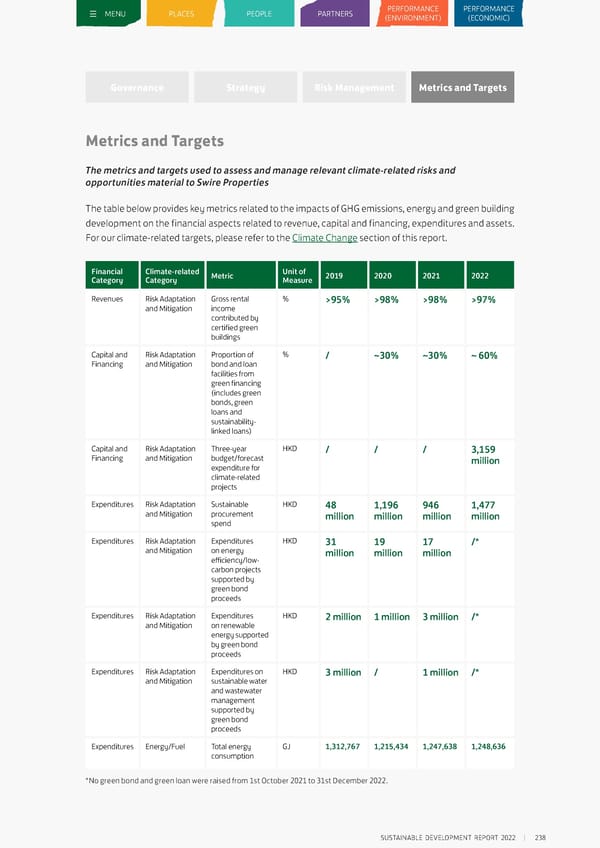

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) Governance Strategy Risk Management Metrics and Targets Metrics and Targets The metrics and targets used to assess and manage relevant climate-related risks and opportunities material to Swire Properties The table below provides key metrics related to the impacts of GHG emissions, energy and green building development on the financial aspects related to revenue, capital and financing, expenditures and assets. For our climate-related targets, please refer to the Climate Change section of this report. Financial Climate-related Metric Unit of 2019 2020 2021 2022 Category Category Measure Revenues Risk Adaptation Gross rental % >95% >98% >98% >97% and Mitigation income contributed by certified green buildings Capital and Risk Adaptation Proportion of % / ~30% ~30% ~ 60% Financing and Mitigation bond and loan facilities from green financing (includes green bonds, green loans and sustainability- linked loans) Capital and Risk Adaptation Three-year HKD / / / 3,159 Financing and Mitigation budget/forecast million expenditure for climate-related projects Expenditures Risk Adaptation Sustainable HKD 48 1,196 946 1,477 and Mitigation procurement million million million million spend Expenditures Risk Adaptation Expenditures HKD 31 19 17 /* and Mitigation on energy million million million efficiency/low- carbon projects supported by green bond proceeds Expenditures Risk Adaptation Expenditures HKD 2 million 1 million 3 million /* and Mitigation on renewable energy supported by green bond proceeds Expenditures Risk Adaptation Expenditures on HKD 3 million / 1 million /* and Mitigation sustainable water and wastewater management supported by green bond proceeds Expenditures Energy/Fuel Total energy GJ 1,312,767 1,215,434 1,247,638 1,248,636 consumption *No green bond and green loan were raised from 1st October 2021 to 31st December 2022. SUSTAINABLE DEVELOPMENT REPORT 2022 238

Sustainable Development Report 2022 Page 238 Page 240

Sustainable Development Report 2022 Page 238 Page 240