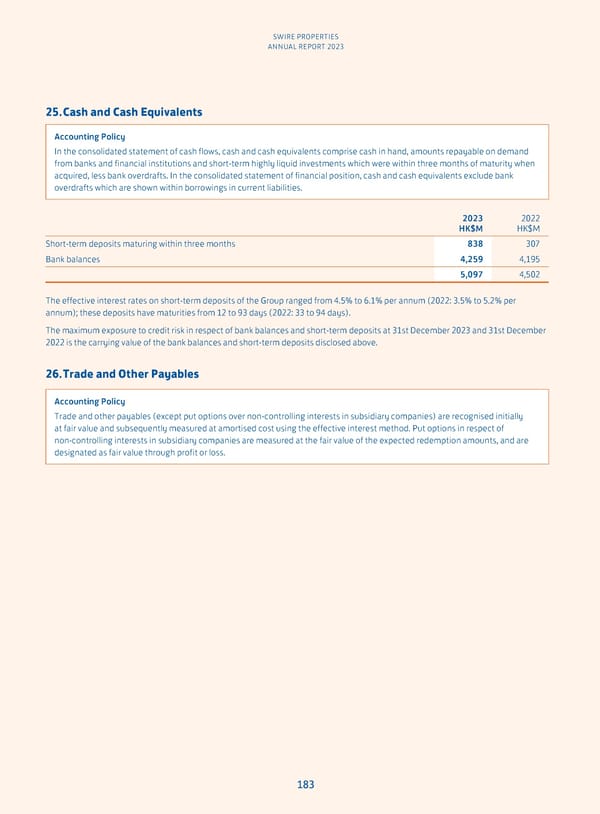

SWIRE PROPERTIES ANNUAL REPORT 2023 25. Cash and Cash Equivalents Accounting Policy In the consolidated statement of cash flows, cash and cash equivalents comprise cash in hand, amounts repayable on demand from banks and financial institutions and short-term highly liquid investments which were within three months of maturity when acquired, less bank overdrafts. In the consolidated statement of financial position, cash and cash equivalents exclude bank overdrafts which are shown within borrowings in current liabilities. 2023 2022 HK$M HK$M Short-term deposits maturing within three months 838 307 Bank balances 4,259 4,195 5,097 4,502 The effective interest rates on short-term deposits of the Group ranged from 4.5% to 6.1% per annum (2022: 3.5% to 5.2% per annum); these deposits have maturities from 12 to 93 days (2022: 33 to 94 days). The maximum exposure to credit risk in respect of bank balances and short-term deposits at 31st December 2023 and 31st December 2022 is the carrying value of the bank balances and short-term deposits disclosed above. 26. Trade and Other Payables Accounting Policy Trade and other payables (except put options over non-controlling interests in subsidiary companies) are recognised initially at fair value and subsequently measured at amortised cost using the effective interest method. Put options in respect of non-controlling interests in subsidiary companies are measured at the fair value of the expected redemption amounts, and are designated as fair value through profit or loss. 183

Annual Report 2023 Page 184 Page 186

Annual Report 2023 Page 184 Page 186