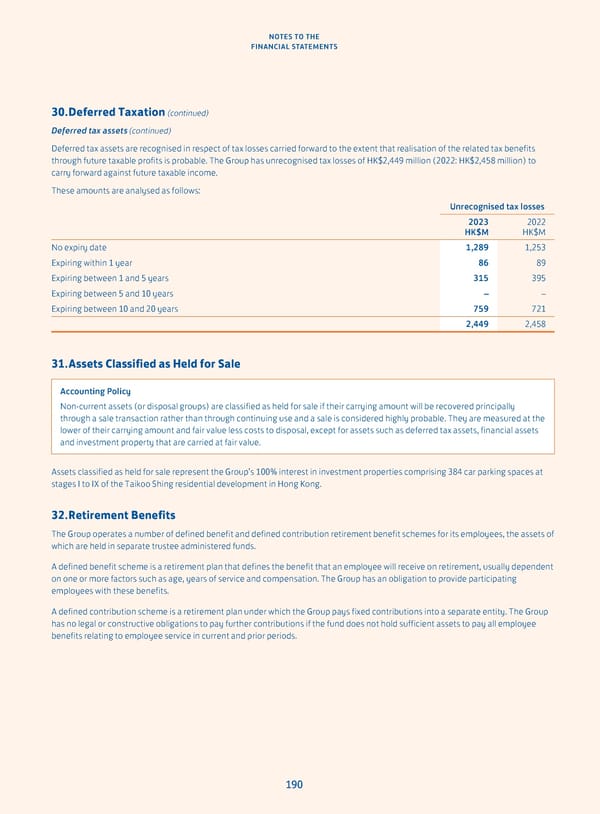

NOTES TO THE FINANCIAL STATEMENTS 30. Deferred Taxation (continued) Deferred tax assets (continued) Deferred tax assets are recognised in respect of tax losses carried forward to the extent that realisation of the related tax benefits through future taxable profits is probable. The Group has unrecognised tax losses of HK$2,449 million (2022: HK$2,458 million) to carry forward against future taxable income. These amounts are analysed as follows: Unrecognised tax losses 2023 2022 HK$M HK$M No expiry date 1,289 1,253 Expiring within 1 year 86 89 Expiring between 1 and 5 years 315 395 Expiring between 5 and 10 years – – Expiring between 10 and 20 years 759 721 2,449 2,458 31. Assets Classified as Held for Sale Accounting Policy Non-current assets (or disposal groups) are classified as held for sale if their carrying amount will be recovered principally through a sale transaction rather than through continuing use and a sale is considered highly probable. They are measured at the lower of their carrying amount and fair value less costs to disposal, except for assets such as deferred tax assets, financial assets and investment property that are carried at fair value. Assets classified as held for sale represent the Group’s 100% interest in investment properties comprising 384 car parking spaces at stages I to IX of the Taikoo Shing residential development in Hong Kong. 32. Retirement Benefits The Group operates a number of defined benefit and defined contribution retirement benefit schemes for its employees, the assets of which are held in separate trustee administered funds. A defined benefit scheme is a retirement plan that defines the benefit that an employee will receive on retirement, usually dependent on one or more factors such as age, years of service and compensation. The Group has an obligation to provide participating employees with these benefits. A defined contribution scheme is a retirement plan under which the Group pays fixed contributions into a separate entity. The Group has no legal or constructive obligations to pay further contributions if the fund does not hold sufficient assets to pay all employee benefits relating to employee service in current and prior periods. 190

Annual Report 2023 Page 191 Page 193

Annual Report 2023 Page 191 Page 193