Sustainable Development Report 2022

Table of Contents 03 Chief Executive’s Message 05 About this Report 05 Profile of Swire Properties Limited 11 SD 2030 Strategy 18 SD Governance 27 Materiality 33 SD in Action: Swire Hotels 49 79 124 156 240 Places People Partners Performance Performance (Environment) (Economic) 220 Climate-related Financial Disclosures 259 2025 and 2030 Targets 261 ESG Reporting Standards and Principles 266 Summary of Green Building Certifications 268 External Charters and Memberships 271 Awards and Certifications 278 Performance Data Summary 287 Assurance Report 290 Global Reporting Initiative Content Index 299 HKEX ESG Reporting Guide Index 305 ISSB Exposure Draft IFRS S2 Climate-related Disclosures Content Index We welcome your feedback on our sustainable development performance and reporting. You can contact us by email at sustainabledevelopment@ swireproperties.com or fill in the Feedback Form.

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) Chief Executive’s Message GRI 2-22 OUR JOURNEY TO NET-ZERO IS NOT OURS ALONE: supporting our stakeholders and our communities in their efforts to decarbonise is vital to the success of our common objectives. 2022 was a milestone year for Swire Properties as we celebrated 50 years of transformative placemaking and sustainable urban development. While the pandemic prevented us from hosting major events for most of the year, we were fortunate to end 2022 with a family day for our employees and our annual community White Christmas Street Fair in Taikoo Place. Our ongoing efforts to integrate sustainable development into every facet of our business are now being recognised globally. We were ranked first in Asia and fourth on the Dow Jones Sustainability Index (“DJSI”) among real estate companies worldwide. We maintained our Global Sector Leader position in the Mixed Use Developments category of the Global Real Estate Sustainability Benchmark (“GRESB”) for the sixth year in a row, and were ranked first on the Hang Seng Corporate Sustainability Index for the fifth consecutive year. In addition to giving us positive encouragement, this recognition motivates us to remain focused on realising of our SD 2030 Strategy. Our continuing journey towards net-zero The wider impacts of climate change are a growing concern to businesses worldwide. Increasing our climate resilience and proactively managing the associated risks is now a priority. While discussions at COP 27 in November 2022 highlighted the challenges of achieving net-zero decarbonisation targets, we remain committed to our 1.5°C-aligned science-based targets, paving the way to achieve net-zero by 2050. We continue to make excellent progress in tackling our Scope 1 and 2 emissions, achieving an absolute emissions reduction of 28% in 2022 compared to our 2019 baseline year. These gains have been enabled by our broad adoption of technology and innovation to reduce energy use and carbon emissions throughout our operations. Recognising the importance of data, I am particularly interested in the insights into energy saving generated by the rollout of our Cloud-Based Smart Energy Management Platform across our portfolios. This year, we integrated a pioneering machine-learning model into the platform that predicts cooling demand around the clock. The model was developed in partnership with a digital automation and energy management company and won a Gold Award and the Grand Prize at the “Global AI Challenge for Building Electrical and Mechanical Facilities” competition. We also signed an off-site renewable electricity purchase agreement for Taikoo Li Sanlitun, making this our third project in the Chinese Mainland to adopt sources of clean energy. We continue to explore renewable energy opportunities in our other projects. Creating value for our partners Our journey to net-zero is not ours alone: supporting our stakeholders and our communities in their efforts to decarbonise is vital to the success of our common objectives. We continue to collaborate with our suppliers and tenants as we track and monitor performance along the whole lifecycle of our buildings. SUSTAINABLE DEVELOPMENT REPORT 2022 3

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) To address upstream carbon emissions during construction, we have worked with our partners to ensure that almost 100% of the concrete used at Two Taikoo Place, our latest development in Hong Kong, was certified low-carbon concrete. Accordingly, the development obtained the Grand Award in the New Building category (Projects Under Construction and/or Design - Commercial) at the 2021 Green Building Awards, organised by the Hong Kong Green Building Council (“HKGBC”) and the Professional Green Building Council. To limit our downstream impacts, we launched our Green Performance Pledge (“GPP”) in July 2022, a bespoke sustainability programme for office tenants. The GPP works closely with our tenants to measure and identify ways to reduce their energy, waste, and water consumption. Interest and uptake for the GPP has been overwhelmingly positive: 52 of our tenants, representing over 30% of the occupied lettable floor area of Swire Properties’ Hong Kong office portfolio, are already participating. Meanwhile, almost 70 food and beverage (“F&B”) tenants have joined our Green Kitchen Initiative, integrating sustainability features into their kitchen fit-outs and operations. In March 2023, we published our third Places Impact Report, featuring Taikoo Hui Guangzhou. Produced in partnership with the South China University of Technology, the report explores the socioeconomic impacts of our placemaking efforts and provides insights into the future role that Taikoo Hui Guangzhou may play in enhancing community vibrancy and building social cohesion. A thriving environment for our people People are critical to the implementation of our SD 2030 Strategy and to our overall success. We aspire to build an inclusive, supportive work environment where employees can thrive. This year, we were delighted to be included in the 2023 Bloomberg Gender-Equality Index, acknowledging the Company’s commitment to achieving gender equality. These positive impacts extend into our local communities in the form of our Community Ambassadors, who volunteered over 6,100 hours of their time this year, giving back to society through NGOs, social welfare initiatives and in many other valuable ways. Catalysing our transition to net-zero via green financing As at 31 December 2022, green financing accounted for approximately 60% of our current bond and loan facilities. This means that we have achieved our 2025 KPI of having a minimum of 50% of green financing three years ahead of schedule. In 2023, we begin piloting the use of internal carbon pricing (“ICP”) to accelerate our transition to a low- carbon economy. Taking the form of an internal carbon fee, the ICP will create an internal mechanism to allocate costs to our carbon emissions and set aside a special fund to increase our investment in decarbonisation projects. A word of thanks Today’s increasingly complex business landscape requires that we remain firmly committed to our vision and values. As we look ahead to the next 50 years, I want to take the opportunity to thank everyone who has worked with us over the years for your dedication, confidence and trust in Swire Properties. Our ambitions are high, but I am confident that we have the talent, spirit and experience to succeed. As we conclude a year full of challenges and celebrations and enter a new decade for Swire Properties, I am optimistic that working together with our outstanding teams and committed partners will help us continue to build and nurture great places that support sustainable, resilient and thriving communities. Chief Executive Tim Blackburn SUSTAINABLE DEVELOPMENT REPORT 2022 4

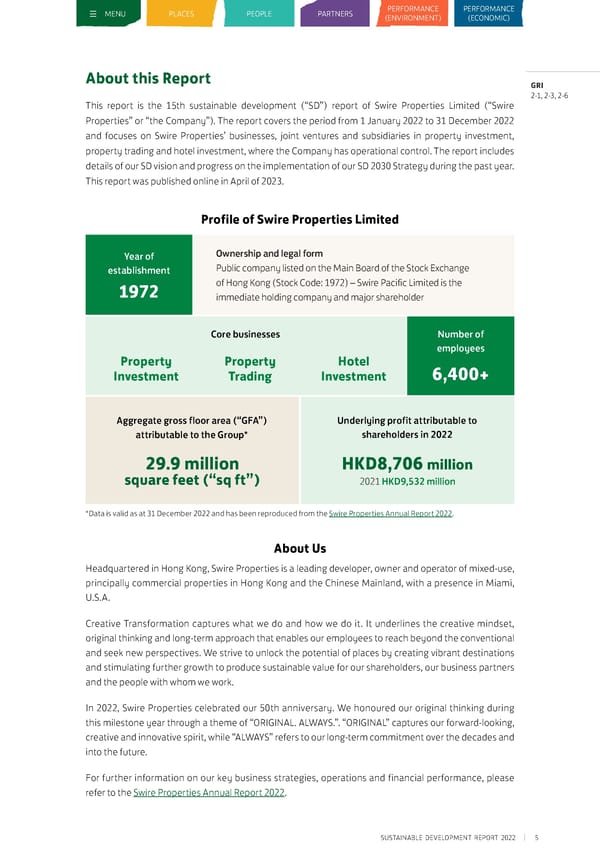

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) About this Report GRI 2-1, 2-3, 2-6 This report is the 15th sustainable development (“SD”) report of Swire Properties Limited (“Swire Properties” or “the Company”). The report covers the period from 1 January 2022 to 31 December 2022 and focuses on Swire Properties’ businesses, joint ventures and subsidiaries in property investment, property trading and hotel investment, where the Company has operational control. The report includes details of our SD vision and progress on the implementation of our SD 2030 Strategy during the past year. This report was published online in April of 2023. Profile of Swire Properties Limited Year of Ownership and legal form establishment Public company listed on the Main Board of the Stock Exchange 1972 of Hong Kong (Stock Code: 1972) – Swire Pacific Limited is the immediate holding company and major shareholder Core businesses Number of Property Property Hotel employees 6,400+ Investment Trading Investment Aggregate gross floor area (“GFA”) Underlying profit attributable to attributable to the Group* shareholders in 2022 29.9 million HKD8,706 million square feet (“sq ft”) 2021 HKD9,532 million *Data is valid as at 31 December 2022 and has been reproduced from the Swire Properties Annual Report 2022. About Us Headquartered in Hong Kong, Swire Properties is a leading developer, owner and operator of mixed-use, principally commercial properties in Hong Kong and the Chinese Mainland, with a presence in Miami, U.S.A. Creative Transformation captures what we do and how we do it. It underlines the creative mindset, original thinking and long-term approach that enables our employees to reach beyond the conventional and seek new perspectives. We strive to unlock the potential of places by creating vibrant destinations and stimulating further growth to produce sustainable value for our shareholders, our business partners and the people with whom we work. In 2022, Swire Properties celebrated our 50th anniversary. We honoured our original thinking during this milestone year through a theme of “ORIGINAL. ALWAYS.”. “ORIGINAL” captures our forward-looking, creative and innovative spirit, while “ALWAYS” refers to our long-term commitment over the decades and into the future. For further information on our key business strategies, operations and financial performance, please refer to the Swire Properties Annual Report 2022. SUSTAINABLE DEVELOPMENT REPORT 2022 5

