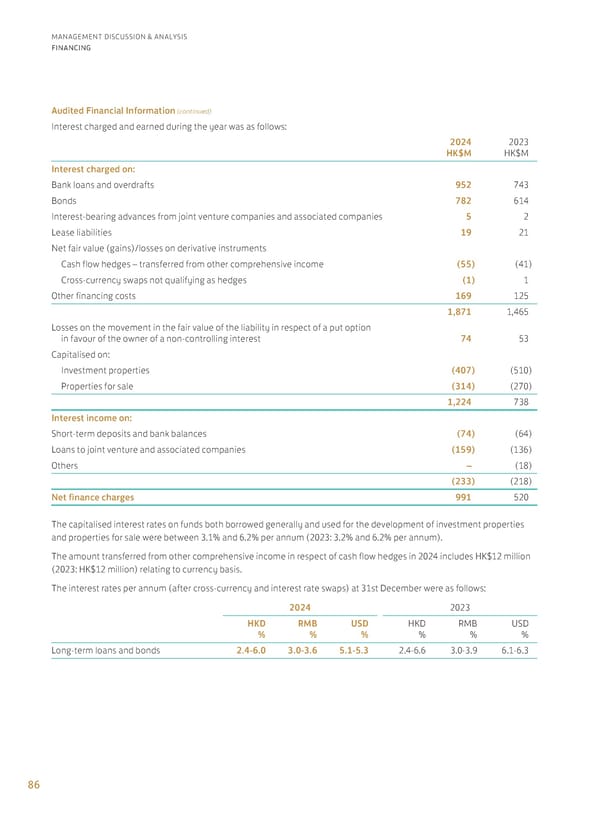

86 MANAGEMENT DISCUSSION & ANALYSIS FINANCING Audited Financial Information (continued) Interest charged and earned during the year was as follows: 2024 HK$M 2023 HK$M Interest charged on: Bank loans and overdrafts 952 743 Bonds 782 614 Interest-bearing advances from joint venture companies and associated companies 5 2 Lease liabilities 19 21 Net fair value (gains)/losses on derivative instruments Cash flow hedges – transferred from other comprehensive income (55) (41) Cross-currency swaps not qualifying as hedges (1) 1 Other financing costs 169 125 1,871 1,465 Losses on the movement in the fair value of the liability in respect of a put option in favour of the owner of a non-controlling interest 74 53 Capitalised on: Investment properties (407) (510) Properties for sale (314) (270) 1,224 738 Interest income on: Short-term deposits and bank balances (74) (64) Loans to joint venture and associated companies (159) (136) Others – (18) (233) (218) Net finance charges 991 520 The capitalised interest rates on funds both borrowed generally and used for the development of investment properties and properties for sale were between 3.1% and 6.2% per annum (2023: 3.2% and 6.2% per annum). The amount transferred from other comprehensive income in respect of cash flow hedges in 2024 includes HK$12 million (2023: HK$12 million) relating to currency basis. The interest rates per annum (after cross-currency and interest rate swaps) at 31st December were as follows: 2024 2023 HKD % RMB % USD % HKD % RMB % USD % Long-term loans and bonds 2.4-6.0 3.0-3.6 5.1-5.3 2.4-6.6 3.0-3.9 6.1-6.3

Annual Report 2024 | EN Page 87 Page 89

Annual Report 2024 | EN Page 87 Page 89