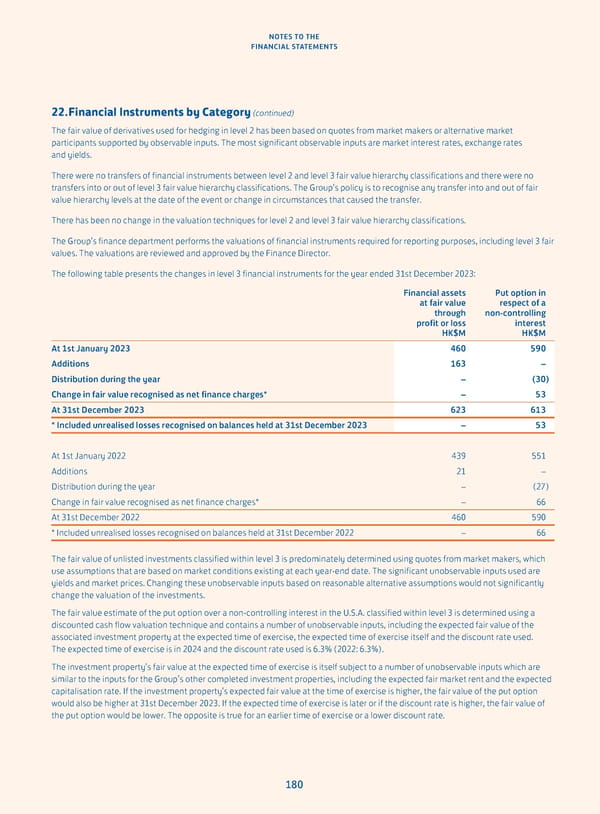

NOTES TO THE FINANCIAL STATEMENTS 22. Financial Instruments by Category (continued) The fair value of derivatives used for hedging in level 2 has been based on quotes from market makers or alternative market participants supported by observable inputs. The most significant observable inputs are market interest rates, exchange rates and yields. There were no transfers of financial instruments between level 2 and level 3 fair value hierarchy classifications and there were no transfers into or out of level 3 fair value hierarchy classifications. The Group’s policy is to recognise any transfer into and out of fair value hierarchy levels at the date of the event or change in circumstances that caused the transfer. There has been no change in the valuation techniques for level 2 and level 3 fair value hierarchy classifications. The Group’s finance department performs the valuations of financial instruments required for reporting purposes, including level 3 fair values. The valuations are reviewed and approved by the Finance Director. The following table presents the changes in level 3 financial instruments for the year ended 31st December 2023: Financial assets Put option in at fair value respect of a through non-controlling profit or loss interest HK$M HK$M At 1st January 2023 460 590 Additions 163 – Distribution during the year – (30) Change in fair value recognised as net finance charges* – 53 At 31st December 2023 623 613 * Included unrealised losses recognised on balances held at 31st December 2023 – 53 At 1st January 2022 439 551 Additions 21 – Distribution during the year – (27) Change in fair value recognised as net finance charges* – 66 At 31st December 2022 460 590 * Included unrealised losses recognised on balances held at 31st December 2022 – 66 The fair value of unlisted investments classified within level 3 is predominately determined using quotes from market makers, which use assumptions that are based on market conditions existing at each year-end date. The significant unobservable inputs used are yields and market prices. Changing these unobservable inputs based on reasonable alternative assumptions would not significantly change the valuation of the investments. The fair value estimate of the put option over a non-controlling interest in the U.S.A. classified within level 3 is determined using a discounted cash flow valuation technique and contains a number of unobservable inputs, including the expected fair value of the associated investment property at the expected time of exercise, the expected time of exercise itself and the discount rate used. The expected time of exercise is in 2024 and the discount rate used is 6.3% (2022: 6.3%). The investment property’s fair value at the expected time of exercise is itself subject to a number of unobservable inputs which are similar to the inputs for the Group’s other completed investment properties, including the expected fair market rent and the expected capitalisation rate. If the investment property’s expected fair value at the time of exercise is higher, the fair value of the put option would also be higher at 31st December 2023. If the expected time of exercise is later or if the discount rate is higher, the fair value of the put option would be lower. The opposite is true for an earlier time of exercise or a lower discount rate. 180

Annual Report 2023 Page 181 Page 183

Annual Report 2023 Page 181 Page 183