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) SD Awards Global Leadership in Sustainability Benchmarks and Indices Our commitment to SD received further global recognition in 2022. We were ranked highly on several major SD-related benchmarks and indices. Dow Jones Sustainability World Index (“DJSI World”) – Top Fourth Globally, Number One in Asia Listed as a DJSI World constituent company since 2017 Listed as a DJSI Asia Pacific constituent company since 2015 In 2022, we raised our global ranking from seventh place overall to fourth place among the 940 companies assessed in the real estate industry. We were also the top ranked company in Asia for the second consecutive year, increasing our score in the Environmental dimension of the assessment from 94 to 96 (Score date: 16 December 2022), taking us from third in 2021 to second globally. Swire Properties achieved an ESG (“Environmental, Social and Governance”) score of 83/100 (Score date: 16 December 2022) on the 2022 S&P Global Corporate Sustainability Assessment, up from 79 in 2021. Global Real Estate Sustainability Benchmark (“GRESB”) – Global Sector Leader and Global Development Sector Leader for Mixed Use Developments Since 2017 We retained our Global Sector Leader title in the Mixed Use Developments category for the sixth year in a row. We were also recognised as the Global Development Sector Leader in the category for the third year in a row. In addition to our five-star rating on the benchmark, we also obtained the highest five-star rating and received an “A” rating in public disclosure for the sixth consecutive year. SUSTAINABLE DEVELOPMENT REPORT 2022 6

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) Hang Seng Corporate Sustainability Index – Top Company Constituent of the Hang Seng Corporate Sustainability Index since 2015 Achieved the highest total score among the constituent companies and “AAA” rating since 2018 In Hong Kong, we topped the Hang Seng Corporate Sustainability Index for the fifth consecutive year, receiving the highest total score among all index constituents while maintaining an “AAA” sustainability rating – the highest possible grading. We were one of the only two companies to receive this rating among more than 500 assessed stocks. Swire Properties was also listed on the Hang Seng Environmental, Social and Governance (“ESG”) 50 Index for the third consecutive year, highlighting the Company’s position as an ESG leader in Hong Kong. Bloomberg Gender-Equality Index Became a member in 2023 Swire Properties responded to the Bloomberg Gender-Equality Index (“GEI”) for the first time and secured a position on the 2023 Bloomberg GEI member list, consisting of ourselves and 483 other companies. The index measures gender equality across five pillars: leadership and talent pipeline, equal pay and gender pay parity, inclusive culture, anti-sexual harassment policies and external brand. * Constituent since 2014 Included in the S&P Constituent since 2016 Achieved an Environmental, Global Sustainability Social and Governance Yearbook since 2017 (“ESG”) rating of “AAA” – Included in the S&P Global the highest possible rating Sustainability Yearbook since 2018 2023, with ESG score within 5% to 10% of the industry’s top-performing company. * Disclaimer: www.swireproperties.com/sd/awards/mscidisclaimer.html SUSTAINABLE DEVELOPMENT REPORT 2022 7

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) ASHRAE Technology Award Swire Properties was recognised for its outstanding achievements in the design and operation of energy efficient buildings at the 2023 ASHRAE Technology Award. Our project on retro- commissioning and the digital transformation of Cityplaza Mall won first place in the Commercial Buildings Existing Building Commissioning (“EBCx”) category. The award highlights our use of innovation and experimentation to continuously improve the energy efficiency of our operations. CIBSE Building Performance Awards 2023 In early 2023, our Cloud-based Smart Energy Platform won the Best Digital Innovation award at the CIBSE Building Performance Awards 2023, which recognises innovation that has made a significant contribution to digital engineering. The platform was commended for its exceptional ambition, scale and the fact that it can be applied to many properties and control building services systems. Swire Properties’ Reporting Awards Swire Properties’ Sustainable Development Report 2021 won the Best Environmental, Social and Governance Reporting Award in the Property Development and Investment category – the top award – while our Annual Report 2021 won a Bronze Award in the General category at the 2022 Best Annual Reports Awards by the Hong Kong Management Association (“HKMA”). The two accolades underscore our commitment to creating and maintaining effective and transparent communications for sustainable development and financial reporting to stakeholders. According to the judges’ report, Swire Properties produced a “materiality-driven report” with extensive coverage of our efforts to improve sustainability performance to withstand systemic climatic, social and economic stresses and volatility. SUSTAINABLE DEVELOPMENT REPORT 2022 8

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) At the Best Corporate Governance and ESG Awards 2022, organised by the Hong Kong Institute of Certified Public Accountants (“HKICPA”), Swire Properties also received the ESG Award in the Non- Hang Seng Index (Large Market Capitalisation) Category. For the second consecutive year, Swire Properties was the top performer among the 540 listed companies assessed. Our Sustainable Development Report 2021 received the Silver Award at the Occupational Safety and Health Annual Report Award. The award was presented to Swire Properties at the 21st Hong Kong Occupational Safety and Health Award organised by the Occupational Safety and Health Council, an award scheme that recognises organisations with excellence in the presentation of occupational safety and health performance and community development information in annual reports or sustainability reports. HKIHRM HR Excellence Awards At the Hong Kong Institute of Human Resource Management (“HKIHRM”) HR Excellence Awards 2021/2022, Swire Properties was the only company to win the Excellence Award for ESG in the Organisational category. These awards recognise organisations and individuals that achieve business success through outstanding people strategies and practices. The award is a symbol of our industry-leading efforts to integrate ESG and sustainability into our talent management and development capabilities to help our people reach their full potential in the safest, most ideal working environment. We also received a special award for our industry-leading COVID-19 response. SUSTAINABLE DEVELOPMENT REPORT 2022 9

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) Green Building Award 2021 Swire Properties won the Pioneer Award in Green Building Leadership (Facilities Management) at the Green Building Awards 2021. We are now the only developer to have won the Pioneer Award in different Green Building Leadership subcategories in multiple years – we won in the Development subcategory in 2019 and took the Grand Award in 2016. Our newest Grade-A office tower, Two Taikoo Place, also won the Grand Award in the New Buildings Category: Projects Under Construction and/or Design – Commercial. This is the second building in Taikoo Place to obtain a Grand Award in the New Buildings Category, with One Taikoo Place winning it in 2019. 2022 RICS Awards Swire Properties won three top prizes at the 2022 RICS Awards Hong Kong and 2022 RICS Awards China. We were given the “Sustainability Award” for our decarbonisation efforts and our establishment of 1.5°C-aligned science-based targets that cover emissions from building operations including tenants and embodied carbon from new projects. The “Regeneration Project of the Year” was awarded to Taikoo Li Sanlitun West, while the Young Achiever of the Year award was given to Francis Lo, Senior Manager, Portfolio. Social Capital Builder Awards 2022 Swire Properties won the Social Capital and Sustainability Grand Award at the Social Capital Builder Awards 2022. These awards, given by the Community Investment and Inclusion Fund every two years, aim to encourage cross- sectoral collaboration among corporations and organisations to actively build social capital. SUSTAINABLE DEVELOPMENT REPORT 2022 10

For 50 years, Swire Properties has adopted, advocated and adhered to a philosophy of responsible development.

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) SD 2030 Strategy GRI 2-22 For 50 years, Swire Properties has adopted, HKEX advocated and adhered to a philosophy of responsible Mandatory development. Disclosure Requirement We are committed to operating in an environmentally, socially and economically responsible manner across all aspects of our business. In 2016, we introduced our SD vision to clearly articulate our direction: To be the leading sustainable development performer in our industry globally by 2030 In the same year, we formulated our SD 2030 Strategy to implement this SD vision. This strategy has helped us build our SD capability and has ensured that SD considerations are part of all our operations and business decisions. Our SD 2030 Strategy is built on five strategic pillars: Places, People, Partners, Performance (Environment) and Performance (Economic) (“the Pillars” or “Pillar”). SD 2030 is premised on a creative mindset of innovation and experimentation and promoted through communication and engagement. Places are at the heart of, and central to, accomplishing our SD 2030 Strategy. Places Through effective placemaking and long-term placekeeping, we aim to continue to transform the places in which we invest so as to create value, whilst retaining their character, supporting communities and enhancing people’s lives. Focus areas for Places: Vibrancy Livelihood Wellbeing Resilience SUSTAINABLE DEVELOPMENT REPORT 2022 12

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) The contributions of our employees are indispensable to our success. We aim to create an environment where our employees will be healthier, happier and more productive. We invest in our employees and provide People rewarding career paths so as to develop a diverse and industry-leading team. Focus areas for People: Talent Attraction Talent Rewards Occupational Diversity and Management Health and Safety Inclusion Volunteering Our business partners are crucial to the realisation of our SD 2030 Strategy. We aim to continue to develop long-term, mutually beneficial Partners relationships with our business partners and other key parties so as to improve our environmental, social and economic performance. Focus areas for Partners: Suppliers Tenants Customers Residential Owners Government and Occupiers Non-governmental, Joint Venture Non-profit Organisations Partners (“NGOs”) SUSTAINABLE DEVELOPMENT REPORT 2022 13

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) As a leading property developer, we are committed to building and managing our developments sustainably. We aim to continue to design, construct and manage high-quality Performance developments that contribute positively to the environment and the (Environment) communities in which we operate. Focus areas for Performance (Environment): Climate Change Energy Resource and Water Biodiversity Circularity Occupant Building/Asset Wellbeing Investments We believe that long-term value creation depends on the sustainable development of our business. We aim to deliver a sustainable economic performance coupled with Performance good corporate governance and high ethical standards. (Economic) Focus areas for Performance (Economic): Financial Green Financing Corporate Risk Disclosure and Performance Governance Management Communications SUSTAINABLE DEVELOPMENT REPORT 2022 14

