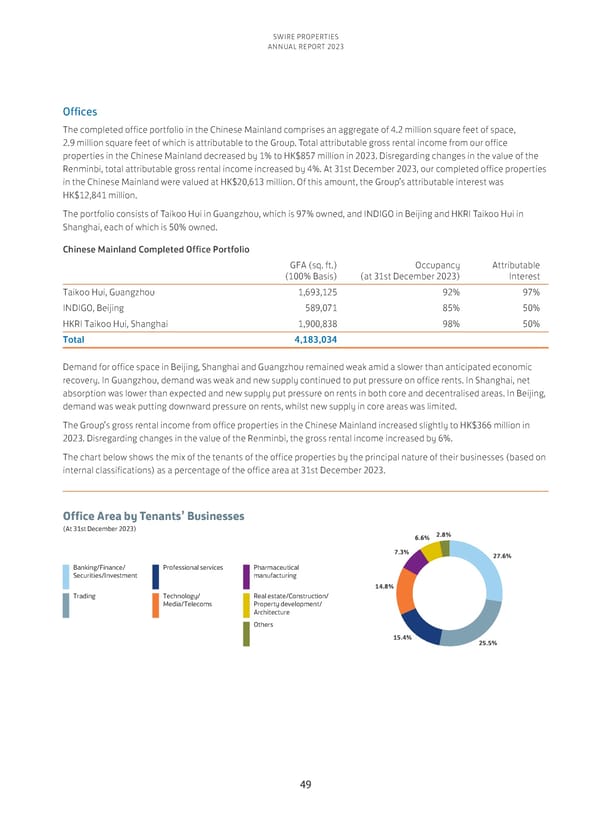

SWIRE PROPERTIES ANNUAL REPORT 2023 Offices The completed office portfolio in the Chinese Mainland comprises an aggregate of 4.2 million square feet of space, 2.9 million square feet of which is attributable to the Group. Total attributable gross rental income from our office properties in the Chinese Mainland decreased by 1% to HK$857 million in 2023. Disregarding changes in the value of the Renminbi, total attributable gross rental income increased by 4%. At 31st December 2023, our completed office properties in the Chinese Mainland were valued at HK$20,613 million. Of this amount, the Group’s attributable interest was HK$12,841 million. The portfolio consists of Taikoo Hui in Guangzhou, which is 97% owned, and INDIGO in Beijing and HKRI Taikoo Hui in Shanghai, each of which is 50% owned. Chinese Mainland Completed Office Portfolio GFA (sq. ft.) Occupancy Attributable (100% Basis) (at 31st December 2023) Interest Taikoo Hui, Guangzhou 1,693,125 92% 97% INDIGO, Beijing 589,071 85% 50% HKRI Taikoo Hui, Shanghai 1,900,838 98% 50% Total 4,183,034 Demand for office space in Beijing, Shanghai and Guangzhou remained weak amid a slower than anticipated economic recovery. In Guangzhou, demand was weak and new supply continued to put pressure on office rents. In Shanghai, net absorption was lower than expected and new supply put pressure on rents in both core and decentralised areas. In Beijing, demand was weak putting downward pressure on rents, whilst new supply in core areas was limited. The Group’s gross rental income from office properties in the Chinese Mainland increased slightly to HK$366 million in 2023. Disregarding changes in the value of the Renminbi, the gross rental income increased by 6%. The chart below shows the mix of the tenants of the office properties by the principal nature of their businesses (based on internal classifications) as a percentage of the office area at 31st December 2023. Office Area by Tenants’ Businesses (At 31st December 2023) 2.8% 6.6% 7.3% 27.6% Banking/Finance/ Professional services Pharmaceutical Securities/Investment manufacturing 14.8% Trading Technology/ Real estate/Construction/ Media/Telecoms Property development/ Architecture Others 15.4% 25.5% 49

Annual Report 2023 Page 50 Page 52

Annual Report 2023 Page 50 Page 52