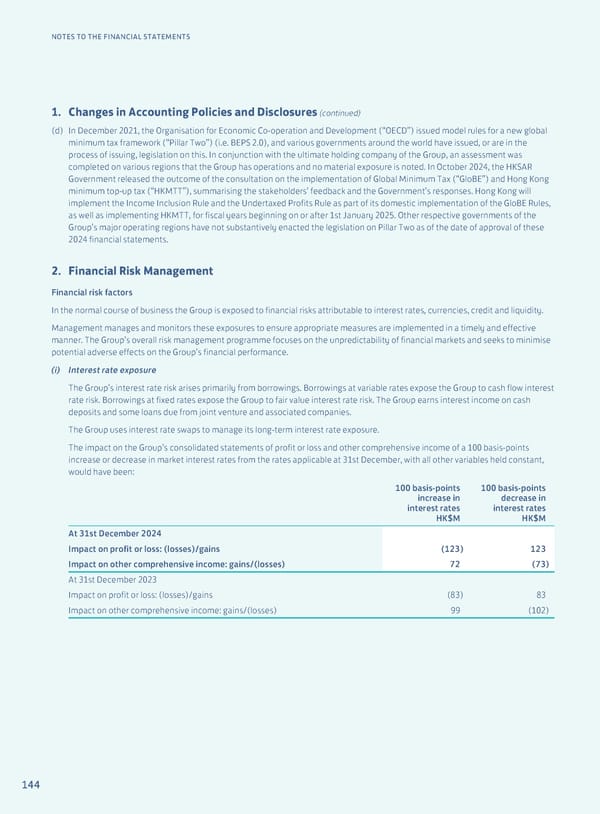

144 NOTES TO THE FINANCIAL STATEMENTS 1. Changes in Accounting Policies and Disclosures (continued) (d) In December 2021, the Organisation for Economic Co-operation and Development (“OECD”) issued model rules for a new global minimum tax framework (“Pillar Two”) (i.e. BEPS 2.0), and various governments around the world have issued, or are in the process of issuing, legislation on this. In conjunction with the ultimate holding company of the Group, an assessment was completed on various regions that the Group has operations and no material exposure is noted. In October 2024, the HKSAR Government released the outcome of the consultation on the implementation of Global Minimum Tax (“GloBE”) and Hong Kong minimum top-up tax (“HKMTT”), summarising the stakeholders’ feedback and the Government’s responses. Hong Kong will implement the Income Inclusion Rule and the Undertaxed Profits Rule as part of its domestic implementation of the GloBE Rules, as well as implementing HKMTT, for fiscal years beginning on or after 1st January 2025. Other respective governments of the Group’s major operating regions have not substantively enacted the legislation on Pillar Two as of the date of approval of these 2024 financial statements. 2. Financial Risk Management Financial risk factors In the normal course of business the Group is exposed to financial risks attributable to interest rates, currencies, credit and liquidity. Management manages and monitors these exposures to ensure appropriate measures are implemented in a timely and effective manner. The Group’s overall risk management programme focuses on the unpredictability of financial markets and seeks to minimise potential adverse effects on the Group’s financial performance. (i) Interest rate exposure The Group’s interest rate risk arises primarily from borrowings. Borrowings at variable rates expose the Group to cash flow interest rate risk. Borrowings at fixed rates expose the Group to fair value interest rate risk. The Group earns interest income on cash deposits and some loans due from joint venture and associated companies. The Group uses interest rate swaps to manage its long-term interest rate exposure. The impact on the Group’s consolidated statements of profit or loss and other comprehensive income of a 100 basis-points increase or decrease in market interest rates from the rates applicable at 31st December, with all other variables held constant, would have been: 100 basis-points increase in interest rates HK$M 100 basis-points decrease in interest rates HK$M At 31st December 2024 Impact on profit or loss: (losses)/gains (123) 123 Impact on other comprehensive income: gains/(losses) 72 (73) At 31st December 2023 Impact on profit or loss: (losses)/gains (83) 83 Impact on other comprehensive income: gains/(losses) 99 (102)

Annual Report 2024 | EN Page 145 Page 147

Annual Report 2024 | EN Page 145 Page 147