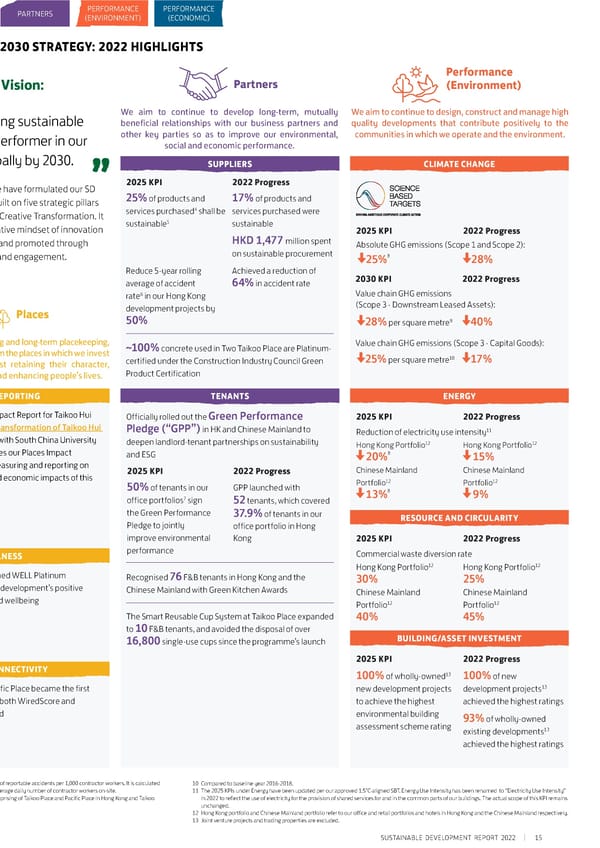

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) SUSTAINABLE DEVELOPMENT (SD) 2030 STRATEGY: 2022 HIGHLIGHTS Performance Performance (Economic) People Our SD Vision: Partners (Environment) We aim to deliver sustainable economic performance We aim to create an environment where our employees We aim to continue to develop long-term, mutually We aim to continue to design, construct and manage high coupled with good corporate governance and high will be healthier, happier and more productive, to invest in To be the leading sustainable beneficial relationships with our business partners and quality developments that contribute positively to the ethical standards. our employees and to provide rewarding career paths so development performer in our other key parties so as to improve our environmental, communities in which we operate and the environment. as to develop a diverse and industry-leading team. social and economic performance. FINANCIAL PERFORMANCE TALENT MANAGEMENT industry globally by 2030. SUPPLIERS CLIMATE CHANGE HKD 8,706 million in underlying profit attributable to 2025 KPI 2022 Progress To achieve this vision, we have formulated our SD 2025 KPI 2022 Progress shareholders A 25% increase in training ~154,000 training hours 2030 Strategy, which is built on five strategic pillars 25% of products and 17% of products and 2 4 shall be hours/employee/year delivered and embraces the spirit of Creative Transformation. It services purchased services purchased were GREEN FINANCING 5 24 training hours/ is underpinned by our creative mindset of innovation sustainable sustainable 2025 KPI 2022 Progress ( 97%) 2025 KPI 2022 Progress employee/year and experimentation, and promoted through HKD 1,477 million spent Absolute GHG emissions (Scope 1 and Scope 2): Achieve a minimum of ~60% of current bond and on sustainable procurement communication and engagement. 25%8 28% 50% of bond and loan loan facilities are facilities from green from green financing OCCUPATIONAL HEALTH AND SAFETY Reduce 5-year rolling Achieved a reduction of average of accident 64% in accident rate 2030 KPI 2022 Progress financing 2025 KPI 2022 Progress 6 Value chain GHG emissions rate in our Hong Kong CORPORATE GOVERNANCE Maintain Lost Time Injury Rate (“LTIR”) development projects by (Scope 3 - Downstream Leased Assets): Places Non-hotel operations: Non-hotel operations: 50% 9 2025 KPI 2022 Progress 28% per square metre 40% ≤1.2 0.57 Maintain no less than 30% 31% of our Board Through effective placemaking and long-term placekeeping, ~100% concrete used in Two Taikoo Place are Platinum- Value chain GHG emissions (Scope 3 - Capital Goods): of female representation on positions are held by female Hotel operations: Hotel operations: we aim to continue to transform the places in which we invest 10 ≤2.0 1.56 so as to create value, whilst retaining their character, certified under the Construction Industry Council Green 25% per square metre 17% our Board members Product Certification supporting communities and enhancing people’s lives. DISCLOSURE AND COMMUNICATIONS DIVERSITY & INCLUSION IMPACT REPORTING TENANTS ENERGY Published our fifth set of climate-related financial First time inclusion in the 2023 Bloomberg Published our third Places Impact Report for Taikoo Hui Officially rolled out the Green Performance 2025 KPI 2022 Progress disclosures as per TCFD recommendations Gender-Equality Index (“GEI”) Guangzhou, “The Creative Transformation of Taikoo Hui Pledge (“GPP”) in HK and Chinese Mainland to 11 Reduction of electricity use intensity Guangzhou”, in conjunction with South China University deepen landlord-tenant partnerships on sustainability 12 12 Hong Kong Portfolio Hong Kong Portfolio SD information is disclosed in accordance with the of Technology. The report uses our Places Impact and ESG 20%8 15% requirements of major global sustainability benchmarks Framework for assessing, measuring and reporting on 2025 KPI 2022 Progress 2025 KPI 2022 Progress Chinese Mainland Chinese Mainland the environmental, social and economic impacts of this 12 12 Portfolio Portfolio Maintain a female 50% of tenants in our GPP launched with 8 2 40.2% of the workforce development 13% 9% 7 sign representation of no less are female office portfolios 52 tenants, which covered 40% in the workforce the Green Performance 37.9% of tenants in our than RESOURCE AND CIRCULARITY Pledge to jointly office portfolio in Hong Maintain a gender balance 38.3% of senior improve environmental Kong 2025 KPI 2022 Progress Ranked 4th globally and Global Sector Leader – in senior management management positions performance No. 1 in Asia, 6th consecutive year are held by women WELLNESS Commercial waste diversion rate Member of the World Index – 12 12 Hong Kong Portfolio Hong Kong Portfolio 6th consecutive year Maintain gender pay ratio Gender pay ratio (female to Taikoo Hui Guangzhou obtained WELL Platinum 76 F&B tenants in Hong Kong and the Recognised 30% 25% 1 : 1 3: 1 : 0.92 at male) certification, recognising the development’s positive Chinese Mainland with Green Kitchen Awards Chinese Mainland Chinese Mainland impacts on human health and wellbeing 12 12 1 Portfolio Portfolio The Smart Reusable Cup System at Taikoo Place expanded 40% 45% to 10 F&B tenants, and avoided the disposal of over 16,800 single-use cups since the programme’s launch BUILDING/ASSET INVESTMENT Ranked No. 1 for 5th “AAA” rating consecutive year, 2025 KPI 2022 Progress “AAA” rating VOLUNTEERING DIGITAL CONNECTIVITY 13 100% of wholly-owned 100% of new Our Community Ambassador Programme contributed Two Taikoo Place and Six Pacific Place became the first 13 new development projects development projects >6,100 volunteer service hours, supporting 73 buildings in Hong Kong to be both WiredScore and to achieve the highest achieved the highest ratings activities SmartScore Platinum certified environmental building 93% of wholly-owned assessment scheme rating 13 existing developments achieved the highest ratings 1 Disclaimer: www.swireproperties.com/sd/awards/mscidisclaimer.html 6 Using 2015-2019 (5-year average) as baseline. Accidental rate represents the number of reportable accidents per 1,000 contractor workers. It is calculated 10 Compared to baseline year 2016-2018. 2 Compared to the baseline year of 2016. as the total number of reportable accidents multiplied by 1,000 and then divided by average daily number of contractor workers on-site. 11 The 2025 KPIs under Energy have been updated per our approved 1.5°C-aligned SBT. Energy Use Intensity has been renamed to “Electricity Use Intensity” 3 In 2022, gender pay ratio is calculated based on a non-weighed average methodology. 7 Measured by occupied lettable floor area (“LFA”) of office portfolios at 100% basis comprising of Taikoo Place and Pacific Place in Hong Kong and Taikoo in 2022 to reflect the use of electricity for the provision of shared services for and in the common parts of our buildings. The actual scope of this KPI remains 4 For wholly-owned investment portfolios. Hui Guangzhou. unchanged. 5 Products that meet specific sustainability criteria such as green certification or accreditation by reputable, independent third parties. 8 Compared to the 2019 baseline. 12 Hong Kong portfolio and Chinese Mainland portfolio refer to our office and retail portfolios and hotels in Hong Kong and the Chinese Mainland respectively. 9 Compared to the 2018 baseline. 13 Joint venture projects and trading properties are excluded. SUSTAINABLE DEVELOPMENT REPORT 2022 15

MENUPLACESPEOPLEPARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) SUSTAINABLE DEVELOPMENT (SD) 2030 STRATEGY: 2022 HIGHLIGHTS Performance Performance (Economic)PeopleOur SD Vision: Partners (Environment) We aim to deliver sustainable economic performance We aim to create an environment where our employees We aim to continue to develop long-term, mutually We aim to continue to design, construct and manage high coupled with good corporate governance and high will be healthier, happier and more productive, to invest in To be the leading sustainable beneficial relationships with our business partners and quality developments that contribute positively to the ethical standards.our employees and to provide rewarding career paths so development performer in our other key parties so as to improve our environmental, communities in which we operate and the environment. as to develop a diverse and industry-leading team. social and economic performance. FINANCIAL PERFORMANCETALENT MANAGEMENTindustry globally by 2030. SUPPLIERS CLIMATE CHANGE HKD 8,706 million in underlying profit attributable to 2025 KPI2022 ProgressTo achieve this vision, we have formulated our SD 2025 KPI2022 Progress shareholdersA 25% increase in training ~154,000 training hours 2030 Strategy, which is built on five strategic pillars 25% of products and 17% of products and 2 4 shall be hours/employee/yeardeliveredand embraces the spirit of Creative Transformation. It services purchased services purchased were GREEN FINANCING 5 24 training hours/is underpinned by our creative mindset of innovation sustainable sustainable 2025 KPI2022 Progress( 97%) 2025 KPI 2022 Progress employee/year and experimentation, and promoted through HKD 1,477 million spent Absolute GHG emissions (Scope 1 and Scope 2): Achieve a minimum of ~60% of current bond and on sustainable procurement communication and engagement. 25%8 28% 50% of bond and loan loan facilities are facilities from green from green financingOCCUPATIONAL HEALTH AND SAFETYReduce 5-year rolling Achieved a reduction of average of accident 64% in accident rate 2030 KPI 2022 Progress financing2025 KPI2022 Progress rate6 in our Hong Kong Value chain GHG emissions CORPORATE GOVERNANCEMaintain Lost Time Injury Rate (“LTIR”) development projects by (Scope 3 - Downstream Leased Assets): Places Non-hotel operations: Non-hotel operations: 50% 9 2025 KPI2022 Progress 28% per square metre 40% ≤1.2 0.57 Maintain no less than 30% 31% of our Board Through effective placemaking and long-term placekeeping, ~100% concrete used in Two Taikoo Place are Platinum- Value chain GHG emissions (Scope 3 - Capital Goods): of female representation on positions are held by female Hotel operations: Hotel operations: we aim to continue to transform the places in which we invest 10 ≤2.0 1.56 so as to create value, whilst retaining their character, certified under the Construction Industry Council Green 25% per square metre 17% our Boardmembers Product Certification supporting communities and enhancing people’s lives. DISCLOSURE AND COMMUNICATIONSDIVERSITY & INCLUSIONIMPACT REPORTING TENANTS ENERGY Published our fifth set of climate-related financial First time inclusion in the 2023 Bloomberg Published our third Places Impact Report for Taikoo Hui Officially rolled out the Green Performance 2025 KPI 2022 Progress disclosures as per TCFD recommendationsGender-Equality Index (“GEI”)Guangzhou, “The Creative Transformation of Taikoo Hui Pledge (“GPP”) in HK and Chinese Mainland to 11 Reduction of electricity use intensity Guangzhou”, in conjunction with South China University deepen landlord-tenant partnerships on sustainability 12 12 Hong Kong Portfolio Hong Kong Portfolio SD information is disclosed in accordance with the of Technology. The report uses our Places Impact and ESG 8 20% 15% requirements of major global sustainability benchmarksFramework for assessing, measuring and reporting on 2025 KPI2022 Progress 2025 KPI 2022 Progress Chinese Mainland Chinese Mainland the environmental, social and economic impacts of this 12 12 Portfolio Portfolio Maintain a female 50% of tenants in our GPP launched with 8 2 40.2% of the workforce development 13% 9% 7 sign representation of no less are female office portfolios 52 tenants, which covered 40% in the workforce the Green Performance 37.9% of tenants in our than RESOURCE AND CIRCULARITY Pledge to jointly office portfolio in Hong Maintain a gender balance 38.3% of senior improve environmental Kong 2025 KPI 2022 Progress Ranked 4th globally and Global Sector Leader – in senior managementmanagement positions performance No. 1 in Asia, 6th consecutive yearare held by womenWELLNESS Commercial waste diversion rate Member of the World Index – 12 12 Hong Kong Portfolio Hong Kong Portfolio 6th consecutive yearMaintain gender pay ratio Gender pay ratio (female to Taikoo Hui Guangzhou obtained WELL Platinum 76 F&B tenants in Hong Kong and the Recognised 30% 25% 1 : 13: 1 : 0.92 at male)certification, recognising the development’s positive Chinese Mainland with Green Kitchen Awards Chinese Mainland Chinese Mainland impacts on human health and wellbeing 12 12 1 Portfolio Portfolio The Smart Reusable Cup System at Taikoo Place expanded 40% 45% to 10 F&B tenants, and avoided the disposal of over 16,800 single-use cups since the programme’s launch BUILDING/ASSET INVESTMENT Ranked No. 1 for 5th “AAA” rating consecutive year, 2025 KPI 2022 Progress “AAA” ratingVOLUNTEERINGDIGITAL CONNECTIVITY 13 100% of wholly-owned 100% of new Our Community Ambassador Programme contributed Two Taikoo Place and Six Pacific Place became the first 13 new development projects development projects >6,100 volunteer service hours, supporting 73 buildings in Hong Kong to be both WiredScore and to achieve the highest achieved the highest ratings activitiesSmartScore Platinum certified environmental building 93% of wholly-owned assessment scheme rating 13 existing developments achieved the highest ratings 1 Disclaimer: www.swireproperties.com/sd/awards/mscidisclaimer.html6 Using 2015-2019 (5-year average) as baseline. Accidental rate represents the number of reportable accidents per 1,000 contractor workers. It is calculated 10 Compared to baseline year 2016-2018. 2 Compared to the baseline year of 2016.as the total number of reportable accidents multiplied by 1,000 and then divided by average daily number of contractor workers on-site.11 The 2025 KPIs under Energy have been updated per our approved 1.5°C-aligned SBT. Energy Use Intensity has been renamed to “Electricity Use Intensity” 3 In 2022, gender pay ratio is calculated based on a non-weighed average methodology.7 Measured by occupied lettable floor area (“LFA”) of office portfolios at 100% basis comprising of Taikoo Place and Pacific Place in Hong Kong and Taikoo in 2022 to reflect the use of electricity for the provision of shared services for and in the common parts of our buildings. The actual scope of this KPI remains 4 For wholly-owned investment portfolios.Hui Guangzhou. unchanged. 5 Products that meet specific sustainability criteria such as green certification or accreditation by reputable, independent third parties.8 Compared to the 2019 baseline.12 Hong Kong portfolio and Chinese Mainland portfolio refer to our office and retail portfolios and hotels in Hong Kong and the Chinese Mainland respectively. 9 Compared to the 2018 baseline. 13 Joint venture projects and trading properties are excluded. SUSTAINABLE DEVELOPMENT REPORT 2022 15

