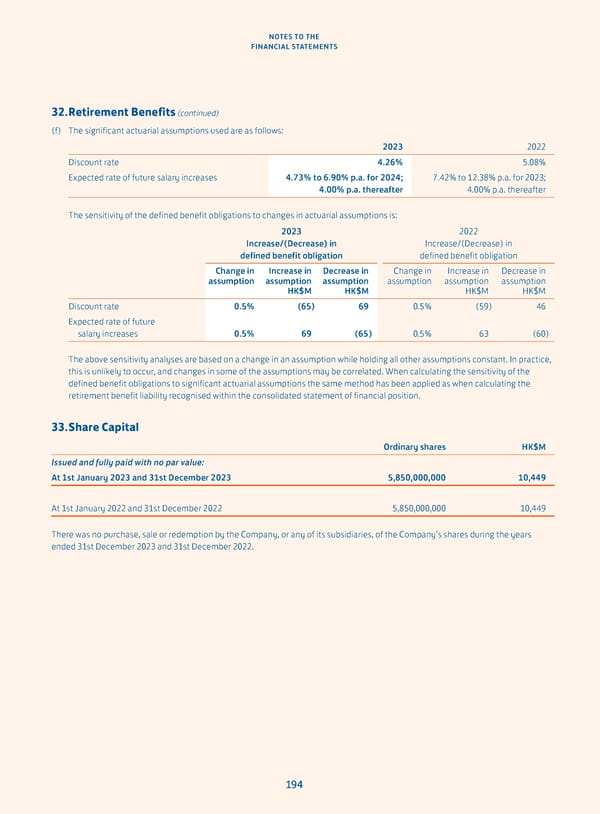

NOTES TO THE FINANCIAL STATEMENTS 32. Retirement Benefits (continued) (f) The significant actuarial assumptions used are as follows: 2023 2022 Discount rate 4.26% 5.08% Expected rate of future salary increases 4.73% to 6.90% p.a. for 2024; 7.42% to 12.38% p.a. for 2023; 4.00% p.a. thereafter 4.00% p.a. thereafter The sensitivity of the defined benefit obligations to changes in actuarial assumptions is: 2023 2022 Increase/(Decrease) in Increase/(Decrease) in defined benefit obligation defined benefit obligation Change in Increase in Decrease in Change in Increase in Decrease in assumption assumption assumption assumption assumption assumption HK$M HK$M HK$M HK$M Discount rate 0.5% (65) 69 0.5% (59) 46 Expected rate of future salary increases 0.5% 69 (65) 0.5% 63 (60) The above sensitivity analyses are based on a change in an assumption while holding all other assumptions constant. In practice, this is unlikely to occur, and changes in some of the assumptions may be correlated. When calculating the sensitivity of the defined benefit obligations to significant actuarial assumptions the same method has been applied as when calculating the retirement benefit liability recognised within the consolidated statement of financial position. 33. Share Capital Ordinary shares HK$M Issued and fully paid with no par value: At 1st January 2023 and 31st December 2023 5,850,000,000 10,449 At 1st January 2022 and 31st December 2022 5,850,000,000 10,449 There was no purchase, sale or redemption by the Company, or any of its subsidiaries, of the Company’s shares during the years ended 31st December 2023 and 31st December 2022. 194

Annual Report 2023 Page 195 Page 197

Annual Report 2023 Page 195 Page 197