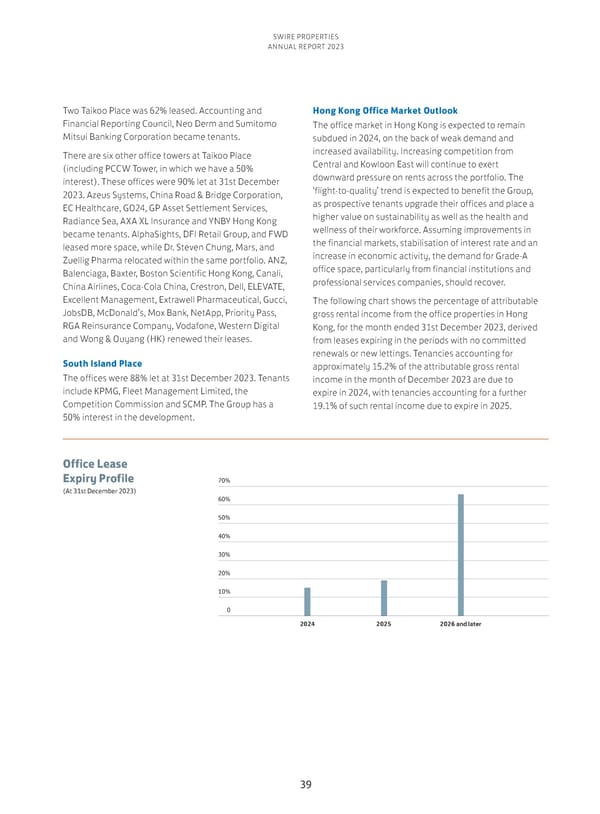

SWIRE PROPERTIES ANNUAL REPORT 2023 Two Taikoo Place was 62% leased. Accounting and Hong Kong Office Market Outlook Financial Reporting Council, Neo Derm and Sumitomo The office market in Hong Kong is expected to remain Mitsui Banking Corporation became tenants. subdued in 2024, on the back of weak demand and There are six other office towers at Taikoo Place increased availability. Increasing competition from (including PCCW Tower, in which we have a 50% Central and Kowloon East will continue to exert interest). These offices were 90% let at 31st December downward pressure on rents across the portfolio. The 2023. Azeus Systems, China Road & Bridge Corporation, ‘flight-to-quality’ trend is expected to benefit the Group, EC Healthcare, GO24, GP Asset Settlement Services, as prospective tenants upgrade their offices and place a Radiance Sea, AXA XL Insurance and YNBY Hong Kong higher value on sustainability as well as the health and became tenants. AlphaSights, DFI Retail Group, and FWD wellness of their workforce. Assuming improvements in leased more space, while Dr. Steven Chung, Mars, and the financial markets, stabilisation of interest rate and an Zuellig Pharma relocated within the same portfolio. ANZ, increase in economic activity, the demand for Grade-A Balenciaga, Baxter, Boston Scientific Hong Kong, Canali, office space, particularly from financial institutions and China Airlines, Coca-Cola China, Crestron, Dell, ELEVATE, professional services companies, should recover. Excellent Management, Extrawell Pharmaceutical, Gucci, The following chart shows the percentage of attributable JobsDB, McDonald’s, Mox Bank, NetApp, Priority Pass, gross rental income from the office properties in Hong RGA Reinsurance Company, Vodafone, Western Digital Kong, for the month ended 31st December 2023, derived and Wong & Ouyang (HK) renewed their leases. from leases expiring in the periods with no committed South Island Place renewals or new lettings. Tenancies accounting for approximately 15.2% of the attributable gross rental The offices were 88% let at 31st December 2023. Tenants income in the month of December 2023 are due to include KPMG, Fleet Management Limited, the expire in 2024, with tenancies accounting for a further Competition Commission and SCMP. The Group has a 19.1% of such rental income due to expire in 2025. 50% interest in the development. Office Lease Expiry Profile 70% (At 31st December 2023) 60% 50% 40% 30% 20% 10% 0 2024 2025 2026 and later 39

Annual Report 2023 Page 40 Page 42

Annual Report 2023 Page 40 Page 42