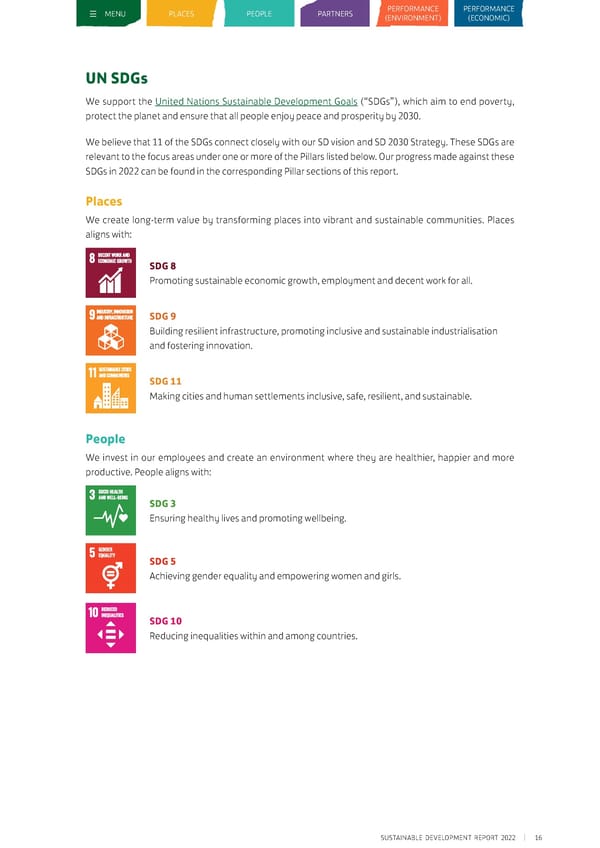

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) UN SDGs We support the United Nations Sustainable Development Goals (“SDGs”), which aim to end poverty, protect the planet and ensure that all people enjoy peace and prosperity by 2030. We believe that 11 of the SDGs connect closely with our SD vision and SD 2030 Strategy. These SDGs are relevant to the focus areas under one or more of the Pillars listed below. Our progress made against these SDGs in 2022 can be found in the corresponding Pillar sections of this report. Places We create long-term value by transforming places into vibrant and sustainable communities. Places aligns with: SDG 8 Promoting sustainable economic growth, employment and decent work for all. SDG 9 Building resilient infrastructure, promoting inclusive and sustainable industrialisation and fostering innovation. SDG 11 Making cities and human settlements inclusive, safe, resilient, and sustainable. People We invest in our employees and create an environment where they are healthier, happier and more productive. People aligns with: SDG 3 Ensuring healthy lives and promoting wellbeing. SDG 5 Achieving gender equality and empowering women and girls. SDG 10 Reducing inequalities within and among countries. SUSTAINABLE DEVELOPMENT REPORT 2022 16

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) Partners Our business partners are crucial to the success of our SD 2030 Strategy. Partners aligns with: SDG 12 Ensuring sustainable consumption and production patterns. SDG 17 Strengthening partnerships for sustainable development. Performance (Environment) We design, construct and manage high-quality developments that contribute positively to communities and the environment. Performance (Environment) aligns with: SDG 3 Ensuring healthy lives and promoting wellbeing. SDG 6 Ensuring availability and sustainable water management. SDG 7 Ensuring access to reliable and sustainable energy. SDG 11 Making cities and human settlements inclusive, safe, resilient, and sustainable. SDG 12 Ensuring sustainable consumption and production patterns. SDG 13 Taking urgent action to combat climate change and its impacts. Performance (Economic) We believe that long-term value creation depends on the sustainable development of our business. Performance (Economic) aligns with: SDG 8 Promoting sustainable economic growth, employment and decent work for all. SDG 17 Strengthening partnerships for sustainable development. SUSTAINABLE DEVELOPMENT REPORT 2022 17

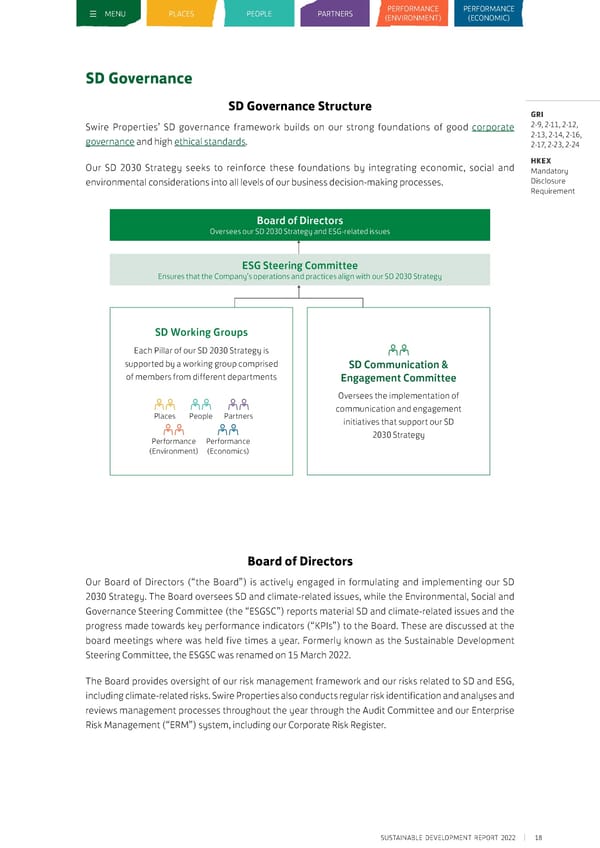

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) SD Governance SD Governance Structure GRI Swire Properties’ SD governance framework builds on our strong foundations of good corporate 2-9, 2-11, 2-12, governance and high ethical standards. 2-13, 2-14, 2-16, 2-17, 2-23, 2-24 Our SD 2030 Strategy seeks to reinforce these foundations by integrating economic, social and HKEX Mandatory environmental considerations into all levels of our business decision-making processes. Disclosure Requirement Board of Directors Oversees our SD 2030 Strategy and ESG-related issues ESG Steering Committee Ensures that the Company’s operations and practices align with our SD 2030 Strategy SD Working Groups Each Pillar of our SD 2030 Strategy is supported by a working group comprised SD Communication & of members from different departments Engagement Committee Oversees the implementation of Places People Partners communication and engagement initiatives that support our SD Performance Performance 2030 Strategy (Environment) (Economics) Board of Directors Our Board of Directors (“the Board”) is actively engaged in formulating and implementing our SD 2030 Strategy. The Board oversees SD and climate-related issues, while the Environmental, Social and Governance Steering Committee (the “ESGSC”) reports material SD and climate-related issues and the progress made towards key performance indicators (“KPIs”) to the Board. These are discussed at the board meetings where was held five times a year. Formerly known as the Sustainable Development Steering Committee, the ESGSC was renamed on 15 March 2022. The Board provides oversight of our risk management framework and our risks related to SD and ESG, including climate-related risks. Swire Properties also conducts regular risk identification and analyses and reviews management processes throughout the year through the Audit Committee and our Enterprise Risk Management (“ERM”) system, including our Corporate Risk Register. SUSTAINABLE DEVELOPMENT REPORT 2022 18

