2022 Interim Report | EN

English Version.

Stock Code: 01972 Interim Report 2022 www.swireproperties.com

CONTENTS 2 Company Profile 8 Financial Highlights 9 Chairman’s Statement 12 Chief Executive’s Statement 16 Review of Operations 43 Financing 49 Report on Review of Condensed Interim Financial Statements 50 Condensed Interim Financial Statements 55 Notes to the Condensed Interim Financial Statements 73 Supplementary Information 75 Glossary 76 Financial Calendar and Information for Investors

COMPANY PROFILE Swire Properties Limited (the “Company”) is a leading developer, owner and operator of mixed-use, principally commercial, properties in Hong Kong and the Chinese Mainland, with a record of creating long-term value by transforming urban areas. Our business comprises three elements: property investment, property trading and hotel investment. Founded in Hong Kong in 1972, the Company is listed on The Stock Exchange of Hong Kong Limited and, with its subsidiaries, employs around 5,000 people. The Company’s shopping malls are home to more than 2,200 retail outlets. Its offices house a working population estimated to exceed 75,000. Our investment portfolio in Hong Kong comprises Taikoo Place, Pacific Place and Cityplaza. In the Chinese Mainland, the Company has six major commercial projects in operation in Beijing, Guangzhou, Chengdu and Shanghai. The Company has interests in the luxury and high quality residential markets in Hong Kong, Indonesia and Vietnam. There are also land banks in Miami, U.S.A. Swire Hotels develops and manages hotels in Hong Kong, the Chinese Mainland and the U.S.A. 2 Swire Properties Limited Interim Report 2022

CREATIVE TRANSFORMATION Captures what we do and how we do it. It underlines the creative mindset and long-term approach that enables us to seek out new perspectives, and original thinking that goes beyond the conventional. It also encapsulates our ability to unlock the potential of places and create vibrant destinations that can engender further growth and create sustainable value for our stakeholders. 4 Swire Properties Limited Interim Report 2022

5

“Our vision is to be the leading sustainable development performer in our industry globally by 2030.” – GUY BRADLEY, CHAIRMAN

2022 HIGHLIGHT ACHIEVEMENTS Won Pioneer Award 36 office tenants committed in Green Building to the Green Performance Leadership Category Pledge in ten months (Facilities Management) from its launch, covering Two Taikoo Place won over 1.8 million sq ft of Grand Award in New occupied lettable floor Building Category (Projects area across the Company’s Under Construction and/or Hong Kong office portfolio Design – Commercial) Launched a pioneering circular office furniture solution for Taikoo Place and Pacific Place tenants, a Hong Kong-and-industry first Taikoo Li Sanlitun achieved Platinum under 60 F&B tenants participated LEED Operations and in the Green Kitchen Initiative Maintenance Version 4.1 Taikoo Hui, Guangzhou Secured three more achieved Platinum under sustainability-linked LEED Operations and loan facilities, totalling Maintenance Version 4 HK$3.5 billion Approximately 45% of Once again recognised current bond and loan as Hong Kong’s Most facilities sourced from Attractive Employer at the green financing Randstad Employer Brand Awards 2022 7

FINANCIAL HIGHLIGHTS Six months ended 30th June 2022 2021 Note HK$M HK$M Change Results Revenue 6,698 9,068 -26% Profit attributable to the Company’s shareholders Underlying (a), (b) 4,140 4,513 -8% Recurring underlying (b) 3,643 3,716 -2% Reported 4,319 1,984 +118% Cash generated from operations 3,933 6,673 -41% Net cash (outflow)/inflow before financing (1,939) 1,231 n.a. HK$ HK$ Earnings per share Underlying (c), (d) 0.71 0.77 -8% Recurring underlying (c), (d) 0.62 0.64 -2% Reported (c), (d) 0.74 0.34 +118% Dividend per share First interim 0.32 0.31 +3% 30th June 31st December 2022 2021 HK$M HK$M Change Financial Position Total equity (including non-controlling interests) 293,236 294,158 0% Net debt 15,499 10,334 +50% Gearing ratio (a) 5.3% 3.5% +1.8%pt. HK$ HK$ Equity attributable to the Company’s shareholders per share (a) 49.61 49.94 -1% Notes: (a) Refer to glossary on page 75 for definition. (b) A reconciliation between reported profit and underlying profit attributable to the Company’s shareholders is provided on page 17. (c) Refer to note 11 in the financial statements for the weighted average number of shares. (d) The percentage change is the same as the corresponding percentage change in profit attributable to the Company’s shareholders. Six months ended 30th June 2022 2021 HK$M HK$M Underlying profit/(losses) by segment Property investment 3,843 3,908 Property trading (22) (28) Hotels (178) (164) Recurring underlying profit 3,643 3,716 Divestment 497 797 4,140 4,513 8 Swire Properties Limited Interim Report 2022

CHAIRMAN’S STATEMENT Dear shareholders, Underlying profit attributable to shareholders decreased by HK$373 million from HK$4,513 million in the first half The first six months of 2022 were challenging, with the of 2021 to HK$4,140 million in the first half of 2022, continuing impact of COVID-19 on our business. However, primarily due to the reduction in profit from the sale of 2022 is also proving to be a year of exciting expansion car parking spaces at the Taikoo Shing residential for Swire Properties. We have focused on realising development in Hong Kong. opportunities from the HK$100 billion investment plan which we announced in March. We declared a first interim dividend for 2022 of HK$0.32 per share. This represents an increase of 3% from the first 2022 is a significant year, as we celebrate our 50th interim dividend paid in 2021. The first interim dividend anniversary under the banner of “ORIGINAL. ALWAYS.”. for 2022 will be paid on Thursday, 6th October 2022 to This year is a celebration of our people, our commitment shareholders registered at the close of business on the to creativity, the communities which we serve and the record date, being Friday, 9th September 2022. Shares of places which we have helped to transform. the Company will be traded ex-dividend from Reflecting on our history, to the period when Swire first Wednesday, 7th September 2022. set down roots in Quarry Bay with the Taikoo Dockyard Our policy is to deliver sustainable growth in dividends and the Taikoo Sugar Refinery, it gives me great pride to and to pay out approximately half of our underlying profit see how far we have come in establishing Taikoo Place as in ordinary dividends over time. a global business district. And our vision continues. Our investment pipeline represents an ambitious growth plan for Swire Properties in Hong Kong, the Chinese Mainland Strategic Placemaking Masterplan and South East Asia. We have allocated HK$30 billion of our HK$100 billion This year we also celebrated the 25th anniversary of the investment fund to Hong Kong, specifically to continue to establishment of the Hong Kong Special Administrative build out our investments in Taikoo Place and Pacific Region. Hong Kong is our home city, and we remain fully Place. I am pleased to report that we continue to make committed to supporting the city in maintaining its global good progress with the redevelopment of Taikoo Place, competitiveness. With the expansion of our business and with our newest Grade A office tower, Two Taikoo Place, planned future investments, we are keen to play our part set to be completed later this year. in reinforcing Hong Kong’s status as an international financial centre. Whilst the overall office market has remained soft due to the effects of COVID-19, there has been a trend for prospective tenants to upgrade their premises and Profits and Sustained prioritise sustainability and wellness. Taikoo Place, Dividend Growth particularly with the two newest office towers, One Taikoo Place and Two Taikoo Place, is well-positioned to Our reported profit attributable to shareholders in the benefit from this flight-to-quality. Our focus on designing first half of 2022 was HK$4,319 million, compared with advanced, flexible spaces integrated with top-tier HK$1,984 million in the first half of 2021. amenities and green features has put Taikoo Place firmly on the map as a premium business address. 9

CHAIRMAN’S STATEMENT To that end, we remain committed to building on our of the few residential sites on Hong Kong Island to be investment in Taikoo Place. While the current phase of included in the HKSAR Government’s land sale the HK$15 billion Taikoo Place redevelopment is at its programme this year. final stage, the acquisition of the Zung Fu Industrial Building and the submission of compulsory sale In South East Asia, we broke ground on our Savyavasa applications for a number of buildings in Quarry Bay development in Jakarta earlier this year. We are also have put us in a favourable position to continue our making good progress on our two minority investments, placemaking strategy and to strengthen Taikoo Place’s The River and Empire City, in Ho Chi Minh City. With position as a global business district. HK$20 billion allocated for strategic investments, including residential trading, we remain opportunistic Our office portfolio in Hong Kong continues to and keen to leverage our premium residential brand in demonstrate its resilience. In accordance with our Hong Kong and South East Asia. We are looking to build masterplan for Pacific Place, we intend to expand the a presence in four core cities in South East Asia – portfolio over the next few years, leveraging Admiralty’s Singapore, Bangkok, Jakarta and Ho Chi Minh City, all growing connectivity and importance as a major of which feature a middle-class looking for higher-end transportation hub. We are making good progress on our residential properties. We have teams on the ground new Grade A office tower opposite Three Pacific Place, who are looking for the right partners and prime sites and will add approximately 218,000 square feet of for future investment and development. additional office space to our wider Pacific Place portfolio. Whilst our hotel business is still being adversely affected by COVID-19, we are making good progress on the Whilst there was a recovery in the Hong Kong’s retail expansion of our hotel management business within market in late 2021, this was halted by the fifth COVID-19 non-owned developments in new cities. We have plans wave in January 2022. However, we continued to for two new, third party owned hotels under The House maintain almost full occupancy in our malls, and the Collective brand in Shenzhen and Tokyo. market has been showing signs of recovery, boosted by the HKSAR Government’s consumption voucher scheme and the release of pent-up local demand. We will Future Growth in the continue to invest in our malls and launch innovative Chinese Mainland initiatives to keep up the positive momentum. The residential market in Hong Kong has remained The first six months of 2022 have been challenging for stable, with resilient demand. Our latest project, EIGHT some of our developments in the Chinese Mainland, STAR STREET, has been achieving satisfactory pre-sales, amidst tightened restrictions due to the resurgence of and we have embarked on an ambitious pipeline of new COVID-19. Despite this, we recorded an increase in rental developments to be completed over the next four years. income for the first half of 2022, reflecting contributions We were also pleased to win the tender for a residential from the newly opened Taikoo Li Sanlitun West and site at 269 Queen’s Road East in Wan Chai recently, one Taikoo Li Qiantan, as well as strong local demand and retail sales earlier in the year. 10 Swire Properties Limited Interim Report 2022

