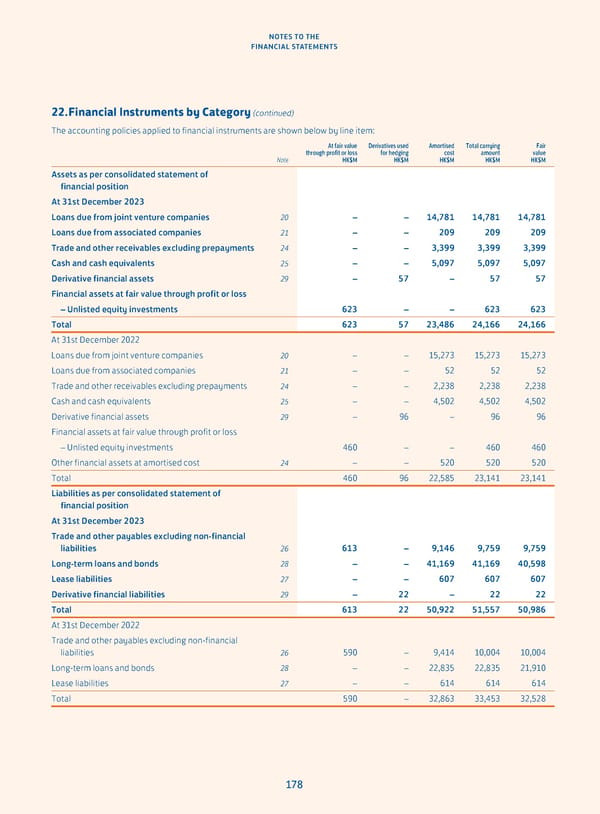

NOTES TO THE FINANCIAL STATEMENTS 22. Financial Instruments by Category (continued) The accounting policies applied to financial instruments are shown below by line item: At fair value Derivatives used Amortised Total carrying Fair through profit or loss for hedging cost amount value Note HK$M HK$M HK$M HK$M HK$M Assets as per consolidated statement of financial position At 31st December 2023 Loans due from joint venture companies 20 – – 14,781 14,781 14,781 Loans due from associated companies 21 – – 209 209 209 Trade and other receivables excluding prepayments 24 – – 3,399 3,399 3,399 Cash and cash equivalents 25 – – 5,097 5,097 5,097 Derivative financial assets 29 – 57 – 57 57 Financial assets at fair value through profit or loss – Unlisted equity investments 623 – – 623 623 Total 623 57 23,486 24,166 24,166 At 31st December 2022 Loans due from joint venture companies 20 – – 15,273 15,273 15,273 Loans due from associated companies 21 – – 52 52 52 Trade and other receivables excluding prepayments 24 – – 2,238 2,238 2,238 Cash and cash equivalents 25 – – 4,502 4,502 4,502 Derivative financial assets 29 – 96 – 96 96 Financial assets at fair value through profit or loss – Unlisted equity investments 460 – – 460 460 Other financial assets at amortised cost 24 – – 520 520 520 Total 460 96 22,585 23,141 23,141 Liabilities as per consolidated statement of financial position At 31st December 2023 Trade and other payables excluding non-financial liabilities 26 613 – 9,146 9,759 9,759 Long-term loans and bonds 28 – – 41,169 41,169 40,598 Lease liabilities 27 – – 607 607 607 Derivative financial liabilities 29 – 22 – 22 22 Total 613 22 50,922 51,557 50,986 At 31st December 2022 Trade and other payables excluding non-financial liabilities 26 590 – 9,414 10,004 10,004 Long-term loans and bonds 28 – – 22,835 22,835 21,910 Lease liabilities 27 – – 614 614 614 Total 590 – 32,863 33,453 32,528 178

Annual Report 2023 Page 179 Page 181

Annual Report 2023 Page 179 Page 181