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) Environmental, Social and Governance Steering Committee The ESGSC is chaired by the Chief Executive of the Company. Other members are the Finance Director and six members of our senior management from the human resources and administration, portfolio management, projects, public affairs, and technical services and sustainable development departments. In 2022, an Independent Non-Executive Director of the Company joined the ESGSC, who is also the Chairman of our Audit Committee. The composition of the ESGSC is reviewed annually by the Chief Executive to ensure an appropriate balance and representation of expertise and experience; and the Chief Executive may appoint any person or persons from within or outside the Company as considered appropriate. The Chairman of the ESGSC reports relevant SD and climate-related matters to the Board, as appropriate. In accordance with its terms of reference, the ESGSC is responsible for: (a) Reviewing, and suggesting any changes to, the Company’s ESG Strategy in respect of ESG matters (the “ESG Strategy”), including approving targets or key initiatives recommended by the working groups; (b) Ensuring that the Company’s operations and practices are carried out in line with the ESG Strategy; (c) Reviewing the Company’s annual performance in achieving targets or key initiatives recommended by the working groups; (d) Reviewing any significant risks, opportunities or investments that exist in connection with the implementation of the ESG Strategy; (e) Reviewing and approving the annual Sustainable Development Report and any relevant ancillary public documents; and (f) Through its Chairman, reporting relevant matters of significance relating to sustainable development to the Board. SD Working Groups Each Pillar is supported by a working group. In 2022, there were six SD working groups that continued to work on the KPIs and future targets set for each Pillar for 2025 and 2030. These are: 1. The Places Working Group, chaired by the Director, Office; 2. The People Working Group, chaired by the Director, Human Resources; 3. The Partners Working Group, chaired by the General Manager, Projects (HK & SE Asia); 4. The Performance (Environment) Working Group, chaired by the Director, TSSD & Facilities Management; 5. The Performance (Economic) Working Group, chaired by the Finance Director; and 6. The Sustainable Development Communication and Engagement Committee, chaired by the Deputy Director – Public Affairs. The members of each SD Working Group are carefully selected to ensure the inclusion of employees with different backgrounds, types of expertise and varying levels of seniority. SUSTAINABLE DEVELOPMENT REPORT 2022 19

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) SD Communication and Engagement Committee Our SD Communication and Engagement Committee identifies, prioritises and oversees the implementation of communication and engagement plans for initiatives that support our SD 2030 Strategy. It is chaired by the Deputy Director – Public Affairs. This Committee also includes representatives from different functions within the Company. Read more about what this Committee accomplished in 2022 here. Sustainable Development Policy GRI Our Sustainable Development Policy (“SD Policy”) was first published in 2008 and has guided the 2-23, 2-24 Company’s operations since then. The Policy is reviewed periodically and was last updated in 2021. The SD Policy reflects our belief that long-term value creation depends on the sustainable development of our business, our supply chain and the communities in which we operate. These factors are continuously considered during the inception, design, construction, occupation and demolition phases of our development projects. The SD Policy explicitly states that the Company will be a good steward of the natural resources and biodiversity within our influence and that we will ensure that all potentially adverse impacts of our operations are identified and managed appropriately. With respect to the environment, our approach follows the precautionary principle1 which states, “Where there are threats of serious or irreversible damage, lack of full scientific certainty shall not be used as a reason for postponing cost-effective measures to prevent environmental degradation”. We strive to operate in a manner that protects the health and safety of all of the people with whom we work. We also strive to be an employer of choice by providing a working environment in which all employees are treated fairly and with respect in order that they realise their full potential. 1 The precautionary approach is referred to in Principle 15 of The Rio Declaration on Environment and Development. SUSTAINABLE DEVELOPMENT REPORT 2022 20

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) Swire Properties’ Policies Our SD Policy is supported by the following policies that focus on specific environmental and social impacts. Anti-Bribery and Biodiversity Policy Board Diversity Climate Change Corruption Policy (revised in 2022) Policy Policy (new) (revised in 2022) Corporate Code of Diversity and Environmental Conduct Inclusion Policy Energy Policy Policy (revised in 2022) Health and Safety Human Rights Policy Parental Leave Respect in Policy (new) Policy and Workplace Policy (revised in 2022) Guidelines Shareholders’ Staff Grievance Supplier Code of Resource and Communication Policy Conduct Circularity Policy Policy (new) (revised in 2022) Remuneration Water Policy Whistleblowing Policy (new) (revised in 2022) Policy (revised in 2022) SUSTAINABLE DEVELOPMENT REPORT 2022 21

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) Integrating SD into our Business Operations Employee Engagement Support from our employees is vital to the success of our SD 2030 Strategy. In 2018, our performance development review system was updated to engage employees in our SD Strategy on a deeper level. Since then, our office employees have continued to align their annual performance goals with each Pillar and the Company’s SD vision. We have also established corporate SD performance metrics that are linked to variable compensation for our Chief Executive and the general managers of our portfolios. The Chief Executive has performance targets that are linked to health and safety throughout the Company’s operations, while the general managers’ performance targets relate to energy management in their respective portfolios. Business Integration and Budgeting In 2022, we continued to implement SD initiatives in our day-to-day operations and decision- making at both the asset and functional levels of all our major business units in Hong Kong and the Chinese Mainland. All our major business units now incorporate SD considerations into their annual budgets and share proposed budget allocations with the relevant SD Working Groups to ensure adequate resources are made available to realise our SD 2030 targets. The budgets are reviewed and approved by the Board. In 2023, Swire Properties will pilot the use of internal carbon pricing (“ICP”) to determine the potential impacts of carbon emissions from our investments, quantify carbon risks to our business operations It will take place as an internal carbon fee which links each unit of CO2 emissions to a fixed cost, allowing better reallocation of capital towards low-carbon investment and activities. A total of HKD 3,159 million has been budgeted as the future three-year (2023 to 2025) forecast expenditure for climate-related projects, including funds generated from ICP. SUSTAINABLE DEVELOPMENT REPORT 2022 22

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) Corporate Risk Management Our Corporate Risk Register (“CRR”) incorporates ESG-related risks, such as climate-related risks. We have also integrated SD and ESG factors into our corporate risk analysis. In 2022, we began digitalising the CRR dashboard and risk scoring model. The new digitalised CRR platform offers a standard template for updating risk details, risk scoring and risk mitigation measures, making benchmarking across the Swire Group easier. In the next phase, we plan to optimise the system and the reporting protocol. Swire Properties’ management will continue to monitor and conduct regular review of risks and the effectiveness of mitigation strategies. External risk advisors will also be regularly consulted for their risk management experience, allowing us to keep abreast of industry best practices. Green Financing Swire Properties is committed to integrating sustainability considerations into our financing mechanisms. By obtaining green financing, we reaffirm our commitment to sustainable development, and to designing and developing sustainable projects that improve the wellbeing of building occupants and local communities. Beginning in 2018, Swire Properties launched various green financing mechanisms to fund green building developments and other projects. These have included our first green bond, issued in January 2018, and our first sustainability-linked loan, obtained in July 2019, the interest rate of which is indexed against improvements in the Company’s year-on-year ESG performance. Since the launch of these mechanisms, Swire Properties has received reductions in the interest rates of our signed sustainability-linked loans by achieving predetermined sustainability-linked performance targets. In 2022, we secured sustainability-linked loan facilities totalling HKD11.8 billion. As of 31 December 2022, approximately 60% of our bond and loan facilities are from such green financing instruments as green bonds, sustainability-linked loans and green loans. We also continued to update our investors and analysts about our SD performance through a comprehensive ESG webinar and question-and-answer session. In 2023, we issued our fifth annual Green Finance Report 2022, which provides information on projects funded by the green bonds and the green loan and their estimated quantitative environmental impacts, including energy and water savings, renewable energy generation and wastewater management impacts. SUSTAINABLE DEVELOPMENT REPORT 2022 23

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) Communication and Engagement 2022 marked the third year of our SD-themed communication campaign “Sustainability We All Count”. Our first campaign was launched in 2020 with the aim of raising SD awareness amongst Swire Properties employees and stakeholders. In 2021, our second campaign highlighted our commitment to the Business Ambition to 1.5°C, featuring “1.5°C” as our key statement, to echo the ramp up of our SBTs in alignment with the 1.5°C decarbonisation pathway. This year, we pooled our efforts together and continued the campaign, empowering our employees, tenants, customers, suppliers and the public to work together in pursuit of our ambitious 1.5°C goal of reaching net-zero emissions by 2050. “Sustainability We All Count” 3.0 In February 2022, our “Sustainability We All Count” SD-themed communication campaign returned for its third iteration with a new theme: “Fighting Climate Change, Together We Can”. The campaign highlighted our pioneering SD initiatives and community engagement programmes via offline and online channels, both internal and external, aiming to encourage our employees, tenants, key stakeholders and the general public to take action in pursuit of our ambitious 1.5°C goal. As in previous years, the campaign featured “1.5°C” as the key element, with the enduring characters from the initial 2020 campaign drawing attention to the need to limit the global temperature rise to 1.5°C above pre-industrial levels by the end of this century. Posters were displayed in office buildings, malls, lift lobbies and on social media channels to reinforce the message, while frontline employees continued to wear “1.5°C” pins to sustain public awareness. Numerous events supporting the campaign were held during the year, such as a series of public eco- workshops with hands-on interactive activities, co-hosted at Blueprint, that focused on sustainable lifestyle elements; and a number of staff activities and celebrations that commemorated the hard work employees put into making the campaign a success, including customised posters and a “Together We Can” SD Character Contest, asking colleagues to recreate one of the SD characters from the campaign and give it their own creative twist by upcycling used materials. SD 2030 e-Learning Module Covering all basic aspects of our SD 2030 Strategy and relevant ESG topics, this comprehensive new SD e-learning module will become part of the intake process for new staff and will be provided as refresher training to existing staff. It will include videos from Company leaders, case studies and an entertaining “SD Dictionary” introducing SD buzzwords in a lively manner. The module, currently in the final stages of development, will be launched in early 2023. SUSTAINABLE DEVELOPMENT REPORT 2022 24