Thanks to our established Taikoo Hui and Taikoo Li Our success story in the Chinese Mainland has rested in brands, our rate of growth in the Chinese Mainland has large part on the trust we have built up with our local been exciting, with six projects now in operation and government partners and the communities in which we our seventh mixed-use development, Taikoo Li Xi’an, operate. Swire Properties’ brand continues to grow in the announced earlier this year. We have allocated 50% of region, as we demonstrate a strong track record of our HK$100 billion investment fund to investment in the delivering exceptional projects and transforming places Chinese Mainland over the next 10 years. which are a source of local pride in their home cities. We are very excited to be bringing a Taikoo Li development to the ancient city of Xi’an. This marks Conclusion our first investment in the city, and the large-scale project is in a very rare location adjacent to a UNESCO Despite the continued challenges posed by COVID-19, World Heritage Site. Securing this investment speaks we are bullish about our outlook over the medium to volumes for the trust we have built up in the Chinese long-term. Inevitably COVID-19 will continue to affect Mainland in a very short time, and local respect for the our business, but this is a short-term issue which we are Swire Properties brand. well able to withstand, thanks to a healthy balance sheet and strong fundamentals. Looking at the broader region, a key focus for our future investment is the Greater Bay Area, given its As we look to the future, we will continue to use our rapid pace of growth and its strategic importance to HK$100 billion investment fund to reinforce our core Hong Kong. Last year, we announced our plans to assets and pursue new investment opportunities. It develop a potential commercial project in the Julong remains our goal to deliver mid-single-digit annual Bay Area of Guangzhou, in a stunning natural location dividend growth. on the riverfront. More recently, we announced a new, luxury (third party owned) hotel in Shenzhen Bay which This is an exciting time for our business, and I would like will be managed by Swire Hotels. This will be our fifth to thank our shareholders, tenants, business partners and House under the award-winning House Collective brand. the communities in which we operate for your ongoing support. Most of all, I wish to thank the team at Swire Last year, we formed a joint venture with Shanghai Properties for their passion and commitment to our long- Jing’an Real Estate group, the owner of Zhangyuan, term vision and growth. The Company’s five decades of to revitalise the historic shikumen compound in success are a testament to their creativity and hard work. Shanghai, which is close to HKRI Taikoo Hui. Despite the resurgence of COVID-19 in Shanghai, we have been actively pushing ahead with the project, and we target to launch the first phase of Zhangyuan in the fourth quarter of 2022. In Beijing, we are making headway on INDIGO Phase Two, which is part of our masterplan to transform INDIGO into one of the best Guy Bradley performing office locations in the capital. Chairman Hong Kong, 11th August 2022 11

CHIEF EXECUTIVE’S STATEMENT Dear shareholders, Recurring underlying profit from property investment decreased slightly in the first half of 2022. This mainly We continue to operate in a difficult environment, reflected lower retail rental income from Hong Kong and with significant challenges posed by COVID-19 in the higher operating costs, partly offset by higher retail rental first half of 2022. However, our business remained income from the Chinese Mainland. resilient, and we recorded a solid performance from our investment portfolio in Hong Kong and the In Hong Kong, a weaker office market reflected subdued Chinese Mainland. demand and a decline in business activity, particularly during the fifth COVID-19 wave in the first quarter of 2022. Despite short-term setbacks, the Company remains However, leasing activity has recovered with the gradual on a sound financial footing. Our asset management easing of COVID-19 restrictions. Positive reversions were strategy over the last five years has strengthened our achieved at some of our Taikoo Place properties, and our balance sheet, and with our HK$100 billion investment overall office portfolio remained resilient, with high plan, we are actively managing a pipeline of new occupancy. projects in our core markets, which we intend to implement over a 10-year period. During the first quarter of 2022, Hong Kong’s retail market was severely disrupted by COVID-19 related 2022 is a landmark year for Swire Properties, as we social distancing measures including dining restrictions celebrate 50 years of transformative placemaking and and mandatory closures of certain outlets and premises. investment. As a homegrown Hong Kong company, we Tenants’ sales and footfall at our malls decreased are proud to celebrate this milestone in the same year significantly during this period. However, we began to that Hong Kong marks the 25th anniversary of its return see some recovery starting from mid-April, following the to China. gradual relaxation of restrictions and the introduction of Looking ahead, we remain fully committed to scaling up the HKSAR Government’s consumption voucher scheme. our investment in Hong Kong and the Chinese In the Chinese Mainland, retail sales began the year Mainland, as well as in South East Asia. Our leadership in strongly. However, our malls were affected to varying sustainable development and the digital transformation degrees by the resurgence of COVID-19 cases and related of our business also remain priorities as we focus on our preventive measures, particularly in Shanghai and Beijing, long-term growth. in the second quarter of 2022. Our office portfolio in the Chinese Mainland proved resilient despite COVID-19 2022 Interim Results at a Glance related controls in the cities where we operate. We recorded a small recurring underlying loss from our Our underlying profit decreased by HK$373 million to property trading activities in the first half of 2022, as a HK$4,140 million in the first half of 2022, principally result of the sales and marketing expenses at our reflecting the reduction in profit from the sale of non- residential project, EIGHT STAR STREET, in Hong Kong. core assets in Hong Kong. Recurring underlying profit in Our hotel business in Hong Kong and the Chinese the first half of 2022 was HK$3,643 million, compared Mainland continued to suffer from COVID-19 and its with HK$3,716 million in the first half of 2021. associated travel restrictions. 12 Swire Properties Limited Interim Report 2022

Our Future Prospects also help to boost retail sales. We continue to offer shopping incentives in our retail malls to maintain In Hong Kong, demand for office space is expected to positive momentum. Nevertheless, a full recovery of the be weak in the second half of 2022, reflecting increased retail market depends on full reopening of the border vacancy rates and new supply. However, the flight-to- with the Chinese Mainland. quality is expected to continue. Assuming a gradual reopening of the international border and the border Despite the resurgence of COVID-19 in some of the cities with the Chinese Mainland and improvements in the in which we operate in the Chinese Mainland, we expect financial markets, the demand for Grade-A office space, demand for retail space to be stable and to recover particularly from financial institutions and professional steadily over the second half of this year. We also expect services companies, should increase. strong demand for space from retailers of luxury brands in Guangzhou and Chengdu, and stable demand for Taikoo Place is ever evolving, and with projects like Two space in Shanghai from retailers of luxury fashion, Taikoo Place, we are developing new office buildings of cosmetics and lifestyle brands, and from operators of high specifications which represent the future of work. food and beverage outlets. In Beijing, retail sales and The pre-leasing of Two Taikoo Place is making steady demand for retail space are expected to recover steadily progress, with a commitment rate approaching 50%. As in the second half of 2022. our first anchor tenant, Julius Baer, a Swiss private bank, will lease 92,000 square feet of office space. Additional In Beijing, Shanghai and Guangzhou, office demand and strategic tenants have been secured, including one of the market sentiment are expected to recover in the second biggest office lease transactions on Hong Kong Island in half of 2022 assuming COVID-19 restrictions continue recent years, with an anchor tenant for over 150,000 to be relaxed. However, the continued new supply of square feet of office space. office space in Shanghai and Guangzhou, particularly in emerging decentralised submarkets, is exerting We are also continuing the eastward expansion of our downward pressure on rents. Pacific Place portfolio in Hong Kong. We are making good progress on our new office tower opposite Three Pacific With our new investments, we have accelerated the pace Place, which will add approximately 218,000 square feet of our growth in the Chinese Mainland. We secured our of additional office space to our portfolio. first major investment in Xi’an earlier this year, a Taikoo Li concept which will be retail-led and specially designed for In June, we were delighted to win a land tender for a the Small Wild Goose Pagoda historical and cultural zone. residential site at 269 Queen’s Road East in Wan Chai. The Greater Bay Area holds enormous development This is a prime location with excellent potential for a new potential, and we are exploring opportunities to bring our premium residential product in the district. Taikoo Li and Taikoo Hui brands to Shenzhen. On the retail side, we anticipate that overall traffic and The outlook for our hotels remains challenging, with retail sales will continue to improve in our Hong Kong recovery dependent on the full reopening of the border malls, assuming the progressive relaxation of social with the Chinese Mainland combined with the relaxation distancing measures continues. The second phase of the of travel restrictions. However, we have embarked on an HKSAR Government’s consumption voucher scheme will active expansion strategy for our hotel management 13

CHIEF EXECUTIVE’S STATEMENT business, with a focus on extending our two distinctive These targets are widespread across our portfolios, and hotel brands into other cities through hotel management we see this as the right time to fully engage with our agreements. We will be expanding in Shenzhen with our tenants about sustainability. Tenants increasingly have new House hotel in the Shenzhen Bay Area, which is their own ESG commitments, and we are providing tools targeted to open in 2025. The hotel will be within a key and support to help them achieve their goals. commercial hub, and will help meet the growing demand for luxury accommodation in Shenzhen. We launched the Green Performance Pledge (GPP) earlier this year, a tenant-landlord collaboration where We are also excited to be bringing a new House hotel to we will work with tenants to optimise their fit-out and Tokyo, marking the debut of The House Collective brand renovations, gather data and identify opportunities in outside China. The hotel will be located within the iconic their operations to help them continuously improve their Shibuya district and will introduce the brand’s distinctive sustainability performance. The GPP will also feature a design and exceptional service to a new market. sustainable office furniture service, where tenants can access premium and re-used furniture products, with an Our premium residential brand has opened the door for aim to contribute to Hong Kong’s circular economy. This new opportunities in Hong Kong and South East Asia. We is in addition to our Green Kitchen Initiative, where our are making good headway on a pipeline of new projects teams work closely with our retail food and beverage in Hong Kong, including developments in Wong Chuk tenants during the pre-fit out process, to reduce their Hang, Wan Chai and Chai Wan. Our investments in energy and water usage and improve their waste Jakarta and Ho Chi Minh City are also on track, whilst we management practices. continue to explore new opportunities in South East Asia. Our leadership work in sustainability is also reflected In Miami, retail sales continue to grow, thanks to strong in our digital transformation. Since 2020, our new domestic demand. ventures department has helped to accelerate the adoption of emerging technologies for our business, and manages a US$50 million corporate venture capital Leadership in Sustainability and fund to invest in promising technology start-ups around Digital Innovation the world. By engaging with thought leaders and scouting innovative new technology, we aim to make prudent Since launching our Sustainable Development 2030 financial and strategic investments with a view to helping Strategy in 2016, we have demonstrated a deep level our business grow. of commitment and ambition to be a sustainable development leader in our industry. We ranked number one in Asia and seventh in our industry globally in the Celebrating 50 Years of Success Dow Jones Sustainability World Index last year, and we are building on these accomplishments with very The festivities for our “ORIGINAL. ALWAYS.” 50th aggressive targets intended to help reach the global anniversary campaign will continue throughout 2022. 1.5˚C decarbonisation goal. We are very proud to be celebrating this milestone with our teams and the many stakeholders who have played a crucial role in our success. 14 Swire Properties Limited Interim Report 2022

