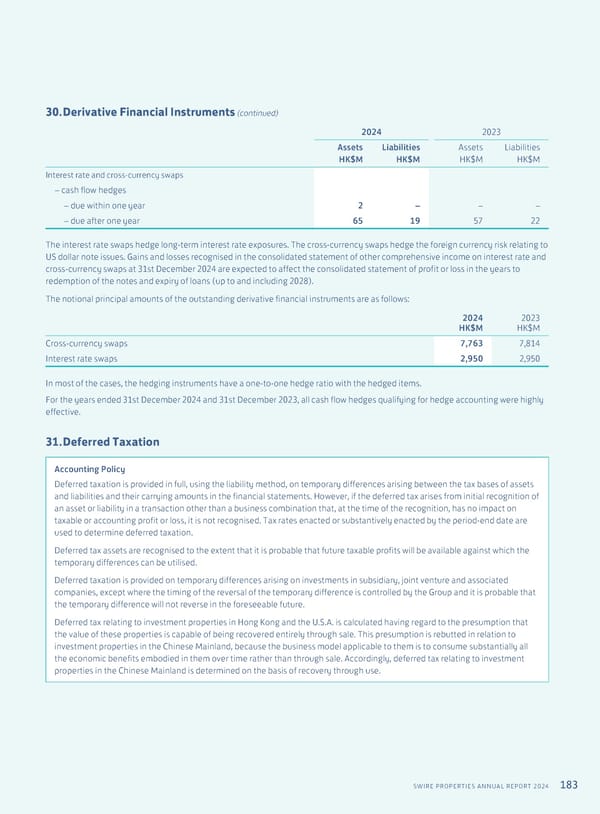

183 SWIRE PROPERTIES ANNUAL REPORT 2024 30. Derivative Financial Instruments (continued) 2024 2023 Assets HK$M Liabilities HK$M Assets HK$M Liabilities HK$M Interest rate and cross-currency swaps – cash flow hedges – due within one year 2 – – – – due after one year 65 19 57 22 The interest rate swaps hedge long-term interest rate exposures. The cross-currency swaps hedge the foreign currency risk relating to US dollar note issues. Gains and losses recognised in the consolidated statement of other comprehensive income on interest rate and cross-currency swaps at 31st December 2024 are expected to affect the consolidated statement of profit or loss in the years to redemption of the notes and expiry of loans (up to and including 2028). The notional principal amounts of the outstanding derivative financial instruments are as follows: 2024 HK$M 2023 HK$M Cross-currency swaps 7,763 7,814 Interest rate swaps 2,950 2,950 In most of the cases, the hedging instruments have a one-to-one hedge ratio with the hedged items. For the years ended 31st December 2024 and 31st December 2023, all cash flow hedges qualifying for hedge accounting were highly effective. 31. Deferred Taxation Accounting Policy Deferred taxation is provided in full, using the liability method, on temporary differences arising between the tax bases of assets and liabilities and their carrying amounts in the financial statements. However, if the deferred tax arises from initial recognition of an asset or liability in a transaction other than a business combination that, at the time of the recognition, has no impact on taxable or accounting profit or loss, it is not recognised. Tax rates enacted or substantively enacted by the period-end date are used to determine deferred taxation. Deferred tax assets are recognised to the extent that it is probable that future taxable profits will be available against which the temporary differences can be utilised. Deferred taxation is provided on temporary differences arising on investments in subsidiary, joint venture and associated companies, except where the timing of the reversal of the temporary difference is controlled by the Group and it is probable that the temporary difference will not reverse in the foreseeable future. Deferred tax relating to investment properties in Hong Kong and the U.S.A. is calculated having regard to the presumption that the value of these properties is capable of being recovered entirely through sale. This presumption is rebutted in relation to investment properties in the Chinese Mainland, because the business model applicable to them is to consume substantially all the economic benefits embodied in them over time rather than through sale. Accordingly, deferred tax relating to investment properties in the Chinese Mainland is determined on the basis of recovery through use.

Annual Report 2024 | EN Page 184 Page 186

Annual Report 2024 | EN Page 184 Page 186