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) Innovation and Experimentation A creative mindset of innovation and experimentation is crucial to the successful execution of our SD 2030 Strategy. In 2022, we repeatedly demonstrated our commitment to innovation and experimentation. Innovation Accelerator Swire Properties’ Innovation Accelerator (“IA”) programme was established in 2020 to promote a culture of innovation and create a positive, collaborative community of Change Agents who enjoy extensive training, tailor-made workshops and a chance to incubate ideas with senior management. 2022 saw the programme celebrate Swire Properties’ 50th anniversary with a busy year of roundtables, training and sharing sessions. Fifteen roundtables were held through the year, raising awareness and helping participants acquire basic knowledge of artificial intelligence (“AI”), blockchain, cloud-based services, and big and small data. These events, attracting large numbers of virtual and face-to-face participants, promoted new collaborations between different committees, departments and stakeholders. Topics included a placemaking masterclass, insights from our strategic partnership with Tsinghua University on the Joint Research Centre for Building Energy Efficiency and Sustainability, and an introduction to robotic process automation which was followed by a workshop on how to “build your own bot”. Eight IA training initiatives were held in 2022 to reinforce the “three Is” Change Agent DNA, which are essential components of IA programme: the “three Is” – being “inquisitive”, “influential” and “impactful”. Interactive and experiential workshops were organised on various topics including design thinking, the growth mindset and agility, aiming to equip our employees with a customer-centric mindset during product and service design. The flagship Clockwise programme saw 16 ideas generated over the year and added to current IA projects by our Change Agents. Each of these ideas received a strong commendation and were followed up for future planning within the relevant business units. In late 2022, the IA programme finished recruiting the second cohort of 60 Change Agents who met the criteria of being openminded, willing to change and not afraid to challenge the status quo. An inauguration ceremony was held in December 2022 to mark the start of their journey. SUSTAINABLE DEVELOPMENT REPORT 2022 25

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) New Ventures Working closely with technology companies, investors, accelerators and start-ups, Swire Properties’ New Ventures is a specialised department that identifies emerging trends and accelerates the adoption of best-in-class emerging technologies at scale for the Company. New Ventures does this in two ways – by identifying and trialling technologies that can help grow our businesses, and by actively investing in companies. This allows Swire Properties to flexibly adapt its strategy in light of emerging technology trends. In addition to managing a USD50 million venture fund to invest in Series A to Series C technology start-ups globally, New Ventures also manages a Tech Experimentation Fund that sponsors tech trials across the Company to accelerate innovation internally. 2022 saw New Ventures continue to source, trial and scale best practice technologies to drive strategic business impacts. Some examples include: • Robotics software technology that enables sophisticated architectural design to be executed with precision and speed; • A construction site capture tool and project management platform that reduces the risk of time and cost overruns; and • Frontline optimisation software to improve our retail operations and the customer experience. We also expanded our innovation partnership with Hong Kong Science and Technology Parks Corporation (“HKSTP”). Over the course of three years, HKSTP will introduce technology companies and smart solutions to Swire Properties for trial and adoption, make investment referrals, and explore potential investment collaborations in emerging technology start-ups. The department has been recognised as one of the most innovative organisations by 36Kr, a prominent Chinese Mainland-based media platform and thought leader on technology and innovation. New Ventures will continue to actively explore and adopt exciting technologies that will enhance and innovate Swire Properties’ business. The Next Generation Committee As part of our 50th anniversary celebrations, we launched the Swire Properties Next Generation Committee (“NextCom”), assembled to empower and learn from the Company’s many talented young people upon whom the future success of our business relies. NextCom is an in-house programme designed to give future leaders a platform to share their ideas and create meaningful change within the Company. Inaugurated in November 2022, NextCom is made up of 12 young people from different departments, regions and backgrounds who will form a diverse advisory team that will work closely with the Executive Committee. NextCom will provide key insights on business, strategy and community issues, gather and share opinions from young and junior colleagues, and drive action on topics that create significant business impacts. SUSTAINABLE DEVELOPMENT REPORT 2022 26

We believe that balancing internal and external viewpoints is critical to defining and managing SD issues that are significant to our business and our stakeholders.

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) Materiality HKEX For the purposes of Swire Properties’ SD 2030 Strategy and SD reporting, materiality is defined as any Mandatory Disclosure factor that has a present or future impact on our ability to achieve our SD vision. We believe that balancing Requirement, internal and external viewpoints is critical to defining and managing SD issues that are significant to our Aspect B8 business and our stakeholders. Our Stakeholder Engagement Approach As set out in our SD 2030 Strategy, communication and engagement with employees, investors, tenants, customers, suppliers, regulators, NGOs, community representatives and many other stakeholders is an integral part of our daily operations. We regularly engage with our stakeholders to understand their priorities, expectations and perceptions regarding SD issues. When we first introduced our SD 2030 Strategy in 2016, we engaged extensively with senior managers and employees from across the business and consulted external sustainability experts. Today, our SD Communication and Engagement Committee continues to gather the support of our employees and other stakeholders to further integrate SD 2030 across our business. Our Stakeholders GRI Swire Properties’ stakeholders are both internal and external interest groups that have a significant 102-40, 102-42, impact on our business, or that experience significant impacts from our operations. We regularly engage 102-43 with these stakeholders through the appropriate channels. SUSTAINABLE DEVELOPMENT REPORT 2022 28

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) Stakeholder Groups and Methods of Engagement Employee Groups Tenants • Surveys and interviews • SD-themed tenant • SPLinks intranet and the engagement programmes employee newsletter • Swire Properties Tenant CornerStone Portal • Training sessions • Joint projects • Competitions and team- • Community events building activities or events • Surveys and interviews • Virtual and in-person forums • Multi-stakeholder meetings • Employee townhalls and seminars on specific • “WeChat Work” mobile issues application Community/NGOs Customers/Consumers • Community events • Surveys • Joint projects • Customer service mobile • Working committees and applications consultations • Community events • Multi-stakeholder meetings • Joint projects and seminars on specific • Customer relationship issues management programmes Suppliers Regulators/Government • Supplier screenings and • Joint projects assessments • Working committees and • Joint projects consultations • Surveys • Interviews • Forums • Community events Industry Experts/Academia Joint Venture Partners • Joint projects and research • Surveys and interviews funds • Multi-stakeholder meetings • Multi-stakeholder forums and seminars on specific and partnerships issues • Seminars • Joint projects Shareholders & Investors Media • SD benchmarks and indices • Annual gatherings • Interviews and meetings • Interviews • Newsletters • Feedback and responses to • Events media enquiries • Investor Day SUSTAINABLE DEVELOPMENT REPORT 2022 29

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) Stakeholder-driven Materiality GRI In 2020, we initiated a materiality review with the support of an independent consultant, the aim of 3-1, 3-2 which was to understand our stakeholders’ perceptions of the progress of our SD 2030 Strategy and their HKEX evolving expectations and priorities for the future. These perceptions have helped us further align our Mandatory Disclosure business practices, improved our decision-making and accountability, and guided the refinement of our Requirement strategy and focus areas in response to the latest local, regional and global developments. In 2021, we continued this process, adopting a combined qualitative and quantitative approach to assessing materiality. We interviewed 23 subject matter experts to identify new challenges and opportunities and conducted a broader survey of 547 external and internal stakeholders, who ranked issues in terms of their perceived importance to society, the environment and, for employees, their perceived impact on our business. Throughout the COVID-19 pandemic, we also gathered stakeholders’ feedback in order to gain greater understanding of the pandemic’s effects on their businesses, the real estate industry and our operations. The findings provided insights into ways of providing tailored support to our stakeholders during challenging times. Swire Properties is continuing to build on and refine our approach to materiality. For years, we have defined the concept of materiality as “any factors that are perceived to be important to our company’s business continuity and development as well as perceived to be important to our stakeholders”. This “importance-based” materiality follows widely adopted sustainability reporting frameworks such as the GRI Standards and has been the focus of previous materiality assessments and stakeholder engagement exercises. To gain an even deeper understanding of what aspects are important to the Company’s business continuity and development, a new materiality assessment and stakeholder engagement exercise will be conducted in 2023 based on the newly established concept of “double materiality”. Double materiality is a concept proposed by the European Commission’s Guidelines on Reporting Climate-related Information that encourages a company to assess materiality based on a topic’s implications for the company’s financial performance (i.e. financial materiality) as well as on the communities and the environment (i.e. impact materiality), and the interconnectivity between the two. This “financial-and-impact-based” double materiality will allow us to better assess the integration of sustainability with our business, understand our sustainability impact and align with global best practices in reporting. SUSTAINABLE DEVELOPMENT REPORT 2022 30

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) Materiality Matrix Tier 1 issues (the most critical Tier 2 issues (important Tier 3 issues (relatively less material issues with the material issues with a high important material issues, as highest potential impact on potential impact on business perceived by stakeholders, that business success) success) can impact business success) Green Building Construction & Renovation 1 Decarbonisation 3 Energy Efficiency Climate Adaptation & Resilience 9 10 Community 2 Technology & Resource & Circularity 13 Investment & 4 Tenant & Customer Innovation Visitor/Occupant Health & Wellbeing Engagement Engagement Renewable Energy 16 14 6 5 Contribute to Local Economic Development 29 7 Local Revitalisation 17 eholders Responsible Supply Chain Management 8 Corporate Governance o stak Indoor Air Quality 20 12 11 Social Inclusion Employee Wellbeing Stakeholder Talent Attraction, tance t Occupational Health & Safety Engagement & 15 Collaboration Retention & Diversity & Equal Opportunities Development Impor 19 Risk Management 18 Labour Practices Cyber Security & Long Term Financial Biodiversity & Human Rights Data Governance Performance & Value Water Conservation Bribery & Corruption Importance to business continuity and development Places People Partners Performance (Environment) Performance (Economic) All pillars of SD 2030 Remarks: Tier 1 and Tier 2 issues are numbered in this matrix The top material issues in the matrix, namely Tier 1 and Tier 2 issues, are consistent with the focus areas of our SD 2030 Strategy and have been addressed in this report in accordance with the relevant Global Reporting Initiative Standards. SUSTAINABLE DEVELOPMENT REPORT 2022 31

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) Top Material Issues Material Issues SD 2030 Strategy GRI Standards Impacts and Boundaries Focus Areas ors omers tners vest oups cademia/In Cust e ParA / Government/ / ts ors t entur ula eholders enants g oint V edia Employee GrCommunity/NGOsSuppliersTConsumersReJInd. ExperSharM 1 Green building Building/Assets and GRI 417 Marketing and Labelling (2016) Construction & Investments Renovation 2 Technology & Integral to multiple N/A Innovation focus areas 3 Energy Efficiency Energy GRI 302 Energy (2016) 4 Tenant & Customers and N/A Customer Tenants Engagement 5 Local Economic Livelihood GRI 203 Indirect Economic Impacts (2016) Development 6 Community Resilience GRI 413 Local Communities (2016) Investment & Engagement 7 Local Vibrancy GRI 203 Indirect Economic Impacts (2016) Revitalisation 8 Corporate Corporate GRI 205 Anti-corruption (2016) Governance Governance GRI 206 Anti-competition Behavior (2016) 9 Climate Climate Change GRI 201 Economic Performance (2016) Adaptation & GRI 305 Emissions (2016) Resilience 10 Decarbonisation Climate Change GRI 305 Emissions (2016) 11 Employee Talent Management GRI 403 Occupational Health & Safety (2018) Wellbeing 12 Stakeholder Integral to multiple N/A Engagement & focus areas Collaboration 13 Resource & Resource and GRI 306 Waste (2020) Circularity Circularity 14 Visitor/occupant Occupant Wellbeing GRI 416 Customer Health and Safety (2016) Health & Wellbeing 15 Talent Attraction, Talent Attraction GRI 401 Employment (2016) Retention & and Talent GRI 404 Training and Education (2016) Development Management GRI 405 Diversity and Equal Opportunity (2016) GRI 406 Non-discrimination (2016) 16 Renewable Energy GRI 302 Energy (2016) Energy 17 Responsible Suppliers GRI 301 Materials (2016) Supply Chain GRI 308 Supplier Environmental Assessment Management (2016) GRI 414 Supplier Social Assessment (2016) 18 Long-term Financial GRI 201 Economic Performance (2016) Financial Performance Performance & Value 19 Risk Management Risk Management GRI 201 Economic Performance (2016) 20 Indoor Air Quality Occupant Wellbeing GRI 416 Customer Health and Safety (2016) Places People Partners Performance (Environment) Performance (Economic) All pillars of SD 2030 SUSTAINABLE DEVELOPMENT REPORT 2022 32

