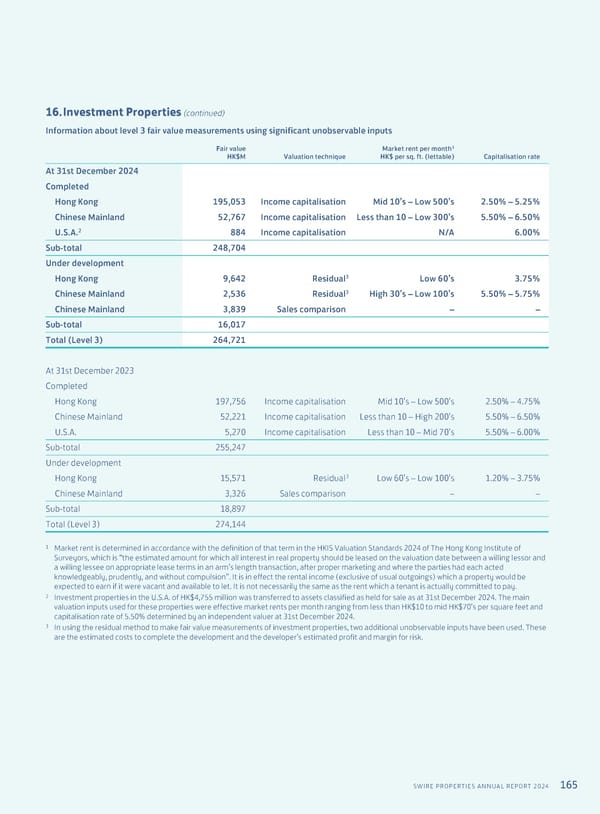

165 SWIRE PROPERTIES ANNUAL REPORT 2024 16. Investment Properties (continued) Information about level 3 fair value measurements using significant unobservable inputs Fair value HK$M Valuation technique Market rent per month1 HK$ per sq. ft. (lettable) Capitalisation rate At 31st December 2024 Completed Hong Kong 195,053 Income capitalisation Mid 10’s – Low 500’s 2.50% – 5.25% Chinese Mainland 52,767 Income capitalisation Less than 10 – Low 300’s 5.50% – 6.50% U.S.A.2 884 Income capitalisation N/A 6.00% Sub-total 248,704 Under development Hong Kong 9,642 Residual3 Low 60’s 3.75% Chinese Mainland 2,536 Residual3 High 30’s – Low 100’s 5.50% – 5.75% Chinese Mainland 3,839 Sales comparison – – Sub-total 16,017 Total (Level 3) 264,721 At 31st December 2023 Completed Hong Kong 197,756 Income capitalisation Mid 10’s – Low 500’s 2.50% – 4.75% Chinese Mainland 52,221 Income capitalisation Less than 10 – High 200’s 5.50% – 6.50% U.S.A. 5,270 Income capitalisation Less than 10 – Mid 70’s 5.50% – 6.00% Sub-total 255,247 Under development Hong Kong 15,571 Residual3 Low 60’s – Low 100’s 1.20% – 3.75% Chinese Mainland 3,326 Sales comparison – – Sub-total 18,897 Total (Level 3) 274,144 1 Market rent is determined in accordance with the definition of that term in the HKIS Valuation Standards 2024 of The Hong Kong Institute of Surveyors, which is “the estimated amount for which all interest in real property should be leased on the valuation date between a willing lessor and a willing lessee on appropriate lease terms in an arm’s length transaction, after proper marketing and where the parties had each acted knowledgeably, prudently, and without compulsion”. It is in effect the rental income (exclusive of usual outgoings) which a property would be expected to earn if it were vacant and available to let. It is not necessarily the same as the rent which a tenant is actually committed to pay. 2 Investment properties in the U.S.A. of HK$4,755 million was transferred to assets classified as held for sale as at 31st December 2024. The main valuation inputs used for these properties were effective market rents per month ranging from less than HK$10 to mid HK$70’s per square feet and capitalisation rate of 5.50% determined by an independent valuer at 31st December 2024. 3 In using the residual method to make fair value measurements of investment properties, two additional unobservable inputs have been used. These are the estimated costs to complete the development and the developer’s estimated profit and margin for risk.

Annual Report 2024 | EN Page 166 Page 168

Annual Report 2024 | EN Page 166 Page 168