We wanted to celebrate arts and culture in its varied Conclusion forms this year, and worked closely with long-term partner Art Basel, as well as the Victoria & Albert Museum, We continue to experience significant challenges to our on a special roving exhibition around our Hong Kong and business as COVID-19 develops, particularly in the retail Chinese Mainland malls. and hospitality sectors. However, we have gained ground in all areas of our business, and our financial strength has We also commissioned a 50th Anniversary Art NFT ensured that we can continue to develop our existing Collection, working with 10 international artists on a portfolios over the long term while investing in new series inspired by our “Originality” theme, which will be opportunities. available later this year as free art drops. We are very proud to mark 50 years of creating We recognise the importance of supporting younger transformational places, and we are grateful for the generations. As part of our anniversary celebrations, support that we have received from our shareholders, we joined with the Hong Kong Palace Museum to our business partners and the community at large. We sponsor the two-year Bi-city Youth Cultural Leadership were also honoured to be recognised by Randstad again Programme. The programme will enable young people in this year, who named Swire Properties as the most Hong Kong and Beijing to connect and exchange cultural attractive company to work for in Hong Kong in 2022. ideas and innovative thinking, with the purpose of nurturing a new generation of exceptional leaders. Our biggest source of pride is our people, who have weathered the storm over recent years. They are our We also launched the 2022 edition of the Swire Properties biggest asset and I thank them for their dedication and Placemaking Academy, where a team of students is again commitment over the past 50 years. participating in a six-month apprenticeship to make our White Christmas Street Fair a more sustainable event for the wider community. Our previous Academy alumni have already gone on to win awards, and we expect this next cohort to benefit greatly from our masterclasses and mentorship over the next six months. We are very proud to continue our wide-ranging Tim Blackburn volunteer work under our community ambassador Chief Executive programme. A new community space called “Quarryside” Hong Kong, 11th August 2022 on the Quarry Bay harbourfront area is on track to open in early 2023, and we are providing consultancy support for the design, construction and operational stages. The project is managed by St. James’ Settlement with sponsorship of HK$15 million from Swire Trust. Once completed, Quarryside will be an exciting new venue for activities and events, which we envision will create closer community ties within our home district. 15

REVIEW OF OPERATIONS Six months ended Year ended 30th June 31st December 2022 2021 2021 HK$M HK$M HK$M Revenue Gross Rental Income derived from Offices 3,039 3,075 6,193 Retail 2,781 2,875 5,785 Residential 183 247 474 (1) Other Revenue 50 50 102 Property Investment 6,053 6,247 12,554 Property Trading 383 2,394 2,443 Hotels 262 427 894 Total Revenue 6,698 9,068 15,891 Operating Profit/(Losses) derived from Property investment From operations 4,047 4,303 8,283 Sale of interests in investment properties 31 302 1,185 Valuation gains/(losses) on investment properties 701 (2,525) (1,947) Property trading 218 496 492 Hotels (137) (109) (174) Total Operating Profit 4,860 2,467 7,839 Share of Post-tax Profit from Joint Venture and Associated Companies 473 817 1,788 Profit Attributable to the Company’s Shareholders 4,319 1,984 7,121 (1) Other revenue is mainly estate management fees. Additional information is provided in the following section to reconcile reported and underlying profit attributable to the Company’s shareholders. These reconciling items principally adjust for the net valuation movements on investment properties and the associated deferred tax in the Chinese Mainland and the U.S.A., and for other deferred tax provisions in relation to investment properties. In Hong Kong and the U.S.A., the Group’s investment properties recorded net property valuation gains of HK$810 million and HK$182 million respectively in the first half of 2022. In the Chinese Mainland, investment properties recorded net property valuation losses of HK$237 million. There is a further adjustment to remove the effect of the movement in the fair value of the liability in respect of a put option in favour of the owner of a non- controlling interest. Amortisation of right-of-use assets classified as investment properties is charged to underlying profit. 16 Swire Properties Limited Interim Report 2022

Six months ended Year ended 30th June 31st December Underlying Profit Reconciliation 2022 2021 2021 Note HK$M HK$M HK$M Profit Attributable to the Company’s Shareholders per Financial Statements 4,319 1,984 7,121 Adjustments in respect of investment properties: Valuation (gains)/losses in respect of investment properties (a) (755) 2,058 708 Deferred tax on investment properties (b) 213 521 1,027 Valuation gains/(losses) realised on sale of interests in investment properties (c) 299 (134) 585 Depreciation of investment properties occupied by the Group (d) 11 11 23 Non-controlling interests’ share of valuation movements less deferred tax 75 44 59 Movement in the fair value of the liability in respect of a put option in favour of the owner of a non-controlling interest (e) 20 23 49 Impairment loss on a hotel held as part of a mixed-use development (f) – 22 22 Less amortisation of right-of-use assets reported under investment properties (g) (42) (16) (53) Underlying Profit Attributable to the Company’s Shareholders 4,140 4,513 9,541 Profit from divestment (497) (797) (2,389) Recurring Underlying Profit Attributable to the Company’s Shareholders 3,643 3,716 7,152 Notes: (a) This represents the net valuation movements as shown in the Group’s consolidated statement of profit or loss and the Group’s share of net valuation movements of joint venture companies. (b) This represents deferred tax movements on the Group’s investment properties, plus the Group’s share of deferred tax movements on investment properties held by joint venture companies. These comprise deferred tax on valuation movements on investment properties in the Chinese Mainland and the U.S.A., and deferred tax provisions made in respect of investment properties held for the long term where it is considered that the liability will not reverse for some considerable time. It also includes certain tax adjustments arising from transfers of investment properties within the Group. (c) Prior to the implementation of HKAS 40, changes in the fair value of investment properties were recorded in the revaluation reserve rather than the consolidated statement of profit or loss. On sale, the valuation gains/(losses) were transferred from the revaluation reserve to the consolidated statement of profit or loss. (d) Prior to the implementation of HKAS 40, no depreciation was charged on investment properties occupied by the Group. (e) The value of the put option in favour of the owner of a non-controlling interest is calculated principally by reference to the estimated fair value of the portion of the underlying investment property in which the owner of the non-controlling interest is interested. (f) Under HKAS 40, hotel properties are stated in the accounts at cost less accumulated depreciation and any provision for impairment losses, rather than at fair value. If HKAS 40 did not apply, wholly-owned and joint venture hotel properties held for the long term as part of mixed-use property developments would be accounted for as investment properties. Accordingly, any increase or decrease in their values would be recorded in the revaluation reserve rather than in the consolidated statement of profit or loss. (g) HKFRS 16 amends the definition of investment property under HKAS 40 to include properties held by lessees as right-of-use assets to earn rentals or for capital appreciation or both, and requires the Group to account for such right-of-use assets at their fair value. The amortisation of such right-of-use assets is charged to underlying profit. 17

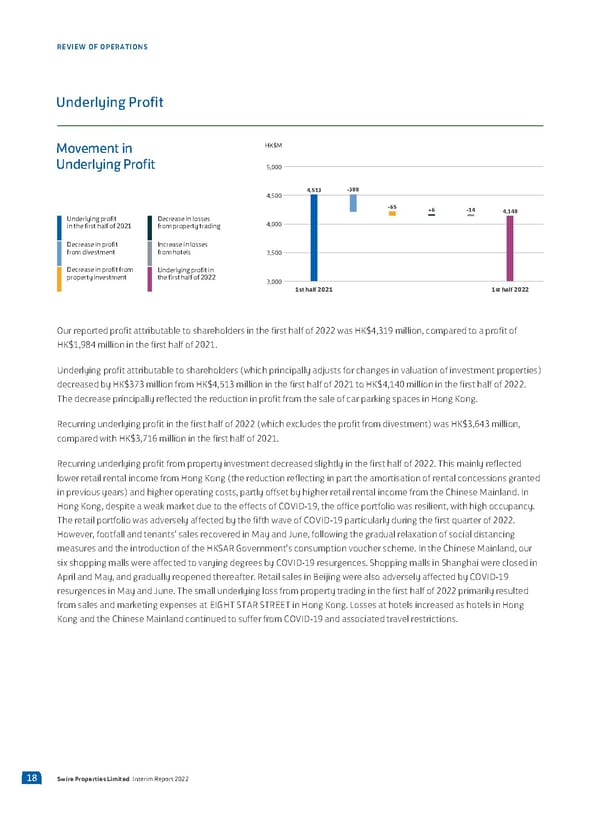

REVIEW OF OPERATIONS Underlying Profit Movement in M Underlying Profit 5,000 4,500 4,513 -300 -65 +6 -14 4,140 Underlying profit Decrease in losses 4,000 in the first half of 2021 from property trading Decrease in profit Increase in losses from divestment from hotels 3,500 Decrease in profit from Underlying profit in property investment the first half of 2022 3,000 1st half 2021 1st half 2022 Our reported profit attributable to shareholders in the first half of 2022 was HK$4,319 million, compared to a profit of HK$1,984 million in the first half of 2021. Underlying profit attributable to shareholders (which principally adjusts for changes in valuation of investment properties) decreased by HK$373 million from HK$4,513 million in the first half of 2021 to HK$4,140 million in the first half of 2022. The decrease principally reflected the reduction in profit from the sale of car parking spaces in Hong Kong. Recurring underlying profit in the first half of 2022 (which excludes the profit from divestment) was HK$3,643 million, compared with HK$3,716 million in the first half of 2021. Recurring underlying profit from property investment decreased slightly in the first half of 2022. This mainly reflected lower retail rental income from Hong Kong (the reduction reflecting in part the amortisation of rental concessions granted in previous years) and higher operating costs, partly offset by higher retail rental income from the Chinese Mainland. In Hong Kong, despite a weak market due to the effects of COVID-19, the office portfolio was resilient, with high occupancy. The retail portfolio was adversely affected by the fifth wave of COVID-19 particularly during the first quarter of 2022. However, footfall and tenants’ sales recovered in May and June, following the gradual relaxation of social distancing measures and the introduction of the HKSAR Government’s consumption voucher scheme. In the Chinese Mainland, our six shopping malls were affected to varying degrees by COVID-19 resurgences. Shopping malls in Shanghai were closed in April and May, and gradually reopened thereafter. Retail sales in Beijing were also adversely affected by COVID-19 resurgences in May and June. The small underlying loss from property trading in the first half of 2022 primarily resulted from sales and marketing expenses at EIGHT STAR STREET in Hong Kong. Losses at hotels increased as hotels in Hong Kong and the Chinese Mainland continued to suffer from COVID-19 and associated travel restrictions. 18 Swire Properties Limited Interim Report 2022

