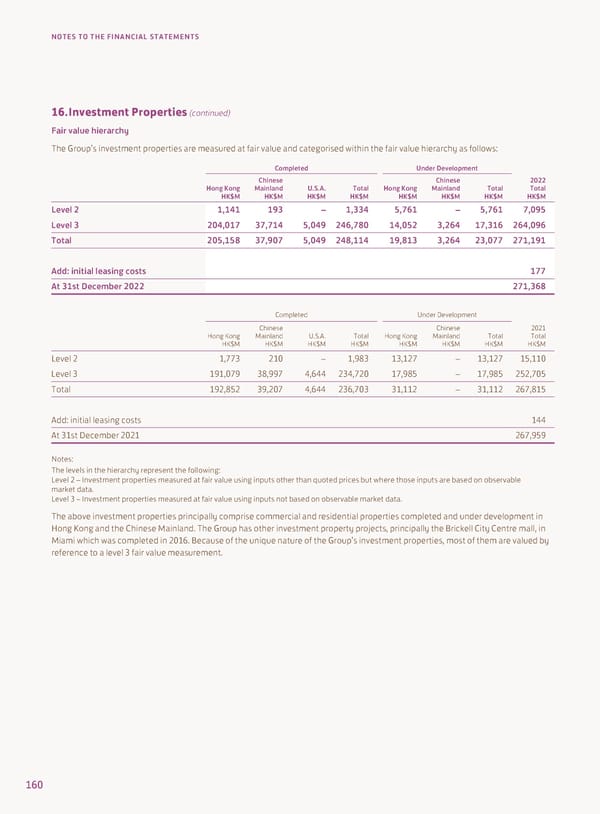

NOTES TO THE FINANCIAL STATEMENTS 16. Investment Properties (continued) Fair value hierarchy The Group’s investment properties are measured at fair value and categorised within the fair value hierarchy as follows: Completed Under Development Chinese Chinese 2022 Hong Kong Mainland U.S.A. Total Hong Kong Mainland Total Total HK$M HK$M HK$M HK$M HK$M HK$M HK$M HK$M Level 2 1,141 193 – 1,334 5,761 – 5,761 7,095 Level 3 204,017 37,714 5,049 246,780 14,052 3,264 17,316 264,096 Total 205,158 37,907 5,049 248,114 19,813 3,264 23,077 271,191 Add: initial leasing costs 177 At 31st December 2022 271,368 Completed Under Development Chinese Chinese 2021 Hong Kong Mainland U.S.A. Total Hong Kong Mainland Total Total HK$M HK$M HK$M HK$M HK$M HK$M HK$M HK$M Level 2 1,773 210 – 1,983 13,127 – 13,127 15,110 Level 3 191,079 38,997 4,644 234,720 17,985 – 17,985 252,705 Total 192,852 39,207 4,644 236,703 31,112 – 31,112 267,815 Add: initial leasing costs 144 At 31st December 2021 267,959 Notes: The levels in the hierarchy represent the following: Level 2 – Investment properties measured at fair value using inputs other than quoted prices but where those inputs are based on observable market data. Level 3 – Investment properties measured at fair value using inputs not based on observable market data. The above investment properties principally comprise commercial and residential properties completed and under development in Hong Kong and the Chinese Mainland. The Group has other investment property projects, principally the Brickell City Centre mall, in Miami which was completed in 2016. Because of the unique nature of the Group’s investment properties, most of them are valued by reference to a level 3 fair value measurement. 160

2022 Annual Report Page 161 Page 163

2022 Annual Report Page 161 Page 163