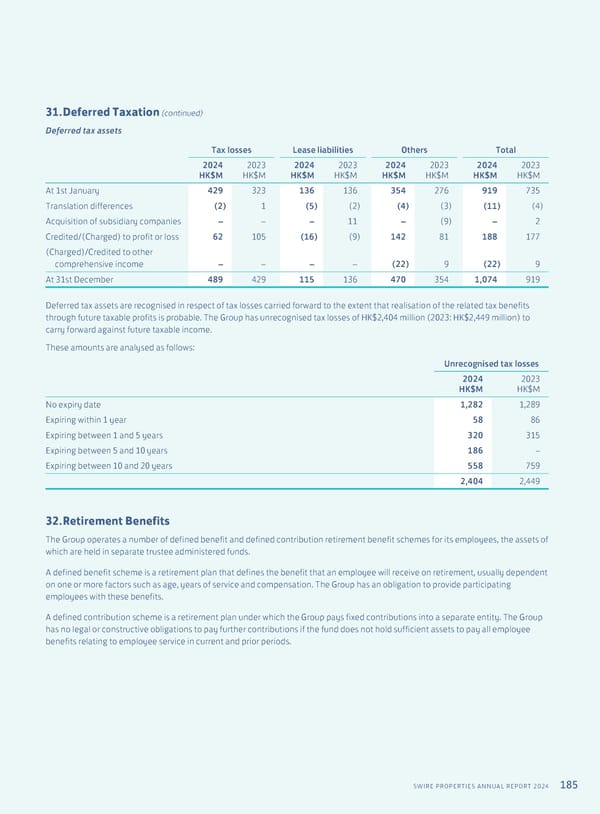

185 SWIRE PROPERTIES ANNUAL REPORT 2024 31. Deferred Taxation (continued) Deferred tax assets Tax losses Lease liabilities Others Total 2024 HK$M 2023 HK$M 2024 HK$M 2023 HK$M 2024 HK$M 2023 HK$M 2024 HK$M 2023 HK$M At 1st January 429 323 136 136 354 276 919 735 Translation differences (2) 1 (5) (2) (4) (3) (11) (4) Acquisition of subsidiary companies – – – 11 – (9) – 2 Credited/(Charged) to profit or loss 62 105 (16) (9) 142 81 188 177 (Charged)/Credited to other comprehensive income – – – – (22) 9 (22) 9 At 31st December 489 429 115 136 470 354 1,074 919 Deferred tax assets are recognised in respect of tax losses carried forward to the extent that realisation of the related tax benefits through future taxable profits is probable. The Group has unrecognised tax losses of HK$2,404 million (2023: HK$2,449 million) to carry forward against future taxable income. These amounts are analysed as follows: Unrecognised tax losses 2024 HK$M 2023 HK$M No expiry date 1,282 1,289 Expiring within 1 year 58 86 Expiring between 1 and 5 years 320 315 Expiring between 5 and 10 years 186 – Expiring between 10 and 20 years 558 759 2,404 2,449 32. Retirement Benefits The Group operates a number of defined benefit and defined contribution retirement benefit schemes for its employees, the assets of which are held in separate trustee administered funds. A defined benefit scheme is a retirement plan that defines the benefit that an employee will receive on retirement, usually dependent on one or more factors such as age, years of service and compensation. The Group has an obligation to provide participating employees with these benefits. A defined contribution scheme is a retirement plan under which the Group pays fixed contributions into a separate entity. The Group has no legal or constructive obligations to pay further contributions if the fund does not hold sufficient assets to pay all employee benefits relating to employee service in current and prior periods.

Annual Report 2024 | EN Page 186 Page 188

Annual Report 2024 | EN Page 186 Page 188