In July and August 2022, Swire Hotels announced plans Key Developments for two new, third party owned hotels under The House In January 2022, the sale of the property located at Fort Collective brand in Tokyo and Shenzhen. The two hotels Lauderdale, Florida was completed. will be managed by Swire Hotels. In March 2022, a consortium in which the Group has a 70% interest successfully acquired (via a government Portfolio Overview land tender) the land use rights in respect of land located at the Small Wild Goose Pagoda historical and cultural The aggregate gross floor area (“GFA”) attributable zone in the Beilin district of Xi’an for a consideration of to the Group at 30th June 2022 was approximately approximately RMB2,575 million. The land is expected to 32.8 million square feet. be developed into a retail-led mixed-use development comprising retail and cultural facilities in addition to a Of the aggregate GFA attributable to the Group, hotel, serviced residences and business apartments. approximately 29.1 million square feet are investment properties and hotels, comprising completed investment In March 2022, the Group obtained full ownership of Zung properties and hotels of approximately 22.9 million Fu Industrial Building in Quarry Bay, Hong Kong. Subject square feet and investment properties under to the Group having successfully bid in the compulsory development or held for future development of sale of the adjacent Wah Ha Factory Building, the two approximately 6.2 million square feet. In Hong Kong, the sites are intended to be redeveloped for office and other investment property and hotel portfolio comprises commercial uses. approximately 13.9 million square feet attributable to the In March 2022, the Group acquired an additional 6.67% Group of primarily Grade-A office and retail premises, interest in the Citygate development. As a result, the hotels, serviced apartments and other luxury residential Group’s interest in the Citygate development has accommodation. In the Chinese Mainland, the Group has increased from 20% to 26.67%. interests in seven major commercial developments in prime locations in Beijing, Guangzhou, Chengdu, In June 2022, the Group acquired (via a government Shanghai and Xi’an. These developments are expected to land tender) a plot of land located at 269 Queen’s Road comprise approximately 13.1 million square feet of East in Wan Chai, Hong Kong for a consideration of attributable GFA when they are all completed. Of this, 9.6 approximately HK$1,962 million. The plot of land is million square feet has already been completed. Outside expected to be developed primarily for residential use Hong Kong and the Chinese Mainland, the investment with an aggregate gross floor area of approximately property portfolio comprises the Brickell City Centre 116,200 square feet. development in Miami, U.S.A. 19

REVIEW OF OPERATIONS The tables below illustrate the GFA (or expected GFA) attributable to the Group of the investment property and hotel portfolio at 30th June 2022. Completed Investment Properties and Hotels (GFA attributable to the Group in million square feet) Residential/ Serviced Under (1) Office Retail Hotels Apartments Planning Total Hong Kong 8.7 2.6 0.8 0.6 – 12.7 Chinese Mainland 2.9 5.4 1.1 0.2 – 9.6 U.S.A. – 0.3 0.3 – – 0.6 Total 11.6 8.3 2.2 0.8 – 22.9 Investment Properties and Hotels Under Development or Held for Future Development (expected GFA attributable to the Group in million square feet) Residential/ Serviced Under (1) Office Retail Hotels Apartments Planning Total Hong Kong 1.2 – – – – 1.2 Chinese Mainland – – – – 3.5 3.5 (2) U.S.A. – – – – 1.5 1.5 Total 1.2 – – – 5.0 6.2 Total Investment Properties and Hotels (GFA (or expected GFA) attributable to the Group in million square feet) Residential/ Serviced Under (1) Office Retail Hotels Apartments Planning Total Total 12.8 8.3 2.2 0.8 5.0 29.1 (1) Hotels are accounted for in the financial statements under property, plant and equipment and, where applicable, the leasehold land portion is accounted for under right-of-use assets. (2) This property is accounted for under properties held for development in the financial statements. The trading portfolio comprises completed units available for sale at EIGHT STAR STREET in Hong Kong. There are six residential projects under development, three in Hong Kong, one in Indonesia and two in Vietnam. There are also land banks in Miami, U.S.A. The table below illustrates the GFA (or expected GFA) attributable to the Group of the trading property portfolio at 30th June 2022. Trading Properties (GFA (or expected GFA) attributable to the Group in million square feet) Under Development Completed or Held for Development (1) Development Total Hong Kong 0.0 0.7 0.7 U.S.A. and elsewhere – 3.0 3.0 Total 0.0 3.7 3.7 (1) Completed development comprises EIGHT STAR STREET in Hong Kong. 20 Swire Properties Limited Interim Report 2022

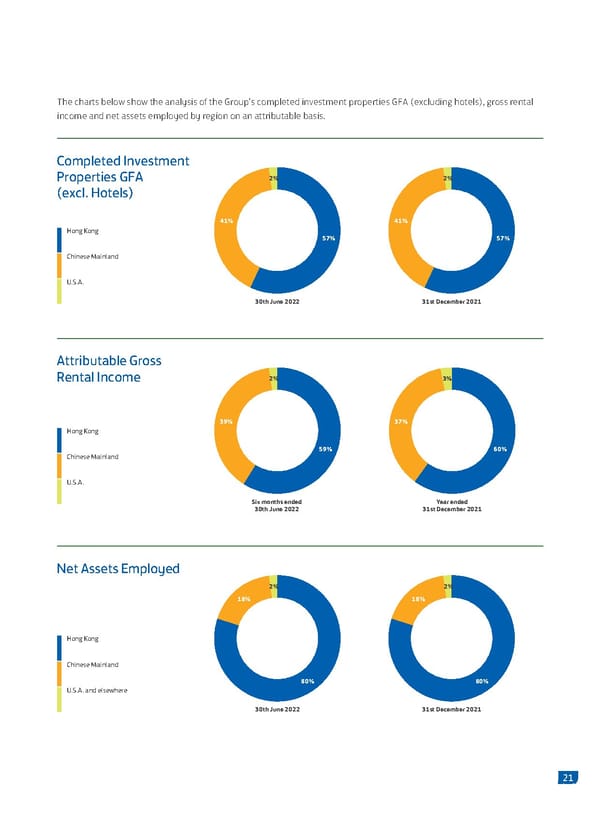

The charts below show the analysis of the Group’s completed investment properties GFA (excluding hotels), gross rental income and net assets employed by region on an attributable basis. Completed Investment Properties GFA 2% 2% (excl. Hotels 41% 41% Hong Kong 57% 57% Chinese Mainland U.S.A. 30th June 2022 31st December 2021 Attributable Gross Rental Income 2% 3% 39% 37% Hong Kong 59% 60% Chinese Mainland U.S.A. Six months ended Year ended 30th June 2022 31st December 2021 Net Assets Employed 2% 2% 18% 18% Hong Kong Chinese Mainland 80% 80% U.S.A. and elsewhere 30th June 2022 31st December 2021 21

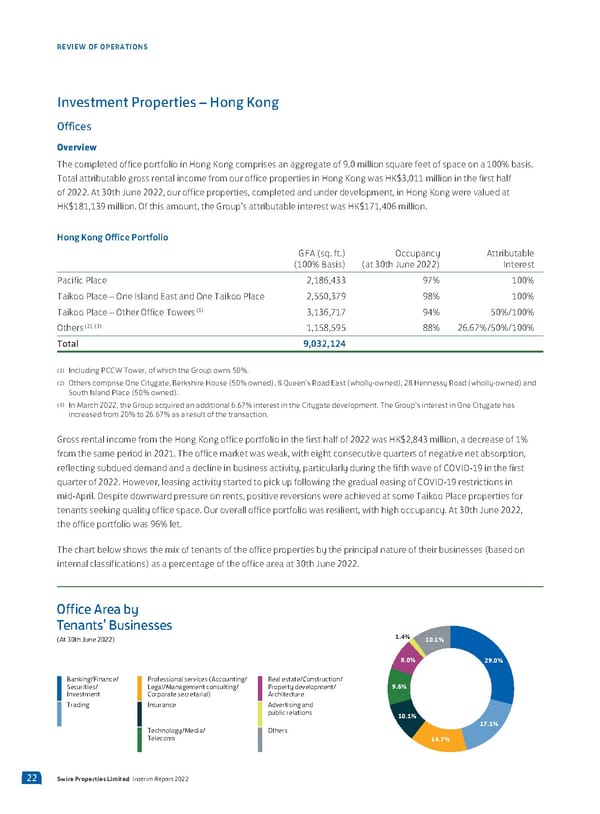

REVIEW OF OPERATIONS Investment Properties – Hong Kong Offices Overview The completed office portfolio in Hong Kong comprises an aggregate of 9.0 million square feet of space on a 100% basis. Total attributable gross rental income from our office properties in Hong Kong was HK$3,011 million in the first half of 2022. At 30th June 2022, our office properties, completed and under development, in Hong Kong were valued at HK$181,139 million. Of this amount, the Group’s attributable interest was HK$171,406 million. Hong Kong Office Portfolio GFA (sq. ft.) Occupancy Attributable (100% Basis) (at 30th June 2022) Interest Pacific Place 2,186,433 97% 100% Taikoo Place – One Island East and One Taikoo Place 2,550,379 98% 100% (1) Taikoo Place – Other Office Towers 3,136,717 94% 50%/100% (2), (3) Others 1,158,595 88% 26.67%/50%/100% Total 9,032,124 (1) Including PCCW Tower, of which the Group owns 50%. (2) Others comprise One Citygate, Berkshire House (50% owned), 8 Queen’s Road East (wholly-owned), 28 Hennessy Road (wholly-owned) and South Island Place (50% owned). (3) In March 2022, the Group acquired an additional 6.67% interest in the Citygate development. The Group’s interest in One Citygate has increased from 20% to 26.67% as a result of the transaction. Gross rental income from the Hong Kong office portfolio in the first half of 2022 was HK$2,843 million, a decrease of 1% from the same period in 2021. The office market was weak, with eight consecutive quarters of negative net absorption, reflecting subdued demand and a decline in business activity, particularly during the fifth wave of COVID-19 in the first quarter of 2022. However, leasing activity started to pick up following the gradual easing of COVID-19 restrictions in mid-April. Despite downward pressure on rents, positive reversions were achieved at some Taikoo Place properties for tenants seeking quality office space. Our overall office portfolio was resilient, with high occupancy. At 30th June 2022, the office portfolio was 96% let. The chart below shows the mix of tenants of the office properties by the principal nature of their businesses (based on internal classifications) as a percentage of the office area at 30th June 2022. ffice Area Tenants Businesses (At €t ‚une ƒ€ƒƒ 1.4% 10.1% 8.0% 29.0% Banking/Finance/ Professional services (Accounting/ eal estate/Construction/ Securities/ Legal/Management consulting/ Propert development/ 9.6% Investment Corporate secretarial Arcitecture Trading Insurance Advertising and pulic relations 10.1% Tecnolog/Media/ ters 17.1% Telecoms 14.7% 22 Swire Properties Limited Interim Report 2022

