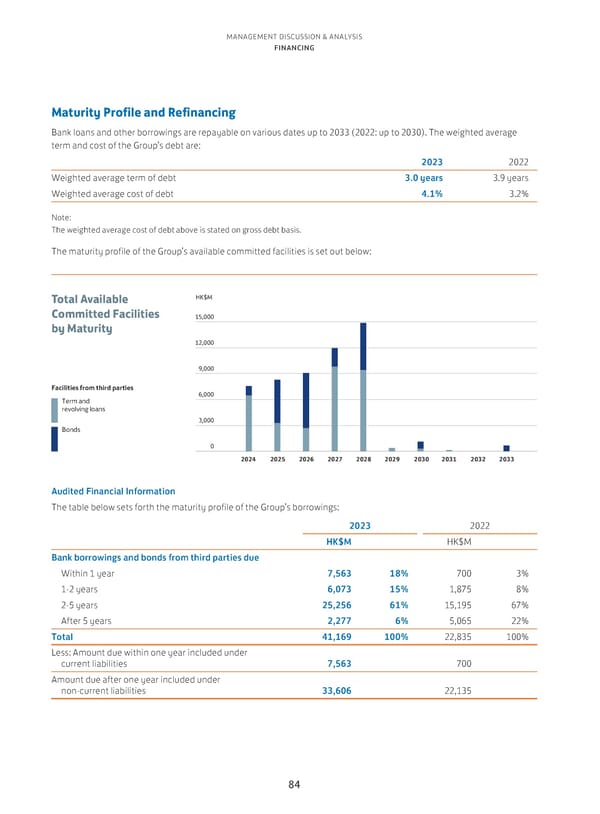

MANAGEMENT DISCUSSION & ANALYSIS FINANCING Maturity Profile and Refinancing Bank loans and other borrowings are repayable on various dates up to 2033 (2022: up to 2030). The weighted average term and cost of the Group’s debt are: 2023 2022 Weighted average term of debt 3.0 years 3.9 years Weighted average cost of debt 4.1% 3.2% Note: The weighted average cost of debt above is stated on gross debt basis. The maturity profile of the Group’s available committed facilities is set out below: Total Available HK$M Committed Facilities 15,000 by Maturity 12,000 9,000 Facilities from third parties 6,000 Term and revolving loans 3,000 Bonds 0 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 Audited Financial Information The table below sets forth the maturity profile of the Group’s borrowings: 2023 2022 HK$M HK$M Bank borrowings and bonds from third parties due Within 1 year 7,563 18% 700 3% 1-2 years 6,073 15% 1,875 8% 2-5 years 25,256 61% 15,195 67% After 5 years 2,277 6% 5,065 22% Total 41,169 100% 22,835 100% Less: Amount due within one year included under current liabilities 7,563 700 Amount due after one year included under non-current liabilities 33,606 22,135 84

Annual Report 2023 Page 85 Page 87

Annual Report 2023 Page 85 Page 87