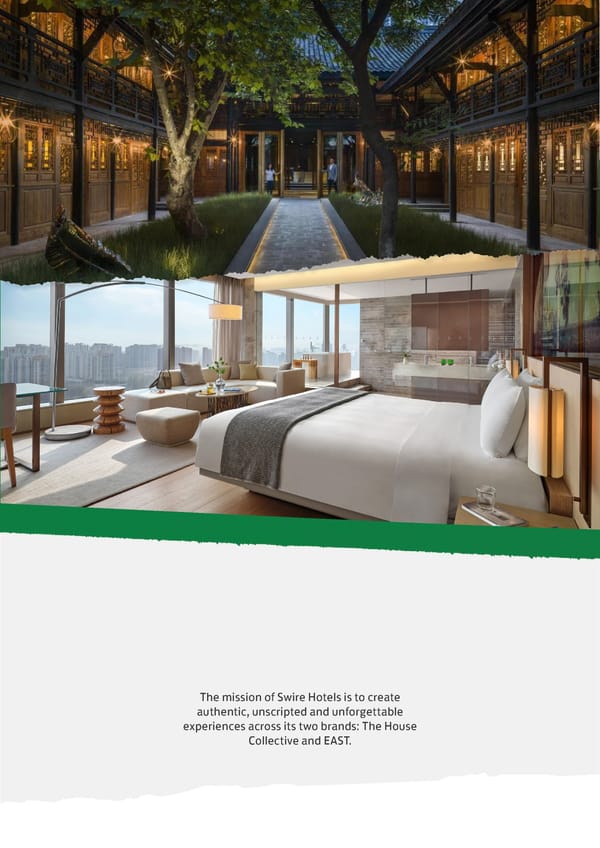

The mission of Swire Hotels is to create authentic, unscripted and unforgettable experiences across its two brands: The House Collective and EAST.

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) The mission of Swire Hotels is to create authentic, unscripted and unforgettable experiences across its two brands: The House Collective and EAST. The Group manages distinctive hotels in Hong Kong and the Chinese Mainland for travellers who seek originality, style and personalised service. The House Collective is a group of refined, highly individual properties. Each House is unique, and created by talented architects and creatives to reflect the unique qualities of their surroundings. The EAST brand consists of lifestyle hotels that are bright, energetic and inspiring, bringing their community and sustainability-oriented mindset to the most dynamic areas of their cities. Both brands have their own approaches to putting SD into action, which mirror their individual, original DNA. Encouraging Creativity and Innovation for our 50th Anniversary As part of Swire Hotel’s commitment to innovation and creative transformation, the EAST brand has launched the “Ideas To Wake Up To” speaker series. This series is periodically hosted across all EAST hotels, bringing together like-minded business leaders and creatives to connect, co-create, learn, and spark new ideas. In 2022, three sessions were hosted with one in Hong Kong and two in Miami, all centred around topics pertaining to sustainable development (“SD”). The Think Differently Awards were launched across Swire Hotels in 2021 to encourage all team members to share their innovative and interesting ideas. In 2022, the awards were focused on SD, spanning three themes: water conservation, energy conservation and waste management. A total of 164 submissions were received. Both the “Ideas To Wake Up To” speaker series and the Think Differently Awards reflect the spirit of originality that Swire Properties celebrated during our 50th anniversary. SUSTAINABLE DEVELOPMENT REPORT 2022 34

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) Places Vibrancy The House Collective runs a biennial art programme called “Encounters Across Cultures”, which invites artists from different backgrounds to collaborate on creative artistic expressions. In 2021, the Houses invited artists from around the world to come together to create and explore the concept of space and movement. Designed during the pandemic, the programme was realised through interactive video installations that – coupled with varying styles of dance – complemented the work of the esteemed architects behind each House. “Art at EAST”, launched in 2019, was the first art programme at EAST Hotels. At EAST Hong Kong, an interactive exhibition called “City Symphony” transports guests on a sound-based journey across the Taikoo neighbourhood using eccentric wooden sculptures. Livelihood At EAST Hong Kong, the Community Ambassadors continued a charity initiative launched in 2020 – the “A Spoonful of Love” campaign, which raises money for people in need in Hong Kong and provides a tasty and nutritious bowl of soup at the same time. The EAST Hong Kong team sourced ingredients to create their own special soup packets. Altogether, 2,261 soup packets were sent to families through 11 NGO partners. We also delivered 5,900 soup packs to doctors, nurses and staff at Eastern Hospital, sending the frontline medical carers a simple message: We Are All in This Together! SUSTAINABLE DEVELOPMENT REPORT 2022 35

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) Wellbeing All hotels offer unique and comprehensive wellness programmes for guests and staff alike. The Upper House offers wellness residencies in Hong Kong, featuring holistic therapies, yoga and meditation sessions, fitness classes and in- room treatments, some of which are conducted in partnership with well-known sports and wellness brands. The Temple House provided regular wellness initiatives throughout the year, from healthy menu selections at the hotel’s restaurants to cross-brand collaborations and unique wellness-themed experiences for guests. These included exercise parties to promote stillness, happiness and wellbeing, and livestreamed yoga classes for staff and “House friends” during the lockdown period. One session attracted over 500 followers to participate. Resilience Between February to October 2022, EAST Hong Kong became a designated quarantine hotel to support the government’s quarantine arrangements for inbound persons from overseas – a crucial part of the city’s overall pandemic strategy at that time. During the soft lockdown period in Chengdu, The Temple House distributed mooncakes to the government community office that provided daily COVID-19 testing to the surrounding neighbourhood. The hotel also donated 215 boxes of mooncakes to charities during the Mid-Autumn Festival. Meanwhile, our hotel teams received care packages at their staff dormitories, while hotel guests were also given special packages daily including wine, cheese, Mi Xun hotpot, special cocktails and puzzle games to ensure they remained well in a positive and upbeat environment. SUSTAINABLE DEVELOPMENT REPORT 2022 36

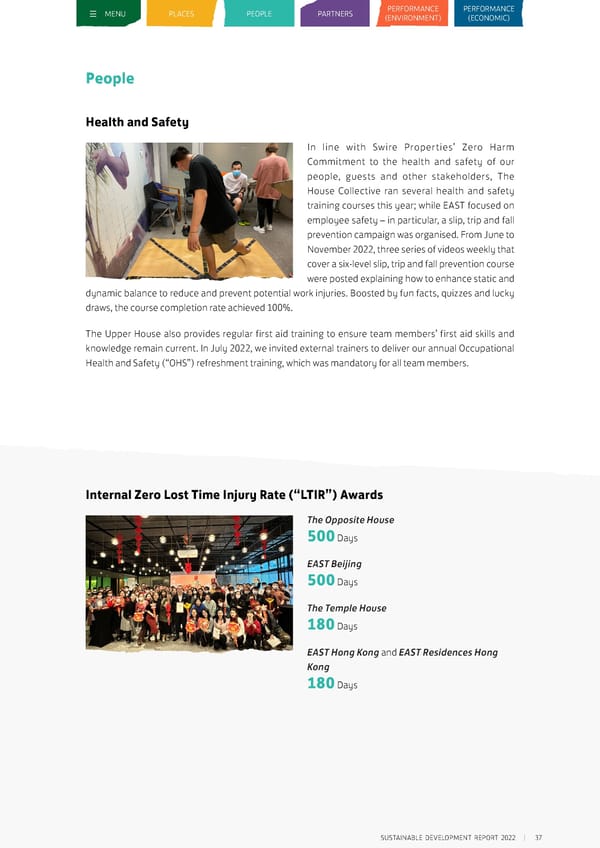

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) People Health and Safety In line with Swire Properties’ Zero Harm Commitment to the health and safety of our people, guests and other stakeholders, The House Collective ran several health and safety training courses this year; while EAST focused on employee safety – in particular, a slip, trip and fall prevention campaign was organised. From June to November 2022, three series of videos weekly that cover a six-level slip, trip and fall prevention course were posted explaining how to enhance static and dynamic balance to reduce and prevent potential work injuries. Boosted by fun facts, quizzes and lucky draws, the course completion rate achieved 100%. The Upper House also provides regular first aid training to ensure team members’ first aid skills and knowledge remain current. In July 2022, we invited external trainers to deliver our annual Occupational Health and Safety (“OHS”) refreshment training, which was mandatory for all team members. Internal Zero Lost Time Injury Rate (“LTIR”) Awards The Opposite House 500 Days EAST Beijing 500 Days The Temple House 180 Days EAST Hong Kong and EAST Residences Hong Kong 180 Days SUSTAINABLE DEVELOPMENT REPORT 2022 37