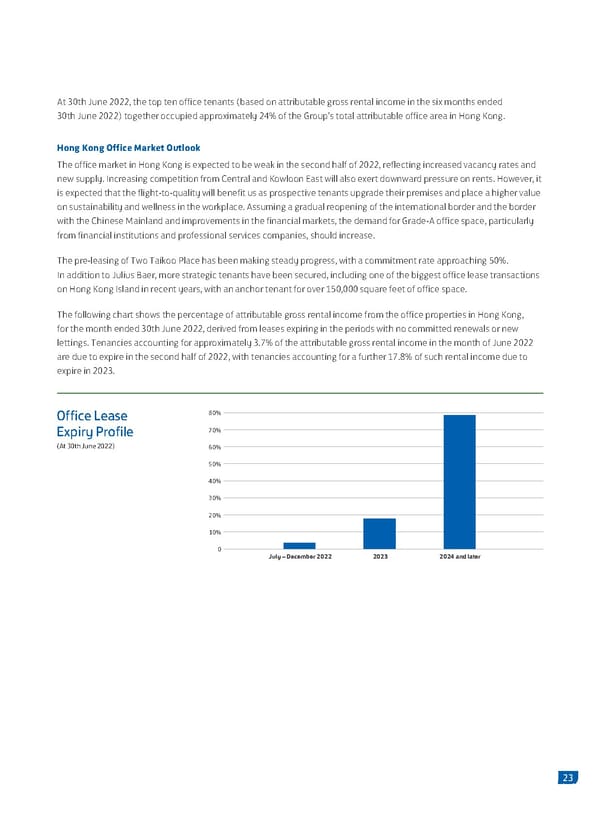

At 30th June 2022, the top ten office tenants (based on attributable gross rental income in the six months ended 30th June 2022) together occupied approximately 24% of the Group’s total attributable office area in Hong Kong. Hong Kong Office Market Outlook The office market in Hong Kong is expected to be weak in the second half of 2022, reflecting increased vacancy rates and new supply. Increasing competition from Central and Kowloon East will also exert downward pressure on rents. However, it is expected that the flight-to-quality will benefit us as prospective tenants upgrade their premises and place a higher value on sustainability and wellness in the workplace. Assuming a gradual reopening of the international border and the border with the Chinese Mainland and improvements in the financial markets, the demand for Grade-A office space, particularly from financial institutions and professional services companies, should increase. The pre-leasing of Two Taikoo Place has been making steady progress, with a commitment rate approaching 50%. In addition to Julius Baer, more strategic tenants have been secured, including one of the biggest office lease transactions on Hong Kong Island in recent years, with an anchor tenant for over 150,000 square feet of office space. The following chart shows the percentage of attributable gross rental income from the office properties in Hong Kong, for the month ended 30th June 2022, derived from leases expiring in the periods with no committed renewals or new lettings. Tenancies accounting for approximately 3.7% of the attributable gross rental income in the month of June 2022 are due to expire in the second half of 2022, with tenancies accounting for a further 17.8% of such rental income due to expire in 2023. Office Lease 80% Expiry Profile 70% (At 30th e 2022 60% 50% 40% 30% 20% 10% 0 July – December 2022 2023 2024 and later 23

REVIEW OF OPERATIONS Retail Overview The completed retail portfolio in Hong Kong comprises an aggregate of 3.2 million square feet of space on a 100% basis. Total attributable gross rental income from our retail properties in Hong Kong was HK$1,058 million in the first half of 2022. At 30th June 2022, our retail properties in Hong Kong were valued at HK$54,926 million. Of this amount, the Group’s attributable interest was HK$46,053 million. The portfolio principally consists of The Mall at Pacific Place, Cityplaza at Taikoo Shing and Citygate Outlets at Tung Chung. The Mall and Cityplaza are wholly-owned by the Group. During the period, the Group increased its interest in the Citygate development (comprising Citygate Outlets) from 20% to 26.67%. The malls are managed by the Group. Hong Kong retail market recovered in late 2021, but the recovery was halted when the fifth wave of COVID-19 hit in January this year. During the first quarter of 2022, the retail market was severely disrupted by social distancing measures including dining restrictions and mandatory closures of certain outlets and premises. Both tenants’ sales and footfall at our malls decreased significantly during this period. There was very little inbound tourism. Leasing activity was low. However, local consumption started to show signs of recovery in the middle of the second quarter of 2022 due to pent-up demand, following the gradual relaxation of social distancing measures, and the introduction of the HKSAR Government’s consumption voucher scheme. During the first half as a whole, retail sales decreased by 2%, 5% and 2% respectively at The Mall, Pacific Place, Cityplaza and Citygate Outlets. Hong Kong Retail Portfolio GFA (sq. ft.) Occupancy Attributable (100% Basis) (at 30th June 2022) Interest The Mall, Pacific Place 711,182 96% 100% Cityplaza 1,096,898 100% 100% (1) Citygate Outlets 803,582 100% 26.67% (1), (2) Others 549,558 100% 26.67%/60%/100% Total 3,161,220 (1) In March 2022, the Group acquired an additional 6.67% interest in the Citygate development. The Group’s interest in Citygate Outlets and Tung Chung Crescent neighbourhood shops increased from 20% to 26.67% as a result of the transaction. (2) Others largely comprise Taikoo Shing neighbourhood shops and StarCrest retail premises (which are wholly-owned), Island Place retail premises (60% owned) and Tung Chung Crescent neighbourhood shops. Gross rental income from the retail portfolio in Hong Kong was HK$1,002 million in the first half of 2022, a decrease of 10% compared to the same period in 2021. The decrease reflected the impact of the fifth wave of COVID-19 and, in part, the amortisation of rental concessions given in previous years. Rental concessions (which were amortised over the remaining lease terms) were given for specific periods on a case-by-case basis to support tenants. In the first half of 2022, rental concessions (on a cash basis) reduced as compared to the same period in 2021. On a cash concession basis, attributable gross rental income decreased by 2% during the period. The malls were almost fully let throughout the period. 24 Swire Properties Limited Interim Report 2022

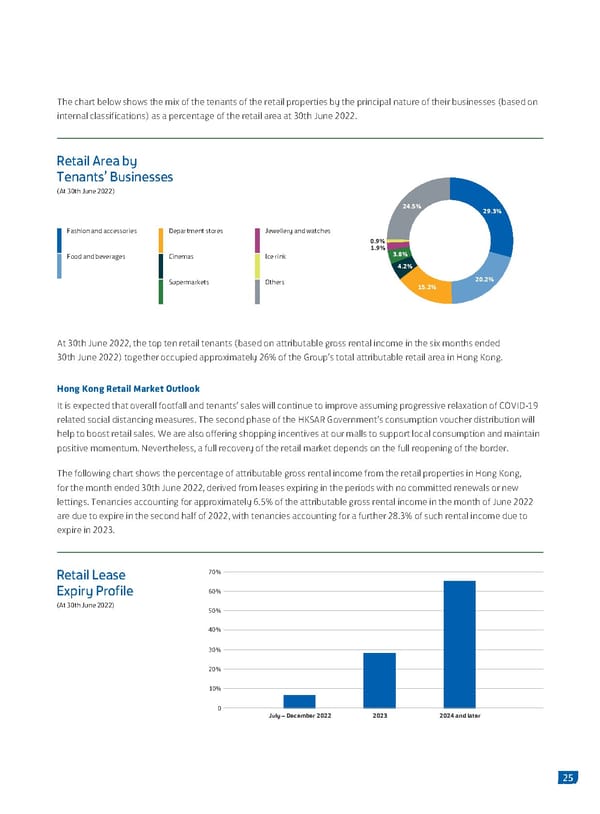

The chart below shows the mix of the tenants of the retail properties by the principal nature of their businesses (based on internal classifications) as a percentage of the retail area at 30th June 2022. Retail Area by enants’ usinesses At th June 24.5% 29.3% Fashion and accessories Department stores Jewellery and watches 0.9% 1.9% 3.8% Food and beverages Cinemas Ice rink 4.2% Supermarkets Others 15.2% 20.2% At 30th June 2022, the top ten retail tenants (based on attributable gross rental income in the six months ended 30th June 2022) together occupied approximately 26% of the Group’s total attributable retail area in Hong Kong. Hong Kong Retail Market Outlook It is expected that overall footfall and tenants’ sales will continue to improve assuming progressive relaxation of COVID-19 related social distancing measures. The second phase of the HKSAR Government’s consumption voucher distribution will help to boost retail sales. We are also offering shopping incentives at our malls to support local consumption and maintain positive momentum. Nevertheless, a full recovery of the retail market depends on the full reopening of the border. The following chart shows the percentage of attributable gross rental income from the retail properties in Hong Kong, for the month ended 30th June 2022, derived from leases expiring in the periods with no committed renewals or new lettings. Tenancies accounting for approximately 6.5% of the attributable gross rental income in the month of June 2022 are due to expire in the second half of 2022, with tenancies accounting for a further 28.3% of such rental income due to expire in 2023. Retail Lease 70% Expiry Profile 60% (At 30th Jue 2022 50% 40% 30% 20% 10% 0 July – December 2022 2023 2024 and later 25

