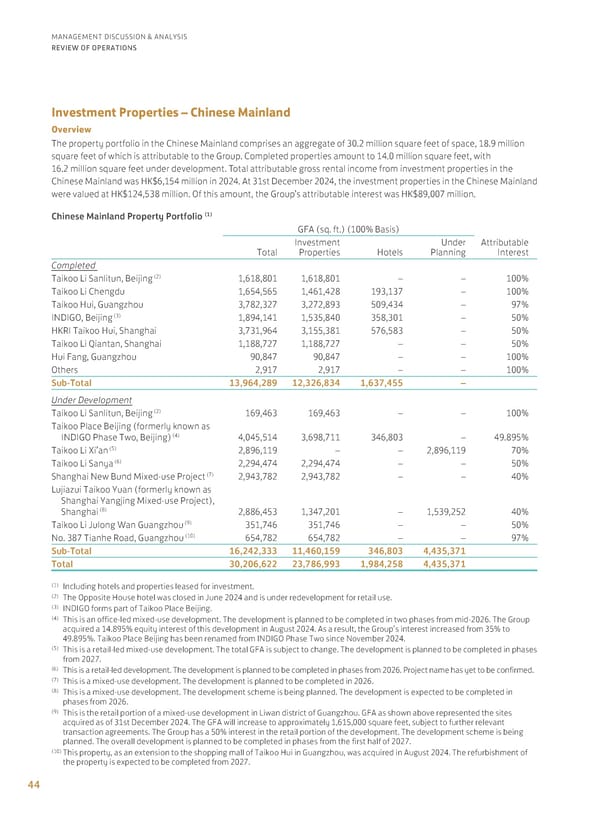

44 MANAGEMENT DISCUSSION & ANALYSIS REVIEW OF OPERATIONS Chinese Mainland Property Portfolio (1) GFA (sq. ft.) (100% Basis) Total Investment Properties Hotels Under Planning Attributable Interest Completed Taikoo Li Sanlitun, Beijing (2) 1,618,801 1,618,801 – – 100% Taikoo Li Chengdu 1,654,565 1,461,428 193,137 – 100% Taikoo Hui, Guangzhou 3,782,327 3,272,893 509,434 – 97% INDIGO, Beijing (3) 1,894,141 1,535,840 358,301 – 50% HKRI Taikoo Hui, Shanghai 3,731,964 3,155,381 576,583 – 50% Taikoo Li Qiantan, Shanghai 1,188,727 1,188,727 – – 50% Hui Fang, Guangzhou 90,847 90,847 – – 100% Others 2,917 2,917 – – 100% Sub-Total 13,964,289 12,326,834 1,637,455 – Under Development Taikoo Li Sanlitun, Beijing (2) 169,463 169,463 – – 100% Taikoo Place Beijing (formerly known as INDIGO Phase Two, Beijing) (4) 4,045,514 3,698,711 346,803 – 49.895% Taikoo Li Xi’an (5) 2,896,119 – – 2,896,119 70% Taikoo Li Sanya (6) 2,294,474 2,294,474 – – 50% Shanghai New Bund Mixed-use Project (7) 2,943,782 2,943,782 – – 40% Lujiazui Taikoo Yuan (formerly known as Shanghai Yangjing Mixed-use Project), Shanghai (8) 2,886,453 1,347,201 – 1,539,252 40% Taikoo Li Julong Wan Guangzhou (9) 351,746 351,746 – – 50% No. 387 Tianhe Road, Guangzhou (10) 654,782 654,782 – – 97% Sub-Total 16,242,333 11,460,159 346,803 4,435,371 Total 30,206,622 23,786,993 1,984,258 4,435,371 (1) Including hotels and properties leased for investment. (2) The Opposite House hotel was closed in June 2024 and is under redevelopment for retail use. (3) INDIGO forms part of Taikoo Place Beijing. (4) This is an office-led mixed-use development. The development is planned to be completed in two phases from mid-2026. The Group acquired a 14.895% equity interest of this development in August 2024. As a result, the Group’s interest increased from 35% to 49.895%. Taikoo Place Beijing has been renamed from INDIGO Phase Two since November 2024. (5) This is a retail-led mixed-use development. The total GFA is subject to change. The development is planned to be completed in phases from 2027. (6) This is a retail-led development. The development is planned to be completed in phases from 2026. Project name has yet to be confirmed. (7) This is a mixed-use development. The development is planned to be completed in 2026. (8) This is a mixed-use development. The development scheme is being planned. The development is expected to be completed in phases from 2026. (9) This is the retail portion of a mixed-use development in Liwan district of Guangzhou. GFA as shown above represented the sites acquired as of 31st December 2024. The GFA will increase to approximately 1,615,000 square feet, subject to further relevant transaction agreements. The Group has a 50% interest in the retail portion of the development. The development scheme is being planned. The overall development is planned to be completed in phases from the first half of 2027. (10) This property, as an extension to the shopping mall of Taikoo Hui in Guangzhou, was acquired in August 2024. The refurbishment of the property is expected to be completed from 2027. Investment Properties – Chinese Mainland Overview The property portfolio in the Chinese Mainland comprises an aggregate of 30.2 million square feet of space, 18.9 million square feet of which is attributable to the Group. Completed properties amount to 14.0 million square feet, with 16.2 million square feet under development. Total attributable gross rental income from investment properties in the Chinese Mainland was HK$6,154 million in 2024. At 31st December 2024, the investment properties in the Chinese Mainland were valued at HK$124,538 million. Of this amount, the Group’s attributable interest was HK$89,007 million.

Annual Report 2024 | EN Page 45 Page 47

Annual Report 2024 | EN Page 45 Page 47