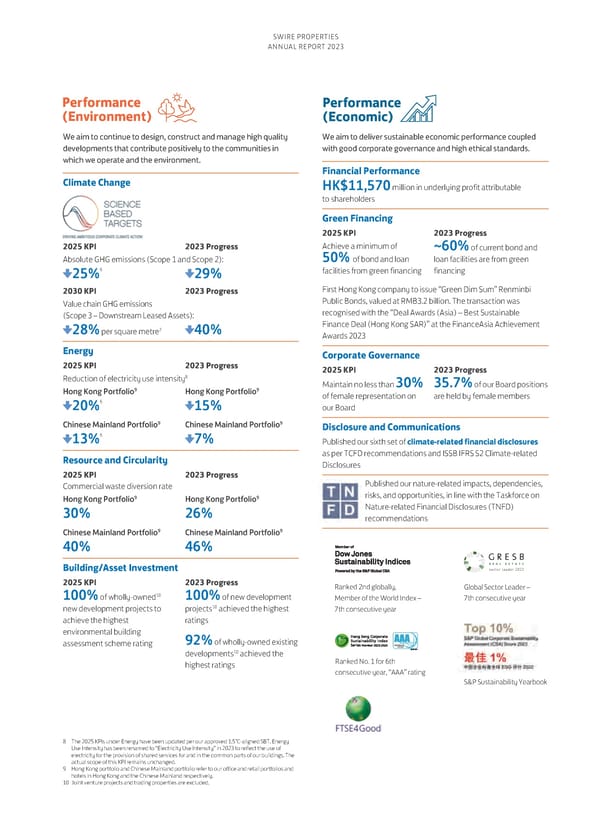

Places Places People People Partners Partners Performance (Environment) SWIRE PROPERTIES ANNUAL REPORT 2023 Performance Performance (Environment) (Economic) We aim to continue to design, construct and manage high quality We aim to deliver sustainable economic performance coupled developments that contribute positively to the communities in with good corporate governance and high ethical standards. which we operate and the environment. Financial Performance Climate Change HK$11,570 million in underlying profit attributable Performance to shareholders (Economic) Green Financing 2025 KPI 2023 Progress 2025 KPI 2023 Progress Achieve a minimum of ~60% of current bond and Absolute GHG emissions (Scope 1 and Scope 2): 50% of bond and loan loan facilities are from green 25%6 29% facilities from green financing financing 2030 KPI 2023 Progress First Hong Kong company to issue “Green Dim Sum” Renminbi Value chain GHG emissions Public Bonds, valued at RMB3.2 billion. The transaction was (Scope 3 – Downstream Leased Assets): recognised with the “Deal Awards (Asia) – Best Sustainable 7 Finance Deal (Hong Kong SAR)” at the FinanceAsia Achievement 28% per square metre 40% Awards 2023 Energy Corporate Governance 2025 KPI 2023 Progress 2025 KPI 2023 Progress 8 Reduction of electricity use intensity Maintain no less than 30% 35.7% of our Board positions 9 9 Hong Kong Portfolio Hong Kong Portfolio of female representation on are held by female members 20%6 15% our Board 9 9 Chinese Mainland Portfolio Chinese Mainland Portfolio Disclosure and Communications 13%6 7% Published our sixth set of climate-related financial disclosures Resource and Circularity as per TCFD recommendations and ISSB IFRS S2 Climate-related Disclosures 2025 KPI 2023 Progress Published our nature-related impacts, dependencies, Commercial waste diversion rate risks, and opportunities, in line with the Taskforce on 9 9 Hong Kong Portfolio Hong Kong Portfolio Nature-related Financial Disclosures (TNFD) 30% 26% recommendations 9 9 Chinese Mainland Portfolio Chinese Mainland Portfolio 40% 46% Building/Asset Investment sector leader 2023 2025 KPI 2023 Progress Ranked 2nd globally, Global Sector Leader – 10 100% of wholly-owned 100% of new development Member of the World Index – 7th consecutive year 10 new development projects to projects achieved the highest 7th consecutive year achieve the highest ratings environmental building 92% of wholly-owned existing assessment scheme rating 2023-2024 10 developments achieved the Ranked No. 1 for 6th highest ratings consecutive year, “AAA” rating S&P Sustainability Yearbook 8 The 2025 KPIs under Energy have been updated per our approved 1.5°C-aligned SBT. Energy Use Intensity has been renamed to “Electricity Use Intensity” in 2023 to reflect the use of electricity for the provision of shared services for and in the common parts of our buildings. The actual scope of this KPI remains unchanged. 9 Hong Kong portfolio and Chinese Mainland portfolio refer to our office and retail portfolios and hotels in Hong Kong and the Chinese Mainland respectively. 10 Joint venture projects and trading properties are excluded.

Annual Report 2023 Page 12 Page 14

Annual Report 2023 Page 12 Page 14