REVIEW OF OPERATIONS Residential Others The completed residential portfolio comprises Pacific Wah Ha Factory Building, No. 8 Shipyard Lane and Place Apartments at Pacific Place, EAST Residences in Zung Fu Industrial Building, No. 1067 King’s Road Quarry Bay, STAR STUDIOS in Wan Chai and a number of In 2018, the Group submitted compulsory sale luxury houses on Hong Kong Island and Lantau Island, applications in respect of these two sites in Quarry Bay. In with an aggregate GFA of approximately 0.6 million March 2022, the Group acquired the remaining interests square feet. The occupancy rate at the residential in Zung Fu Industrial Building and obtained full ownership portfolio was approximately 70% at 30th June 2022. of the site. Subject to the Group having successfully bid in Demand for our residential investment properties was the compulsory sale of the Wah Ha Factory Building site, primarily local, and was affected by COVID-19. the two sites are intended to be redeveloped for office Investment Properties Under Development and other commercial uses with an aggregate GFA of approximately 779,000 square feet. Two Taikoo Place Two Taikoo Place, the second phase of the Taikoo Place 983-987A King’s Road and 16-94 Pan Hoi Street redevelopment, is an office tower with an aggregate In 2018, a joint venture company in which the Group GFA of approximately one million square feet. The holds a 50% interest submitted a compulsory sale development has been built to the highest sustainability application in respect of this site in Quarry Bay. Subject to standards, achieving pre-certified platinum ratings for the joint venture company having successfully bid in the LEED, WELL and BEAM Plus. Interior fit out works are in compulsory sale and in accordance with applicable town progress. Completion is expected later this year. planning controls, it is expected that the site can be redeveloped for residential and retail uses with a GFA 46-56 Queen’s Road East of approximately 440,000 square feet. Planning permission to develop this site in Wan Chai for office use was obtained in 2018. The site area is 9-39 Hoi Wan Street and 33-41 Tong Chong Street approximately 14,400 square feet. The proposed In June 2022, the Group submitted a compulsory sale development has an aggregate GFA of approximately application in respect of this site in Quarry Bay. The gross 218,000 square feet. Superstructure works are in site area is approximately 20,060 square feet. The progress. Completion is expected in 2023. development plan is under review, and is subject to the Group having successfully bid in the compulsory sale. Taikoo Shing Car Parking Spaces Since November 2020, the Group has offered 2,530 car parking spaces in the Taikoo Shing residential development in Hong Kong for sale. 1,405 of these car parking spaces had been sold at 9th August 2022. Sales of 1,366 car parking spaces have been recognised, 164 of them in the first half of 2022. Sales of 39 car parking spaces are expected to be recognised in the second half of 2022. 26 Swire Properties Limited Interim Report 2022

Investment Properties – Chinese Mainland Overview The property portfolio in the Chinese Mainland comprises an aggregate of 21.0 million square feet of space, 13.1 million square feet of which is attributable to the Group. Completed properties amount to approximately 14.0 million square feet, with 7.0 million square feet under development. Total attributable gross rental income from investment properties in the Chinese Mainland was HK$2,785 million in the first half of 2022. At 30th June 2022, the investment properties in the Chinese Mainland were valued at HK$107,530 million. Of this amount, the Group’s attributable interest was HK$70,469 million. Chinese Mainland Property Portfolio (1) GFA (sq. ft.) (100% Basis) Investment Hotels and Under Attributable Total Properties Others Planning Interest Completed Taikoo Li Sanlitun, Beijing 1,789,000 1,619,537 169,463 – 100% Taikoo Hui, Guangzhou 3,782,327 3,272,893 509,434 – 97% INDIGO, Beijing 1,886,865 1,528,564 358,301 – 50% Sino-Ocean Taikoo Li Chengdu 1,661,725 1,465,217 196,508 – 50% HKRI Taikoo Hui, Shanghai 3,536,619 3,148,792 387,827 – 50% Taikoo Li Qiantan, Shanghai 1,188,727 1,188,727 – – 50% Hui Fang, Guangzhou 90,847 90,847 – – 100% Others 2,917 1,458 1,459 – 100% Sub-Total 13,939,027 12,316,035 1,622,992 – Under Development (2) INDIGO Phase Two, Beijing 4,045,514 – – 4,045,514 35% Taikoo Li Xi’an (3) 2,971,607 – – 2,971,607 70% Sub-Total 7,017,121 – – 7,017,121 Total 20,956,148 12,316,035 1,622,992 7,017,121 (1) Including hotels and properties leased for investment. (2) This is an office-led mixed-use development. The development scheme is being planned. The development is planned to be completed in two phases, in mid-2025 and 2026. (3) This is a retail-led mixed-use development. The development scheme is being planned. The development is planned to be completed in 2025. Gross rental income from the Group’s investment property portfolio in the Chinese Mainland was HK$1,784 million in the first half of 2022, 3% higher than in the same period in 2021, reflecting the contribution from the newly opened Taikoo Li Sanlitun West and the strong performance of the retail market in the first quarter of the year before COVID-19 resurgences in the Chinese Mainland. 27

REVIEW OF OPERATIONS Retail The completed retail portfolio in the Chinese Mainland comprises an aggregate of 7.9 million square feet of space, 5.4 million square feet of which is attributable to the Group. Total attributable gross rental income from our retail properties in the Chinese Mainland grew by 9%, to HK$2,305 million, in the first half of 2022. Disregarding amortised rental concessions and changes in the value of the Renminbi, total attributable gross rental income increased by 7%. At 30th June 2022, our completed retail properties in the Chinese Mainland were valued at HK$66,857 million. Of this amount, the Group’s attributable interest was HK$48,881 million. The portfolio consists of Taikoo Li Sanlitun in Beijing and Hui Fang in Guangzhou, which are wholly-owned by the Group, Taikoo Hui in Guangzhou, which is 97% owned, and INDIGO in Beijing, Sino-Ocean Taikoo Li Chengdu, HKRI Taikoo Hui and Taikoo Li Qiantan in Shanghai, each of which is 50% owned. Chinese Mainland Completed Retail Portfolio GFA (sq. ft.) Occupancy Attributable (100% Basis) (at 30th June 2022) Interest Taikoo Li Sanlitun, Beijing (1) 1,619,537 98% 100% Taikoo Hui, Guangzhou 1,529,392 99% 97% INDIGO, Beijing 939,493 100% 50% Sino-Ocean Taikoo Li Chengdu 1,355,360 96% 50% HKRI Taikoo Hui, Shanghai 1,173,459 98% 50% (2) Taikoo Li Qiantan, Shanghai 1,188,727 91% 50% Hui Fang, Guangzhou 90,847 100% 100% Total 7,896,815 (1) Including Taikoo Li Sanlitun West, which officially opened in December 2021. (2) Including space allocated to prospective tenants who have signed letters of intent. In the Chinese Mainland, retail sales began the year strongly. There were also contributions from the newly opened Taikoo Li Sanlitun West and Taikoo Li Qiantan. However, our six shopping malls were affected to varying degrees in the second quarter of 2022 by the resurgence of COVID-19 and related preventive measures in cities where we operate, particularly in Shanghai and Beijing. In Shanghai, retail shops were closed in April and May, and gradually reopened thereafter. Retail sales in Beijing were adversely affected by COVID-19 resurgences in May and June. Our retail sales (excluding Taikoo Li Sanlitun West and Taikoo Li Qiantan) on an attributable basis in the Chinese Mainland in the first half of 2022 decreased by 19%. Retail sales at Taikoo Li Sanlitun in Beijing, Taikoo Hui in Guangzhou, INDIGO in Beijing, Sino-Ocean Taikoo Li Chengdu and HKRI Taikoo Hui in Shanghai decreased by 26%, 7%, 25%, 8% and 53% respectively in the first half of 2022. National retail sales decreased by 1% in the first half of 2022 compared to the same period in 2021. The Group’s gross rental income from retail properties in the Chinese Mainland increased by 3%, to HK$1,586 million, in the first half of 2022. Rental concessions (which were amortised over the remaining lease terms) were given for specific periods on a case-by-case basis to support tenants. Disregarding amortised rental concessions and changes in the value of the Renminbi, gross rental income increased by 1%. 28 Swire Properties Limited Interim Report 2022

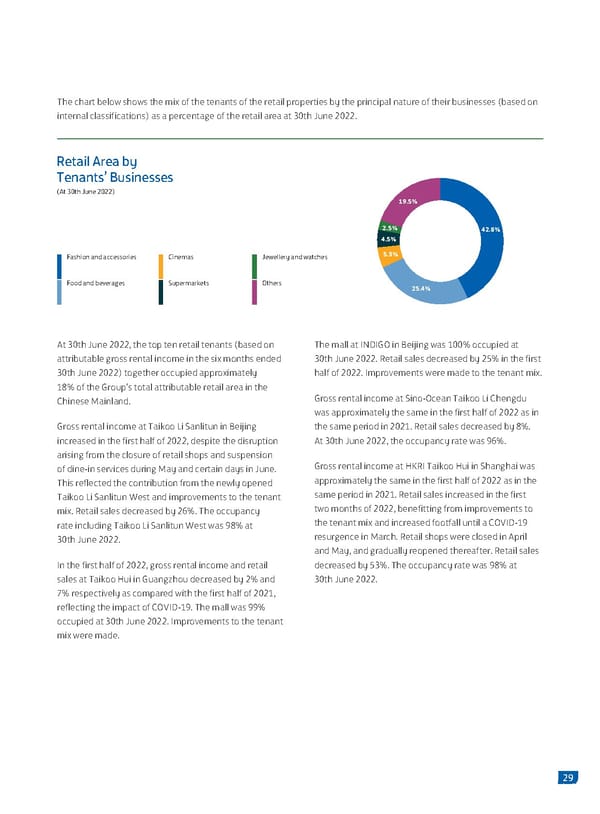

The chart below shows the mix of the tenants of the retail properties by the principal nature of their businesses (based on internal classifications) as a percentage of the retail area at 30th June 2022. Retail Area by Tenants’ usinesses At th June 19.5% 2.5% 42.8% 4.5% Fashion and accessories Cinemas Jewellery and watches 5.3% Food and beverages Supermarkets Others 25.4% At 30th June 2022, the top ten retail tenants (based on The mall at INDIGO in Beijing was 100% occupied at attributable gross rental income in the six months ended 30th June 2022. Retail sales decreased by 25% in the first 30th June 2022) together occupied approximately half of 2022. Improvements were made to the tenant mix. 18% of the Group’s total attributable retail area in the Chinese Mainland. Gross rental income at Sino-Ocean Taikoo Li Chengdu was approximately the same in the first half of 2022 as in Gross rental income at Taikoo Li Sanlitun in Beijing the same period in 2021. Retail sales decreased by 8%. increased in the first half of 2022, despite the disruption At 30th June 2022, the occupancy rate was 96%. arising from the closure of retail shops and suspension of dine-in services during May and certain days in June. Gross rental income at HKRI Taikoo Hui in Shanghai was This reflected the contribution from the newly opened approximately the same in the first half of 2022 as in the Taikoo Li Sanlitun West and improvements to the tenant same period in 2021. Retail sales increased in the first mix. Retail sales decreased by 26%. The occupancy two months of 2022, benefitting from improvements to rate including Taikoo Li Sanlitun West was 98% at the tenant mix and increased footfall until a COVID-19 30th June 2022. resurgence in March. Retail shops were closed in April and May, and gradually reopened thereafter. Retail sales In the first half of 2022, gross rental income and retail decreased by 53%. The occupancy rate was 98% at sales at Taikoo Hui in Guangzhou decreased by 2% and 30th June 2022. 7% respectively as compared with the first half of 2021, reflecting the impact of COVID-19. The mall was 99% occupied at 30th June 2022. Improvements to the tenant mix were made. 29

