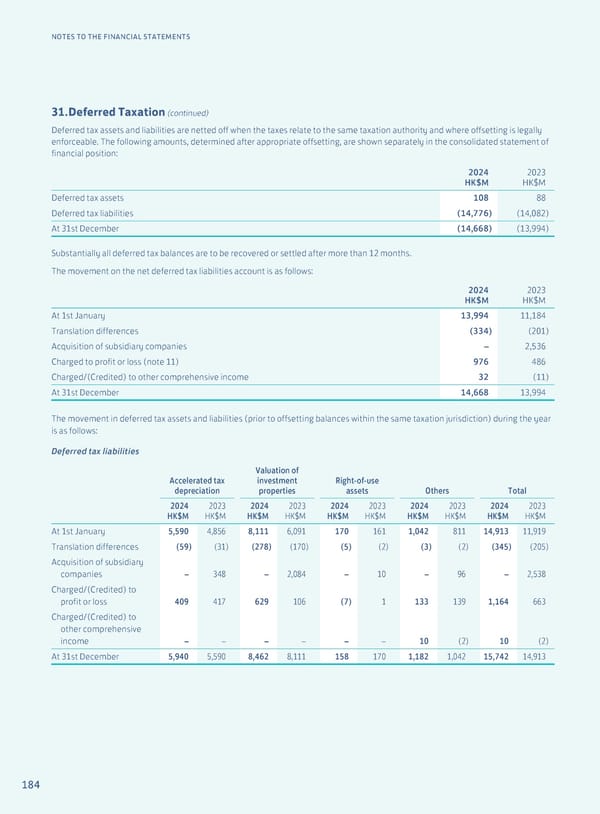

184 NOTES TO THE FINANCIAL STATEMENTS 31. Deferred Taxation (continued) Deferred tax assets and liabilities are netted off when the taxes relate to the same taxation authority and where offsetting is legally enforceable. The following amounts, determined after appropriate offsetting, are shown separately in the consolidated statement of financial position: 2024 HK$M 2023 HK$M Deferred tax assets 108 88 Deferred tax liabilities (14,776) (14,082) At 31st December (14,668) (13,994) Substantially all deferred tax balances are to be recovered or settled after more than 12 months. The movement on the net deferred tax liabilities account is as follows: 2024 HK$M 2023 HK$M At 1st January 13,994 11,184 Translation differences (334) (201) Acquisition of subsidiary companies – 2,536 Charged to profit or loss (note 11) 976 486 Charged/(Credited) to other comprehensive income 32 (11) At 31st December 14,668 13,994 The movement in deferred tax assets and liabilities (prior to offsetting balances within the same taxation jurisdiction) during the year is as follows: Deferred tax liabilities Accelerated tax depreciation Valuation of investment properties Right-of-use assets Others Total 2024 HK$M 2023 HK$M 2024 HK$M 2023 HK$M 2024 HK$M 2023 HK$M 2024 HK$M 2023 HK$M 2024 HK$M 2023 HK$M At 1st January 5,590 4,856 8,111 6,091 170 161 1,042 811 14,913 11,919 Translation differences (59) (31) (278) (170) (5) (2) (3) (2) (345) (205) Acquisition of subsidiary companies – 348 – 2,084 – 10 – 96 – 2,538 Charged/(Credited) to profit or loss 409 417 629 106 (7) 1 133 139 1,164 663 Charged/(Credited) to other comprehensive income – – – – – – 10 (2) 10 (2) At 31st December 5,940 5,590 8,462 8,111 158 170 1,182 1,042 15,742 14,913

Annual Report 2024 | EN Page 185 Page 187

Annual Report 2024 | EN Page 185 Page 187