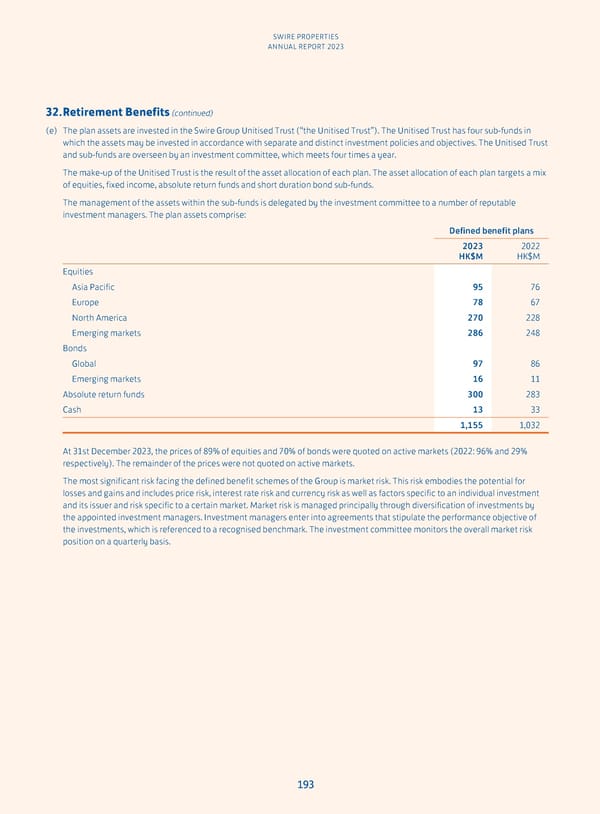

SWIRE PROPERTIES ANNUAL REPORT 2023 32. Retirement Benefits (continued) (e) The plan assets are invested in the Swire Group Unitised Trust (“the Unitised Trust”). The Unitised Trust has four sub-funds in which the assets may be invested in accordance with separate and distinct investment policies and objectives. The Unitised Trust and sub-funds are overseen by an investment committee, which meets four times a year. The make-up of the Unitised Trust is the result of the asset allocation of each plan. The asset allocation of each plan targets a mix of equities, fixed income, absolute return funds and short duration bond sub-funds. The management of the assets within the sub-funds is delegated by the investment committee to a number of reputable investment managers. The plan assets comprise: Defined benefit plans 2023 2022 HK$M HK$M Equities Asia Pacific 95 76 Europe 78 67 North America 270 228 Emerging markets 286 248 Bonds Global 97 86 Emerging markets 16 11 Absolute return funds 300 283 Cash 13 33 1,155 1,032 At 31st December 2023, the prices of 89% of equities and 70% of bonds were quoted on active markets (2022: 96% and 29% respectively). The remainder of the prices were not quoted on active markets. The most significant risk facing the defined benefit schemes of the Group is market risk. This risk embodies the potential for losses and gains and includes price risk, interest rate risk and currency risk as well as factors specific to an individual investment and its issuer and risk specific to a certain market. Market risk is managed principally through diversification of investments by the appointed investment managers. Investment managers enter into agreements that stipulate the performance objective of the investments, which is referenced to a recognised benchmark. The investment committee monitors the overall market risk position on a quarterly basis. 193

Annual Report 2023 Page 194 Page 196

Annual Report 2023 Page 194 Page 196