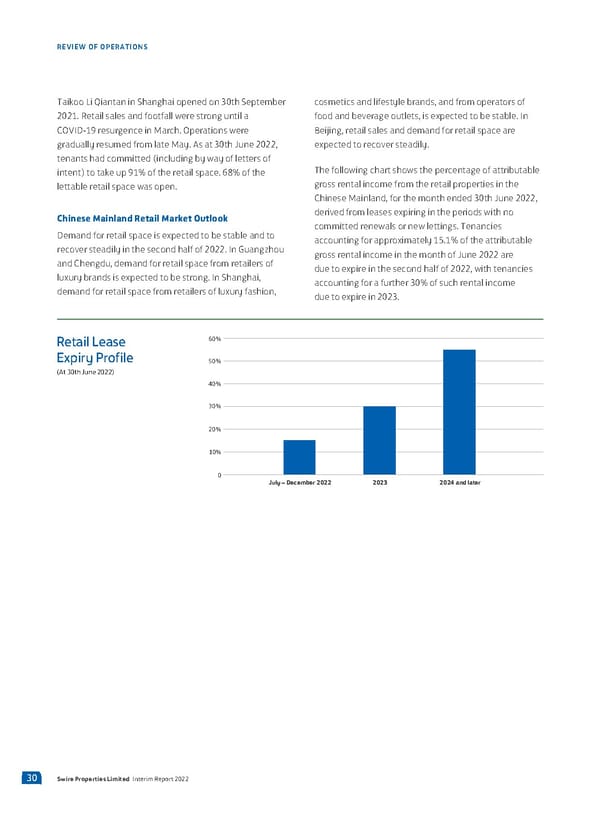

REVIEW OF OPERATIONS Taikoo Li Qiantan in Shanghai opened on 30th September cosmetics and lifestyle brands, and from operators of 2021. Retail sales and footfall were strong until a food and beverage outlets, is expected to be stable. In COVID-19 resurgence in March. Operations were Beijing, retail sales and demand for retail space are gradually resumed from late May. As at 30th June 2022, expected to recover steadily. tenants had committed (including by way of letters of intent) to take up 91% of the retail space. 68% of the The following chart shows the percentage of attributable lettable retail space was open. gross rental income from the retail properties in the Chinese Mainland, for the month ended 30th June 2022, Chinese Mainland Retail Market Outlook derived from leases expiring in the periods with no Demand for retail space is expected to be stable and to committed renewals or new lettings. Tenancies recover steadily in the second half of 2022. In Guangzhou accounting for approximately 15.1% of the attributable and Chengdu, demand for retail space from retailers of gross rental income in the month of June 2022 are luxury brands is expected to be strong. In Shanghai, due to expire in the second half of 2022, with tenancies demand for retail space from retailers of luxury fashion, accounting for a further 30% of such rental income due to expire in 2023. Retail Lease 60% Expiry Profile 50% (At 30th June 2022 40% 30% 20% 10% 0 July – December 2022 2023 2024 and later 30 Swire Properties Limited Interim Report 2022

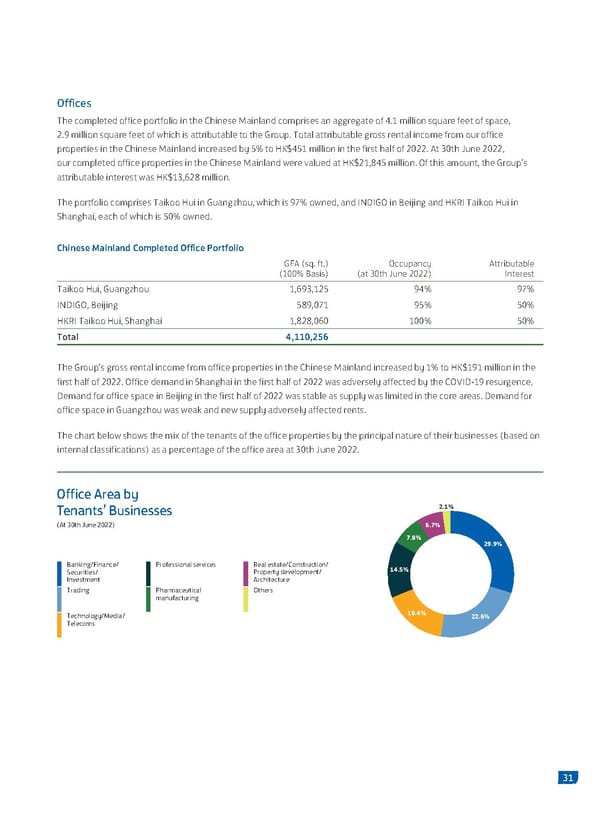

Offices The completed office portfolio in the Chinese Mainland comprises an aggregate of 4.1 million square feet of space, 2.9 million square feet of which is attributable to the Group. Total attributable gross rental income from our office properties in the Chinese Mainland increased by 5% to HK$451 million in the first half of 2022. At 30th June 2022, our completed office properties in the Chinese Mainland were valued at HK$21,845 million. Of this amount, the Group’s attributable interest was HK$13,628 million. The portfolio comprises Taikoo Hui in Guangzhou, which is 97% owned, and INDIGO in Beijing and HKRI Taikoo Hui in Shanghai, each of which is 50% owned. Chinese Mainland Completed Office Portfolio GFA (sq. ft.) Occupancy Attributable (100% Basis) (at 30th June 2022) Interest Taikoo Hui, Guangzhou 1,693,125 94% 97% INDIGO, Beijing 589,071 95% 50% HKRI Taikoo Hui, Shanghai 1,828,060 100% 50% Total 4,110,256 The Group’s gross rental income from office properties in the Chinese Mainland increased by 1% to HK$191 million in the first half of 2022. Office demand in Shanghai in the first half of 2022 was adversely affected by the COVID-19 resurgence. Demand for office space in Beijing in the first half of 2022 was stable as supply was limited in the core areas. Demand for office space in Guangzhou was weak and new supply adversely affected rents. The chart below shows the mix of the tenants of the office properties by the principal nature of their businesses (based on internal classifications) as a percentage of the office area at 30th June 2022. ffice rea y Tenants’ Businesses 2.1% t th une € €€‚ 6.7% 7.8% 29.9% Banking/Finance/ Professional services Real estate/Construction/ 14.5% Securities/ Property development/ Investment rchitecture Trading Pharmaceutical thers manufacturing Technology/Media/ 16.4% 22.6% Telecoms 31

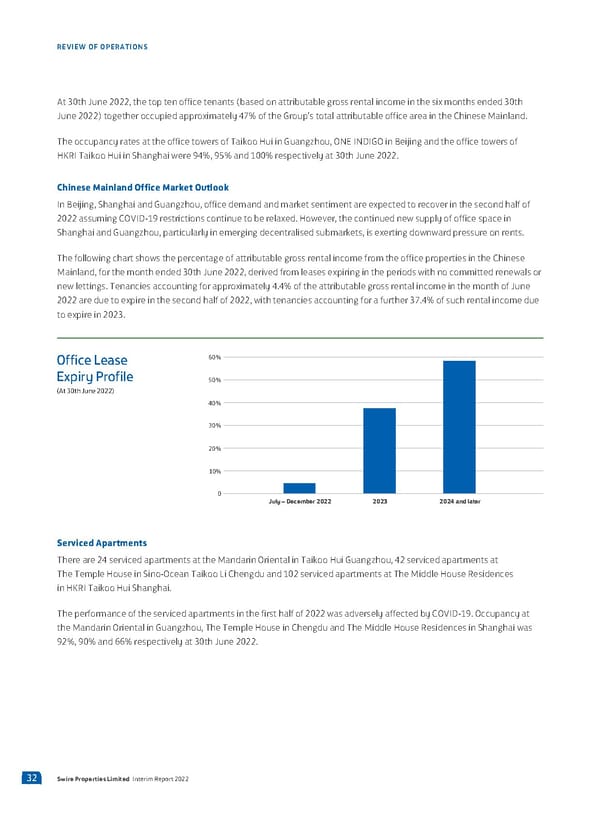

REVIEW OF OPERATIONS At 30th June 2022, the top ten office tenants (based on attributable gross rental income in the six months ended 30th June 2022) together occupied approximately 47% of the Group’s total attributable office area in the Chinese Mainland. The occupancy rates at the office towers of Taikoo Hui in Guangzhou, ONE INDIGO in Beijing and the office towers of HKRI Taikoo Hui in Shanghai were 94%, 95% and 100% respectively at 30th June 2022. Chinese Mainland Office Market Outlook In Beijing, Shanghai and Guangzhou, office demand and market sentiment are expected to recover in the second half of 2022 assuming COVID-19 restrictions continue to be relaxed. However, the continued new supply of office space in Shanghai and Guangzhou, particularly in emerging decentralised submarkets, is exerting downward pressure on rents. The following chart shows the percentage of attributable gross rental income from the office properties in the Chinese Mainland, for the month ended 30th June 2022, derived from leases expiring in the periods with no committed renewals or new lettings. Tenancies accounting for approximately 4.4% of the attributable gross rental income in the month of June 2022 are due to expire in the second half of 2022, with tenancies accounting for a further 37.4% of such rental income due to expire in 2023. Office Lease 60% Expiry Profile 50% (At 30th Jue 2022 40% 30% 20% 10% 0 July – December 2022 2023 2024 and later Serviced Apartments There are 24 serviced apartments at the Mandarin Oriental in Taikoo Hui Guangzhou, 42 serviced apartments at The Temple House in Sino-Ocean Taikoo Li Chengdu and 102 serviced apartments at The Middle House Residences in HKRI Taikoo Hui Shanghai. The performance of the serviced apartments in the first half of 2022 was adversely affected by COVID-19. Occupancy at the Mandarin Oriental in Guangzhou, The Temple House in Chengdu and The Middle House Residences in Shanghai was 92%, 90% and 66% respectively at 30th June 2022. 32 Swire Properties Limited Interim Report 2022