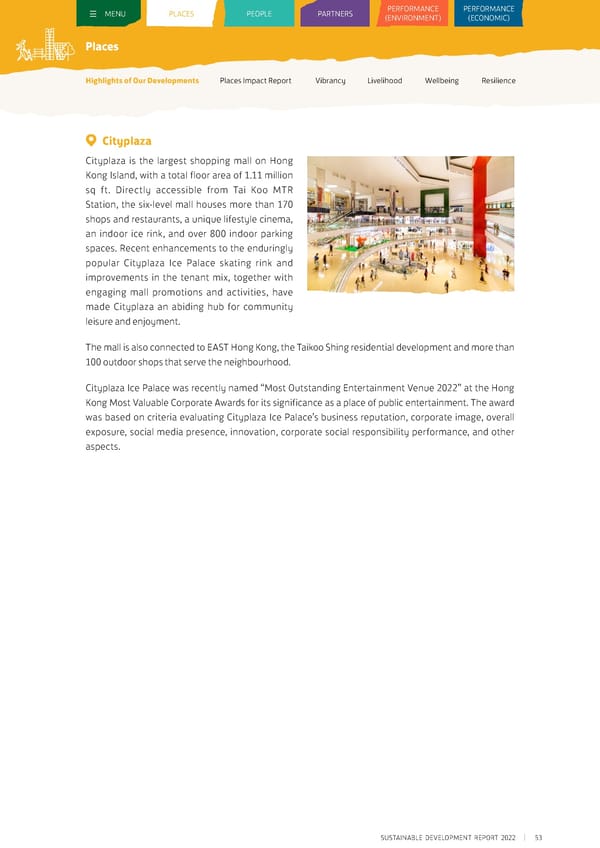

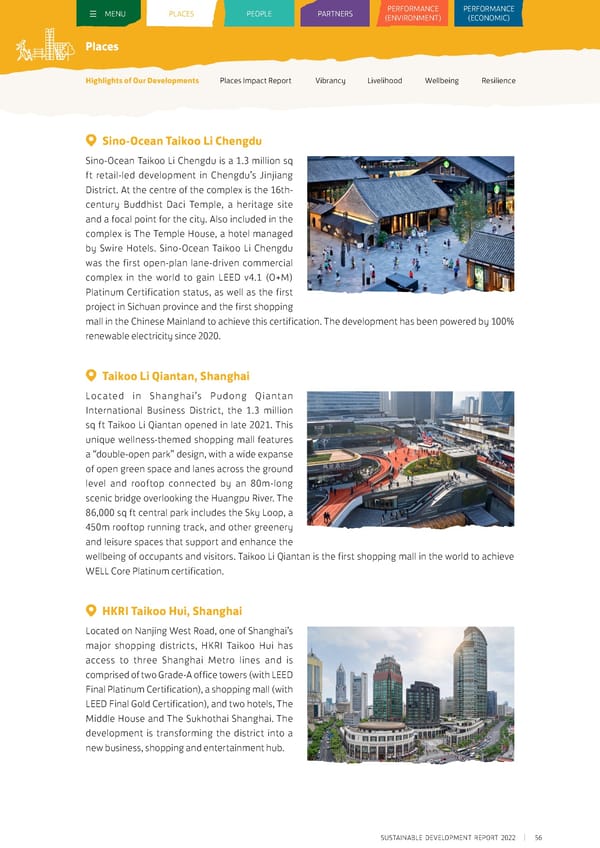

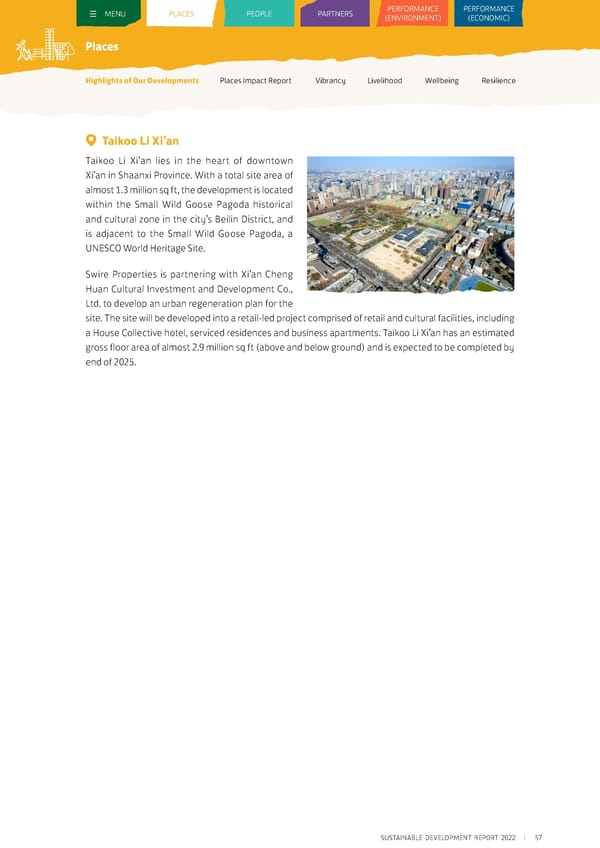

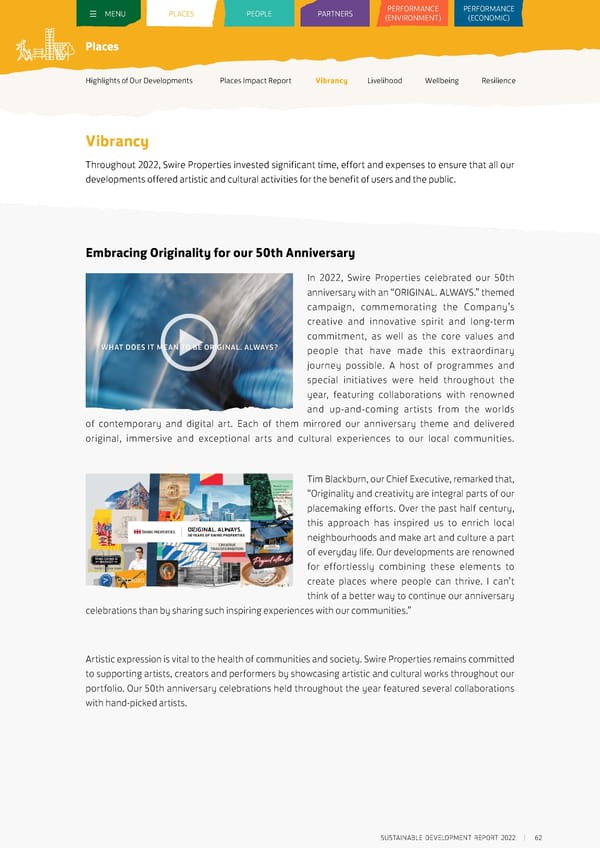

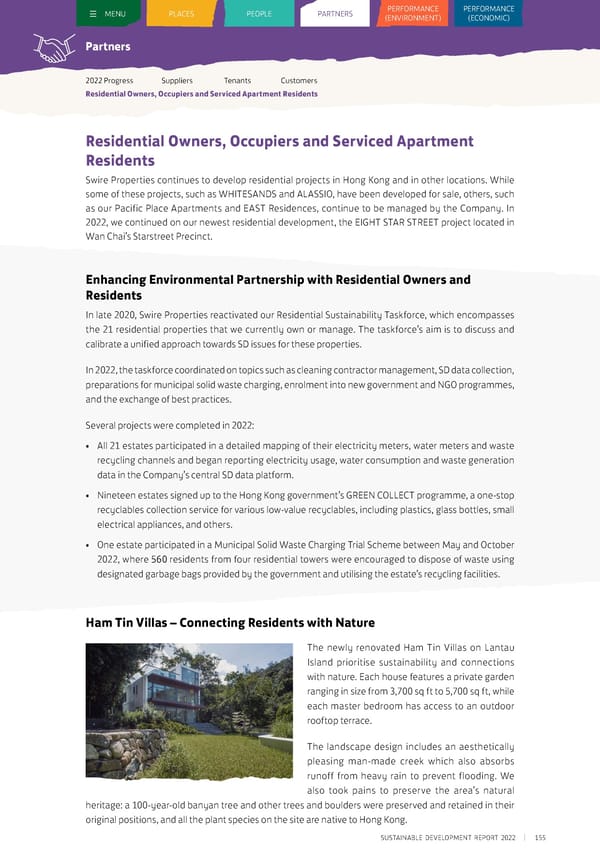

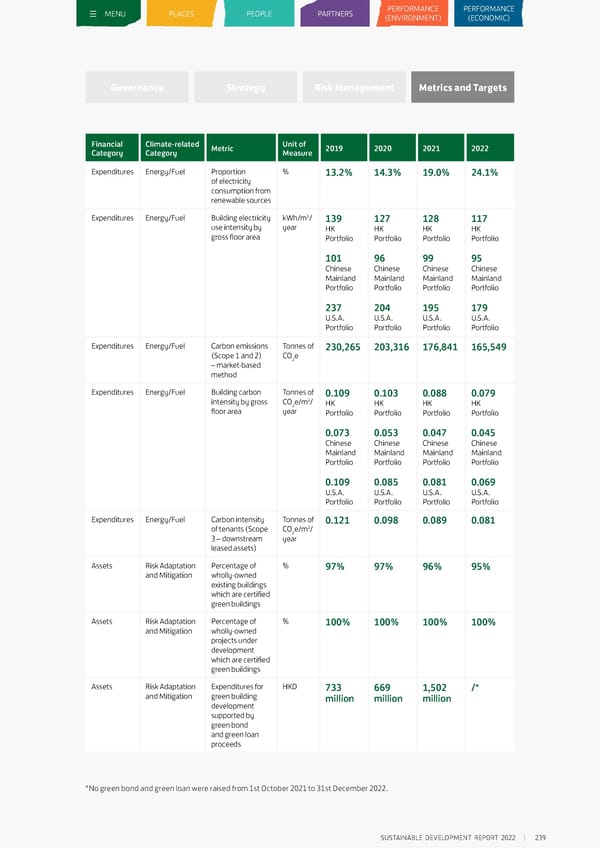

MENU PLACES PEOPLE PARTNERS PERFORMANCE PERFORMANCE (ENVIRONMENT) (ECONOMIC) Diversity and Inclusion In June 2022, in cooperation with Christian Action, EAST Hong Kong hired two team members with refugee identities. One, from Sri Lanka, was hired as a guest experience host and another, from Pakistan, was recruited as a public area attendant. The Upper House also hired two team members holding refugee identities as servers at its restaurant Salisterra, one from Rwanda and another from Indonesia. The Upper House collaborated again this year with The Hong Kong Down Syndrome Association on our well-established “UPSTAIRS” training and work experience programme. This year, 10 members participated, went through the training and gained work experience in five hotel departments. EAST Hong Kong worked with the Jockey Club Sarah Roe School to provide special vocational training to children with learning disabilities. The students gained on-the-job experience, working with the team on tasks such as folding serviettes, greeting guests, preparing table seating, and packing guest amenities bags. Talent Management Swire Hotels launched the Operations Management Trainee Programme throughout the Swire Hotels’ portfolio. Personalised according to a candidate’s strengths and aspirations, the programme opens up opportunities for trainees to work across various departments and locations in Hong Kong and the Chinese Mainland. After 12 to 18 months of on-the-job training, our trainees gained a well-rounded understanding of the hotel business and insights from a management perspective. In July 2022, The Upper House launched a new one-hour SD workshop mandatory for all team members, discussing sustainability at Swire Hotels and how everyone can live a sustainable lifestyle. Other SD- related workshops will be explored in the future. The GroPRO and LeadPRO talent development programmes were run at EAST Hong Kong to support team members and team leaders respectively. Both offered tailored programmes to develop individuals’ qualities and strengths. Cross-exposure to programmes such as the “How to Run a Project” workshop and a coaching workshop were also arranged to support their personal development. SUSTAINABLE DEVELOPMENT REPORT 2022 38