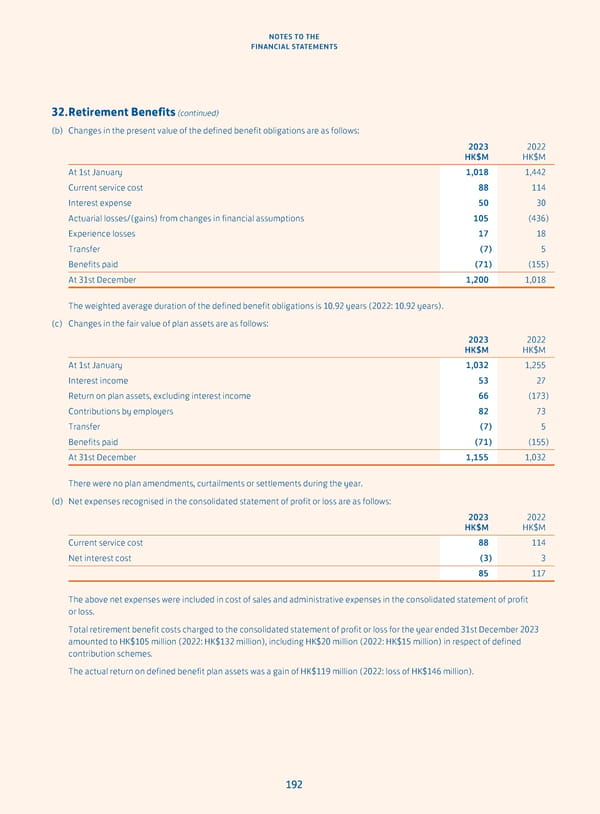

NOTES TO THE FINANCIAL STATEMENTS 32. Retirement Benefits (continued) (b) Changes in the present value of the defined benefit obligations are as follows: 2023 2022 HK$M HK$M At 1st January 1,018 1,442 Current service cost 88 114 Interest expense 50 30 Actuarial losses/(gains) from changes in financial assumptions 105 (436) Experience losses 17 18 Transfer (7) 5 Benefits paid (71) (155) At 31st December 1,200 1,018 The weighted average duration of the defined benefit obligations is 10.92 years (2022: 10.92 years). (c) Changes in the fair value of plan assets are as follows: 2023 2022 HK$M HK$M At 1st January 1,032 1,255 Interest income 53 27 Return on plan assets, excluding interest income 66 (173) Contributions by employers 82 73 Transfer (7) 5 Benefits paid (71) (155) At 31st December 1,155 1,032 There were no plan amendments, curtailments or settlements during the year. (d) Net expenses recognised in the consolidated statement of profit or loss are as follows: 2023 2022 HK$M HK$M Current service cost 88 114 Net interest cost (3) 3 85 117 The above net expenses were included in cost of sales and administrative expenses in the consolidated statement of profit or loss. Total retirement benefit costs charged to the consolidated statement of profit or loss for the year ended 31st December 2023 amounted to HK$105 million (2022: HK$132 million), including HK$20 million (2022: HK$15 million) in respect of defined contribution schemes. The actual return on defined benefit plan assets was a gain of HK$119 million (2022: loss of HK$146 million). 192

Annual Report 2023 Page 193 Page 195

Annual Report 2023 Page 193 Page 195