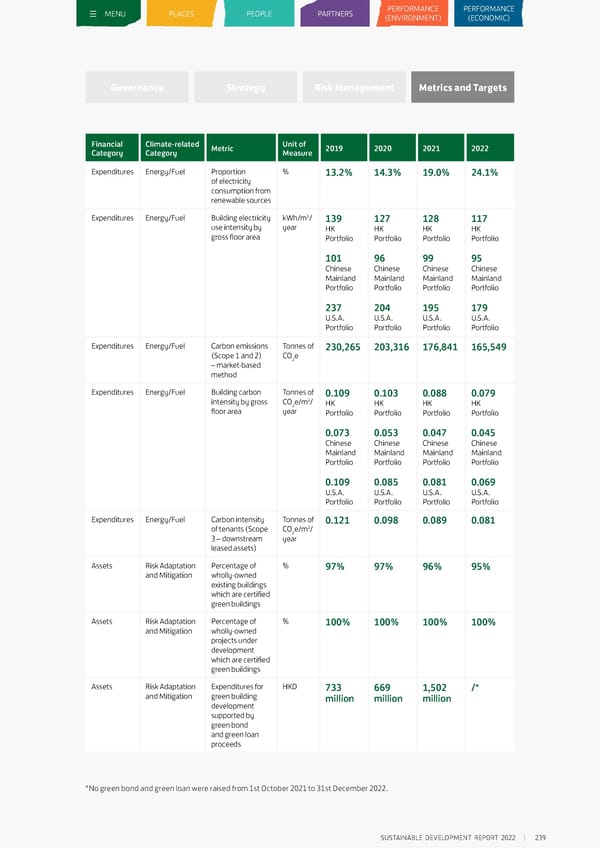

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) Governance Strategy Risk Management Metrics and Targets Financial Climate-related Metric Unit of 2019 2020 2021 2022 Category Category Measure Expenditures Energy/Fuel Proportion % 13.2% 14.3% 19.0% 24.1% of electricity consumption from renewable sources 2 Expenditures Energy/Fuel Building electricity kWh/m/ 139 127 128 117 use intensity by year HK HK HK HK gross floor area Portfolio Portfolio Portfolio Portfolio 101 96 99 95 Chinese Chinese Chinese Chinese Mainland Mainland Mainland Mainland Portfolio Portfolio Portfolio Portfolio 237 204 195 179 U.S.A. U.S.A. U.S.A. U.S.A. Portfolio Portfolio Portfolio Portfolio Expenditures Energy/Fuel Carbon emissions Tonnes of 230,265 203,316 176,841 165,549 (Scope 1 and 2) CO e – market-based 2 method Expenditures Energy/Fuel Building carbon Tonnes of 0.109 0.103 0.088 0.079 intensity by gross CO 2 e/m / HK HK HK HK floor area 2 year Portfolio Portfolio Portfolio Portfolio 0.073 0.053 0.047 0.045 Chinese Chinese Chinese Chinese Mainland Mainland Mainland Mainland Portfolio Portfolio Portfolio Portfolio 0.109 0.085 0.081 0.069 U.S.A. U.S.A. U.S.A. U.S.A. Portfolio Portfolio Portfolio Portfolio Expenditures Energy/Fuel Carbon intensity Tonnes of 0.121 0.098 0.089 0.081 of tenants (Scope CO 2 e/m / 3 – downstream 2 year leased assets) Assets Risk Adaptation Percentage of % 97% 97% 96% 95% and Mitigation wholly-owned existing buildings which are certified green buildings Assets Risk Adaptation Percentage of % 100% 100% 100% 100% and Mitigation wholly-owned projects under development which are certified green buildings Assets Risk Adaptation Expenditures for HKD 733 669 1,502 /* and Mitigation green building million million million development supported by green bond and green loan proceeds *No green bond and green loan were raised from 1st October 2021 to 31st December 2022. SUSTAINABLE DEVELOPMENT REPORT 2022 239

Sustainable Development Report 2022 Page 239 Page 241

Sustainable Development Report 2022 Page 239 Page 241