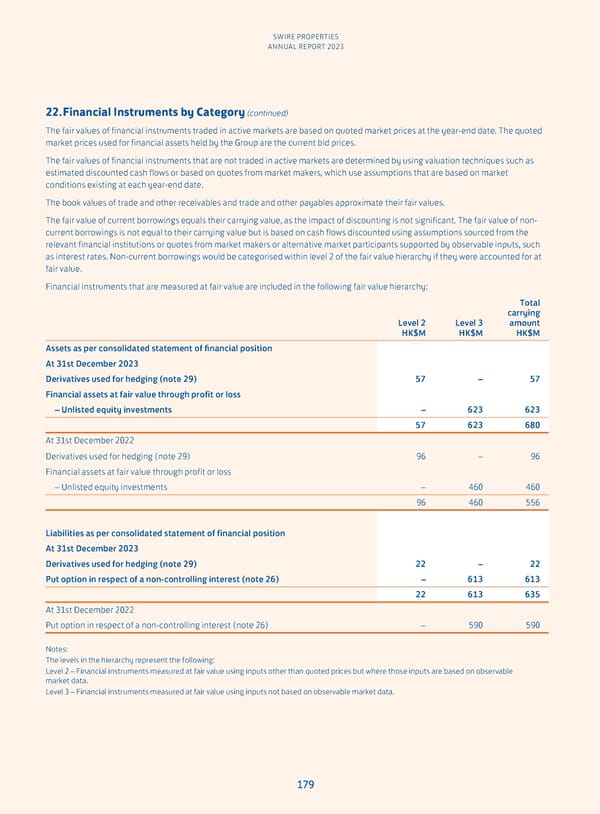

SWIRE PROPERTIES ANNUAL REPORT 2023 22. Financial Instruments by Category (continued) The fair values of financial instruments traded in active markets are based on quoted market prices at the year-end date. The quoted market prices used for financial assets held by the Group are the current bid prices. The fair values of financial instruments that are not traded in active markets are determined by using valuation techniques such as estimated discounted cash flows or based on quotes from market makers, which use assumptions that are based on market conditions existing at each year-end date. The book values of trade and other receivables and trade and other payables approximate their fair values. The fair value of current borrowings equals their carrying value, as the impact of discounting is not significant. The fair value of non- current borrowings is not equal to their carrying value but is based on cash flows discounted using assumptions sourced from the relevant financial institutions or quotes from market makers or alternative market participants supported by observable inputs, such as interest rates. Non-current borrowings would be categorised within level 2 of the fair value hierarchy if they were accounted for at fair value. Financial instruments that are measured at fair value are included in the following fair value hierarchy: Total carrying Level 2 Level 3 amount HK$M HK$M HK$M Assets as per consolidated statement of financial position At 31st December 2023 Derivatives used for hedging (note 29) 57 – 57 Financial assets at fair value through profit or loss – Unlisted equity investments – 623 623 57 623 680 At 31st December 2022 Derivatives used for hedging (note 29) 96 – 96 Financial assets at fair value through profit or loss – Unlisted equity investments – 460 460 96 460 556 Liabilities as per consolidated statement of financial position At 31st December 2023 Derivatives used for hedging (note 29) 22 – 22 Put option in respect of a non-controlling interest (note 26) – 613 613 22 613 635 At 31st December 2022 Put option in respect of a non-controlling interest (note 26) – 590 590 Notes: The levels in the hierarchy represent the following: Level 2 – Financial instruments measured at fair value using inputs other than quoted prices but where those inputs are based on observable market data. Level 3 – Financial instruments measured at fair value using inputs not based on observable market data. 179

Annual Report 2023 Page 180 Page 182

Annual Report 2023 Page 180 Page 182