Chinese Mainland Serviced Apartments Market Outlook The performance of the serviced apartments is expected to recover gradually in the second half of 2022, subject to COVID-19 conditions. Investment Properties Under Development INDIGO Phase Two, Beijing INDIGO Phase Two is an extension of the existing INDIGO development with a GFA of approximately four million square feet. Jointly developed with the Sino-Ocean group, INDIGO Phase Two will be an office-led mixed-use development and is planned to be completed in two phases, in 2025 and 2026, respectively. Piling works have been completed. Foundation works are in progress. The Group has a 35% interest in INDIGO Phase Two. Taikoo Li Xi’an In March 2022, a consortium in which the Group has a 70% interest acquired (via a government land tender) the land use rights in respect of land located at the Small Wild Goose Pagoda historical and cultural zone in the Beilin district of Xi’an. With a site area of approximately 1.3 million square feet, the land is expected to be developed as Taikoo Li Xi’an, a retail- led mixed-use development comprising retail and cultural facilities in addition to a hotel, serviced residences and business apartments. The estimated GFA is approximately three million square feet (above ground and underground), subject to further planning. The project is expected to be completed in 2025. The consortium is a collaboration with Xi’an Cheng Huan Cultural Investment and Development Co., Ltd. The chart below illustrates the expected attributable area of the completed property portfolio in the Chinese Mainland. Attributable Area of Completed ŽA ‘000 s’“ ft“” Property Portfolio in the 14,000 Chinese Mainland 12,000 Taikoo i anlitun, Taikoo i ‰iantan, 10,000 eiin hanhai 8,000 Taikoo ui, €‚ƒ€ „ Phase TŠo, uanhou eiin 6,000 €‚ƒ€ „, eiin Taikoo i ‹i’an 4,000 ino…„†ean ui Žan, 2,000 Taikoo i Chendu uanhou ‡ˆ€ Taikoo ui, „thers 0 hanhai 2022 to 2024 2025 2026 and later 33

REVIEW OF OPERATIONS Others Investment Properties – U.S.A. Zhangyuan, Shanghai Overview In 2021, the Group formed a joint venture management Brickell City Centre, Miami company with Shanghai Jing’an Real Estate (Group) Co., Ltd. This company, which the Group has a 60% interest, Brickell City Centre is an urban mixed-use development in is engaged in the revitalisation and management of the the Brickell financial district of Miami, U.S.A. It has a site Zhangyuan shikumen compound in the Jing’an district area of 504,017 square feet (approximately 11.6 acres). of Shanghai. When the revitalisation is completed, the The first phase of the Brickell City Centre development compound will have a GFA of 645,840 square feet above comprises a shopping centre, two office towers (Two and ground and 753,480 square feet underground, of which Three Brickell City Centre, which were sold in 2020), a an underground area of 197,000 square feet will be for hotel with serviced apartments (EAST Miami, which commercial use. There are 43 shikumen blocks with was sold in 2021) managed by Swire Hotels and two about 170 two or three-storey houses. There are residential towers (Reach and Rise) developed for sale. connections to three metro lines and to HKRI Taikoo All the residential units at Reach and Rise have been sold. Hui. Construction and renovation were in progress at 30th June 2022. The revitalisation is planned to be The Group owns 62.93% of the shopping centre at the completed and opened in two phases, in the fourth Brickell City Centre development. The remaining interest quarter of 2022 and in 2025. The Group does not have in the shopping centre is owned by Simon Property an ownership interest in the compound. Group (25%) and Bal Harbour Shops (12.07%). Bal Harbour Shops has an option, exercisable from February 2020, to sell its interest to the Group. The shopping centre was 93% leased (including by way of letters of intent) at 30th June 2022. Retail sales in the first half of 2022 increased by 36%. 34 Swire Properties Limited Interim Report 2022

The second phase of the Brickell City Centre development, to be known as One Brickell City Centre, is being planned. It will be a commercial development connecting to the first phase of Brickell City Centre. Brickell City Centre, Miami (1) GFA (sq. ft.) Attributable (100% Basis) Interest Completed Shopping centre 496,508 62.9% Future Development Residential 523,000 100% One Brickell City Centre 1,444,000 100% Total 2,463,508 (1) Represents leasable/saleable area except for the car parking spaces, roof top and circulation areas. Miami Market Outlook In Miami, retail sales are expected to grow, thanks to strong domestic demand. Valuation of Investment Properties The portfolio of investment properties was valued at 30th June 2022 on the basis of market value (95% by value having been valued by Cushman & Wakefield Limited and 2% by value having been valued by another independent valuer). The amount of this valuation was HK$271,009 million, compared to HK$267,815 million at 31st December 2021. The increase in the valuation of the investment property portfolio primarily reflected new investment in the Chinese Mainland and an increase in the valuation of the car parking spaces and properties held for development in Hong Kong, partly offset by a decrease in the valuation of the office investment properties in Hong Kong and foreign exchange translation losses in respect of the investment properties in the Chinese Mainland. Under HKAS 40, hotel properties are not accounted for as investment properties. The hotel buildings are included within property, plant and equipment. The leasehold land is included within right-of-use assets. Both are recorded at cost less accumulated depreciation or amortisation and any provision for impairment. 35

REVIEW OF OPERATIONS Property Trading Overview The trading portfolio comprises completed units available for sale at EIGHT STAR STREET in Hong Kong. There are six residential projects under development, three in Hong Kong, one in Indonesia and two in Vietnam. There are also land banks in Miami, U.S.A. Property Trading Portfolio (At 30th June 2022) Actual/Expected GFA (sq. ft.) Construction Attributable (100% Basis) Completion Date Interest Completed Hong Kong (1) (2) – EIGHT STAR STREET, Wan Chai 30,855 2022 100% Under Development Hong Kong – Wong Chuk Hang Station Package Four Property Development 638,305 2024 25% – Chai Wan Inland Lot No. 178 694,278 2025 80% (3) (4) – 269 Queen’s Road East, Wan Chai 102,990 2025 100% Indonesia – Savyavasa, South Jakarta 1,122,728 2024 50% Vietnam – The River 846,201 2022 20% – Empire City 7,131,624 2027 15.73% Held for Development or sale U.S.A. – South Brickell Key, Miami, Florida 550,000 n.a. 100% – Brickell City Centre, Miami, Florida – North Squared site 523,000 n.a. 100% (1) The occupation permit for EIGHT STAR STREET was issued in May 2022. (2) Excluding a retail podium of approximately 2,851 sq. ft. (3) In June 2022, the Group successfully acquired this site (via a government land tender). Transfer of the land title is expected to be completed in the second half of 2022. (4) Excluding a retail podium of approximately 13,197 sq. ft. 36 Swire Properties Limited Interim Report 2022

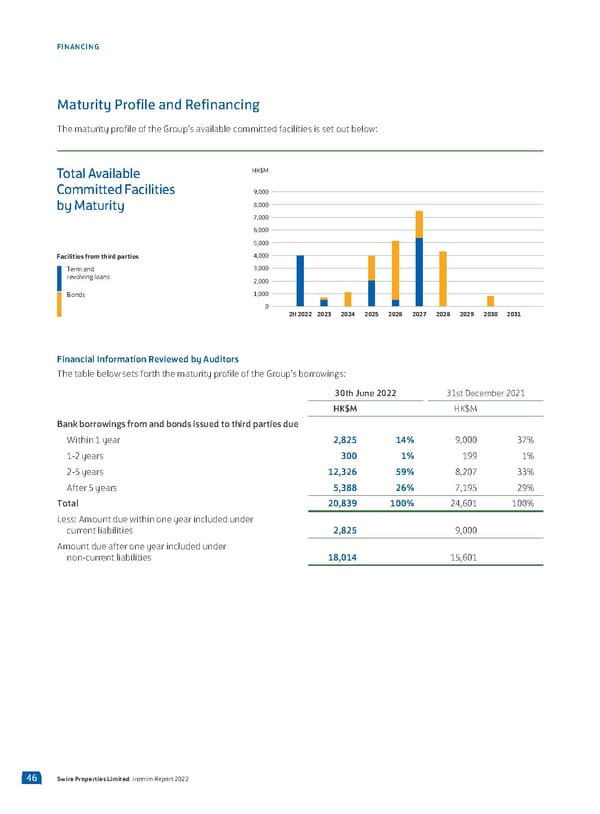

Hong Kong Indonesia EIGHT STAR STREET, Wan Chai In 2019, a joint venture between the Group and Jakarta EIGHT STAR STREET at 8 Star Street, Wan Chai is a Setiabudi Internasional Group completed the acquisition residential building (with retail outlets on the lowest of a plot of land in South Jakarta, Indonesia. The land is two levels) of approximately 34,000 square feet. The being developed into a residential development with an occupation permit has been obtained and the units will aggregate GFA of approximately 1,123,000 square feet. be handed over to the purchasers later this year. 28 out Basement works are under construction. The development of 37 units had been pre-sold at 9th August 2022. is expected to comprise over 400 residential units and to be completed in 2024. The Group has a 50% interest in Wong Chuk Hang Station Package Four Property the joint venture. Pre-sale is in progress. Development Vietnam A joint venture formed by the Group, Kerry Properties In 2020, the Group agreed with City Garden Joint Stock Limited and Sino Land Company Limited is undertaking a Company to develop The River, a luxury residential residential development in Wong Chuk Hang in Hong property in Ho Chi Minh City, Vietnam. The development Kong. The development will comprise two residential comprises 525 luxury apartments in three towers. The towers with an aggregate GFA of approximately Group has an effective 20% interest in the development. 638,000 square feet and about 800 residential units. Approximately 90% of the units had been pre-sold at Superstructure works are in progress. Subject to getting 9th August 2022. necessary approvals, pre-sales are expected to start by the end of 2022. The development is expected to be In 2021, the Group made a minority investment in completed in 2024. The Group has a 25% interest in the Empire City, a residential-led mixed-use development joint venture. (with residential, retail, office, hotel and serviced apartment components) in Ho Chi Minh City, Vietnam. Chai Wan Inland Lot No. 178 The development is under construction and is expected In 2021, a project company held as to 80% by the Group to be completed in phases up to 2027. The Group and as to 20% by China Motor Bus Company, Limited invested in the development through an agreement completed a land exchange with the HKSAR Government with Gaw Capital Partners, an existing participant in the in respect of a plot of land in Chai Wan, Hong Kong. development. Over 45% of the residential units had been The plot of land is expected to be redeveloped into a pre-sold at 9th August 2022. residential complex with an aggregate GFA of approximately 694,000 square feet. Foundation works are in progress. Outlook The development is expected to be completed in 2025. In Hong Kong, demand for residential accommodation is expected to be resilient in the medium and long term. 269 Queen’s Road East, Wan Chai In June 2022, the Group successfully acquired With urbanisation, a growing middle class and a limited (via a government land tender) a plot of land located supply of luxury residential properties, the residential at 269 Queen’s Road East in Wan Chai. The plot of land markets in Jakarta, Indonesia and Ho Chi Minh City, is expected to be developed for residential use with Vietnam are expected to be stable. an aggregate gross floor area of approximately 116,200 square feet. 37