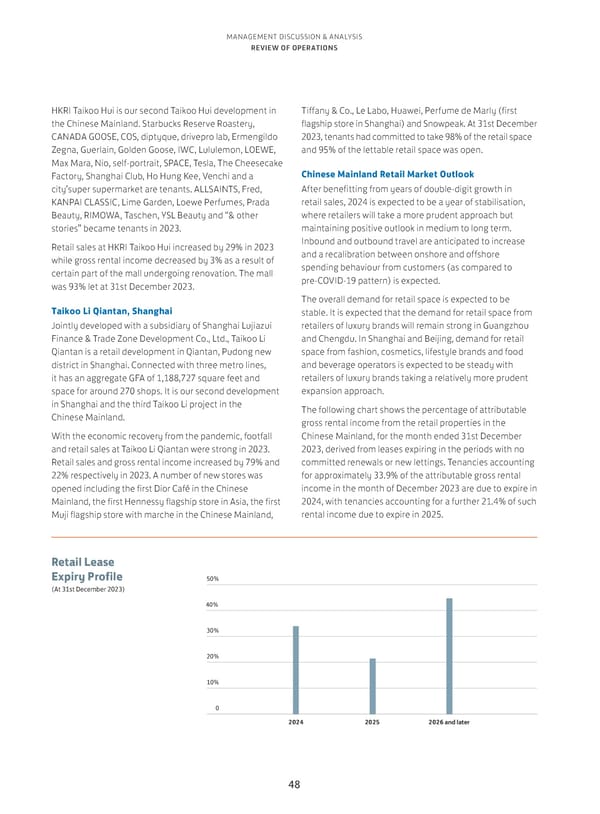

MANAGEMENT DISCUSSION & ANALYSIS REVIEW OF OPERATIONS HKRI Taikoo Hui is our second Taikoo Hui development in Tiffany & Co., Le Labo, Huawei, Perfume de Marly (first the Chinese Mainland. Starbucks Reserve Roastery, flagship store in Shanghai) and Snowpeak. At 31st December CANADA GOOSE, COS, diptyque, drivepro lab, Ermengildo 2023, tenants had committed to take 98% of the retail space Zegna, Guerlain, Golden Goose, IWC, Lululemon, LOEWE, and 95% of the lettable retail space was open. Max Mara, Nio, self-portrait, SPACE, Tesla, The Cheesecake Factory, Shanghai Club, Ho Hung Kee, Venchi and a Chinese Mainland Retail Market Outlook city’super supermarket are tenants. ALLSAINTS, Fred, After benefitting from years of double-digit growth in KANPAI CLASSIC, Lime Garden, Loewe Perfumes, Prada retail sales, 2024 is expected to be a year of stabilisation, Beauty, RIMOWA, Taschen, YSL Beauty and “& other where retailers will take a more prudent approach but stories” became tenants in 2023. maintaining positive outlook in medium to long term. Retail sales at HKRI Taikoo Hui increased by 29% in 2023 Inbound and outbound travel are anticipated to increase while gross rental income decreased by 3% as a result of and a recalibration between onshore and offshore certain part of the mall undergoing renovation. The mall spending behaviour from customers (as compared to was 93% let at 31st December 2023. pre-COVID-19 pattern) is expected. The overall demand for retail space is expected to be Taikoo Li Qiantan, Shanghai stable. It is expected that the demand for retail space from Jointly developed with a subsidiary of Shanghai Lujiazui retailers of luxury brands will remain strong in Guangzhou Finance & Trade Zone Development Co., Ltd., Taikoo Li and Chengdu. In Shanghai and Beijing, demand for retail Qiantan is a retail development in Qiantan, Pudong new space from fashion, cosmetics, lifestyle brands and food district in Shanghai. Connected with three metro lines, and beverage operators is expected to be steady with it has an aggregate GFA of 1,188,727 square feet and retailers of luxury brands taking a relatively more prudent space for around 270 shops. It is our second development expansion approach. in Shanghai and the third Taikoo Li project in the The following chart shows the percentage of attributable Chinese Mainland. gross rental income from the retail properties in the With the economic recovery from the pandemic, footfall Chinese Mainland, for the month ended 31st December and retail sales at Taikoo Li Qiantan were strong in 2023. 2023, derived from leases expiring in the periods with no Retail sales and gross rental income increased by 79% and committed renewals or new lettings. Tenancies accounting 22% respectively in 2023. A number of new stores was for approximately 33.9% of the attributable gross rental opened including the first Dior Café in the Chinese income in the month of December 2023 are due to expire in Mainland, the first Hennessy flagship store in Asia, the first 2024, with tenancies accounting for a further 21.4% of such Muji flagship store with marche in the Chinese Mainland, rental income due to expire in 2025. Retail Lease Expiry Profile 50% (At 31st December 2023) 40% 30% 20% 10% 0 2024 2025 2026 and later 48

Annual Report 2023 Page 49 Page 51

Annual Report 2023 Page 49 Page 51