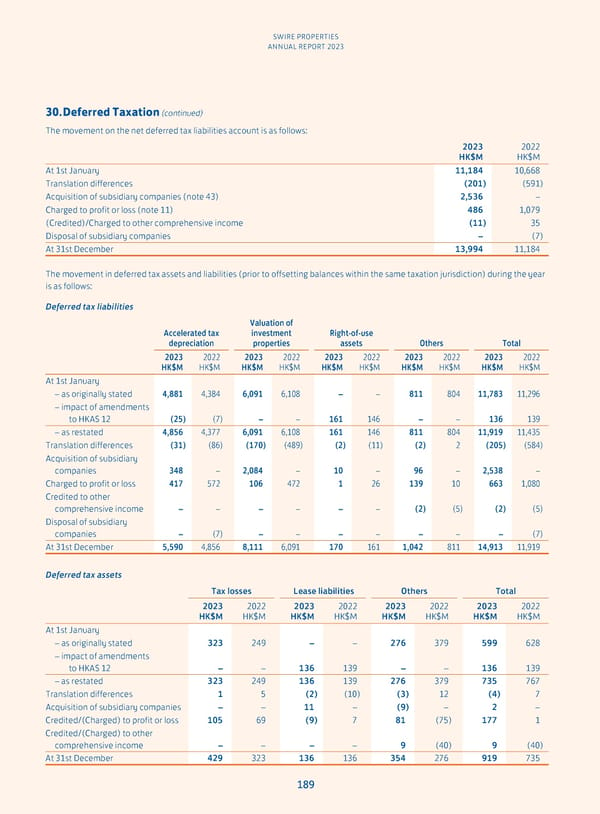

SWIRE PROPERTIES ANNUAL REPORT 2023 30. Deferred Taxation (continued) The movement on the net deferred tax liabilities account is as follows: 2023 2022 HK$M HK$M At 1st January 11,184 10,668 Translation differences (201) (591) Acquisition of subsidiary companies (note 43) 2,536 – Charged to profit or loss (note 11) 486 1,079 (Credited)/Charged to other comprehensive income (11) 35 Disposal of subsidiary companies – (7) At 31st December 13,994 11,184 The movement in deferred tax assets and liabilities (prior to offsetting balances within the same taxation jurisdiction) during the year is as follows: Deferred tax liabilities Valuation of Accelerated tax investment Right-of-use depreciation properties assets Others Total 2023 2022 2023 2022 2023 2022 2023 2022 2023 2022 HK$M HK$M HK$M HK$M HK$M HK$M HK$M HK$M HK$M HK$M At 1st January – as originally stated 4,881 4,384 6,091 6,108 – – 811 804 11,783 11,296 – impact of amendments to HKAS 12 (25) (7) – – 161 146 – – 136 139 – as restated 4,856 4,377 6,091 6,108 161 146 811 804 11,919 11,435 Translation differences (31) (86) (170) (489) (2) (11) (2) 2 (205) (584) Acquisition of subsidiary companies 348 – 2,084 – 10 – 96 – 2,538 – Charged to profit or loss 417 572 106 472 1 26 139 10 663 1,080 Credited to other comprehensive income – – – – – – (2) (5) (2) (5) Disposal of subsidiary companies – (7) – – – – – – – (7) At 31st December 5,590 4,856 8,111 6,091 170 161 1,042 811 14,913 11,919 Deferred tax assets Tax losses Lease liabilities Others Total 2023 2022 2023 2022 2023 2022 2023 2022 HK$M HK$M HK$M HK$M HK$M HK$M HK$M HK$M At 1st January – as originally stated 323 249 – – 276 379 599 628 – impact of amendments to HKAS 12 – – 136 139 – – 136 139 – as restated 323 249 136 139 276 379 735 767 Translation differences 1 5 (2) (10) (3) 12 (4) 7 Acquisition of subsidiary companies – – 11 – (9) – 2 – Credited/(Charged) to profit or loss 105 69 (9) 7 81 (75) 177 1 Credited/(Charged) to other comprehensive income – – – – 9 (40) 9 (40) At 31st December 429 323 136 136 354 276 919 735 189

Annual Report 2023 Page 190 Page 192

Annual Report 2023 Page 190 Page 192